DEF 14A: Definitive proxy statements

Published on April 26, 2019

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under 240.14a-12

OPKO Health, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

x No fee required

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

(1) |

Title of each class of securities to which transaction applies: |

|

(2) |

Aggregate number of securities to which transaction applies: |

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

(4) |

Proposed maximum aggregate value of transaction: |

|

(5) |

Total Fee paid: |

|

¨ Fee paid previously with preliminary materials.

¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) |

Amount Previously Paid: |

|

(2) |

Form, Schedule or Registration Statement No.: |

|

(3) |

Filing Party:

|

|

(4) |

Date Filed: |

|

OPKO HEALTH, INC.

4400 Biscayne Blvd.

Miami, FL 33137

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 20, 2019

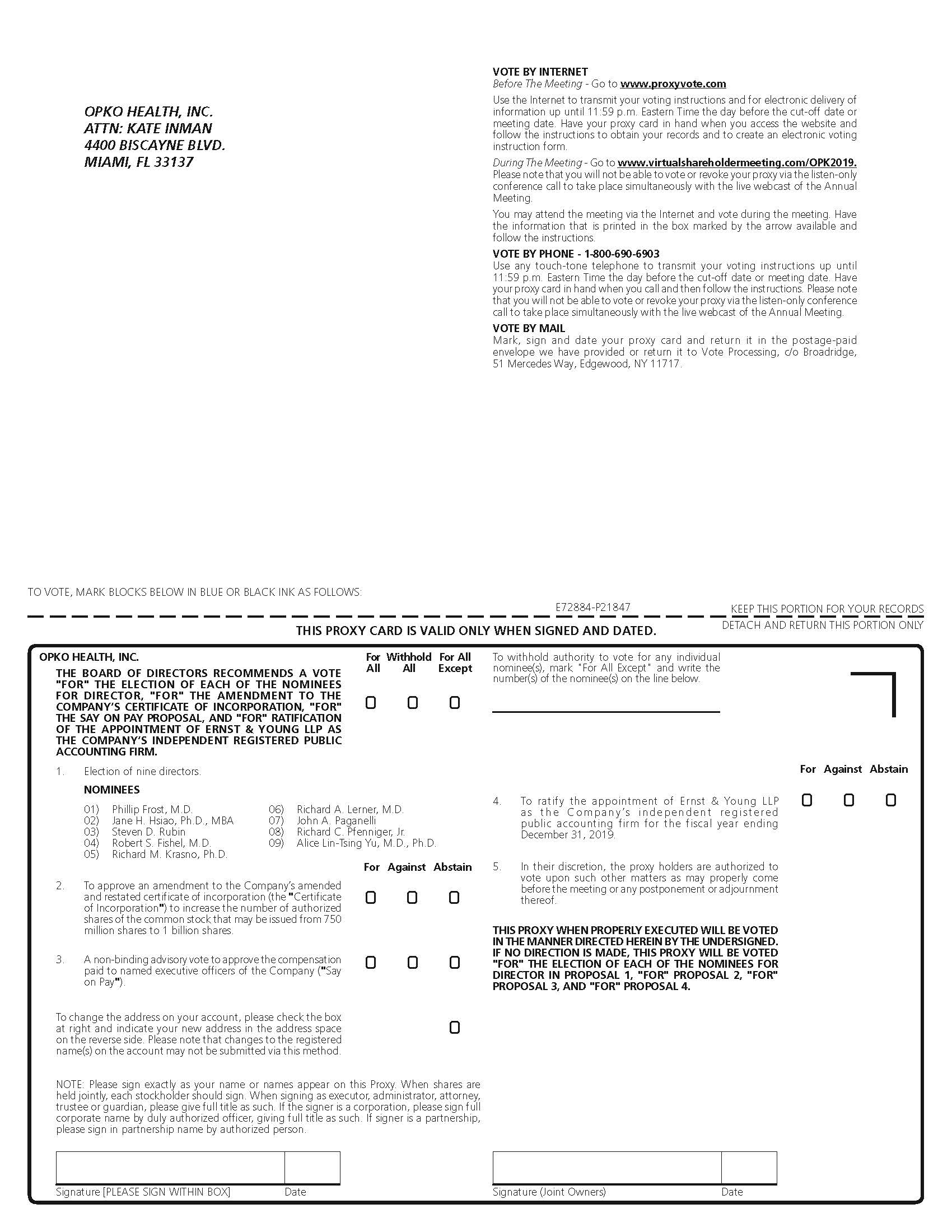

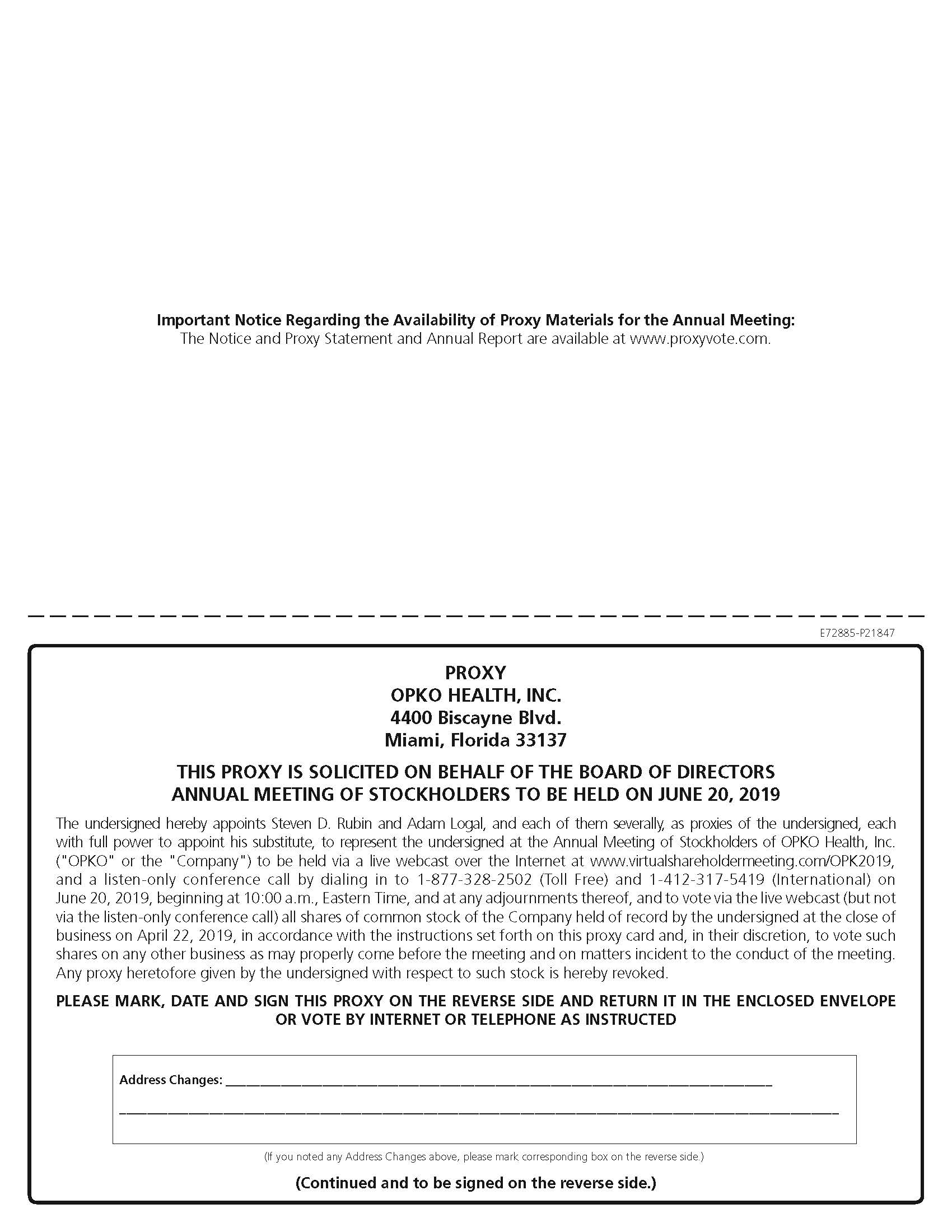

Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of OPKO Health, Inc., a Delaware corporation (the “Company”), will be held on Thursday, June 20, 2019 beginning at 10:00 a.m., Eastern Time. This year, the Annual Meeting will be a virtual meeting of stockholders held via live webcast, during which you will be able to vote your shares electronically and submit your questions. There will also be a listen-only conference call on which you will not be able to vote or submit questions. At the Annual Meeting, we will ask you:

1. To elect as directors the nine nominees named in the attached proxy statement for a term of office expiring at the 2020 annual meeting of stockholders or until their respective successors are duly elected and qualified;

2. To approve an amendment to the Company’s amended and restated certificate of incorporation (the “Certificate of Incorporation”) to increase the number of authorized shares of the common stock that may be issued from 750 million shares to 1 billion shares;

3. To take a non-binding advisory vote to approve the compensation paid to the Company’s named executive officers (“Say on Pay”);

4. To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019; and

5. To transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

Holders of record of our common stock, par value $0.01 per share, at the close of business on Monday, April 22, 2019, will be entitled to notice of and to vote at the Annual Meeting or any adjournments thereof.

Whether or not you plan to participate in the Annual Meeting, it is important that you vote your shares. Regardless of the number of shares you own, please promptly vote your shares by telephone (before the Annual Meeting, and not on the listen-only conference call) or Internet or, if you have received printed copies of the proxy materials, by marking, signing and dating the proxy card and returning it to the Company in the postage paid envelope provided. Should you participate in the live webcast, you may, if you wish, withdraw your proxy and vote your shares during the Annual Meeting on the Internet, but not on the listen-only conference call.

By Order of the Board of Directors,

Kate Inman

Secretary

Miami, Florida

April 26, 2019

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on June 20, 2019

The Proxy Statement and 2018 Annual Report are available at www.opko.com.

OPKO HEALTH, INC.

PROXY STATEMENT FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

THURSDAY, JUNE 20, 2019

This proxy statement is being made available to you by the Board of Directors (the “Board”) of OPKO Health, Inc. (the “Company,” “OPKO,” or “we,” “us” or “our”) in connection with the solicitation of proxies to be voted at the Annual Meeting of Stockholders of the Company on Thursday, June 20, 2019, beginning at 10:00 a.m., Eastern Time, and all adjournments thereof (the “Annual Meeting”). The 2019 Annual Meeting will be a virtual meeting of stockholders to be held as a live webcast over the Internet at www.virtualshareholdermeeting.com/OPK2019, along with a listen-only conference call. There will not be a physical meeting location. The meeting will be conducted via live webcast and a listen-only conference call by calling 1-877-328-2502 (Toll Free) or 1-412-317-5419 (International). However, please note that those using the dial-in number for the listen-only conference call will not be able to vote or submit questions. At the meeting, the items of business to be voted on are:

1. |

To elect as directors the nine nominees named in this proxy statement for a term of office expiring at the 2020 annual meeting of stockholders or until their respective successors are duly elected and qualified;

|

2. |

To approve an amendment to the Company’s amended and restated certificate of incorporation (the “Certificate of Incorporation”) to increase the number of authorized shares of the common stock that may be issued from 750 million shares to 1 billion shares; |

3. |

To take a non-binding advisory vote to approve the compensation paid to the Company’s named executive officers (“Say on Pay”); |

4. |

To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019; and

|

5. |

To transact such other business as may properly come before the Annual Meeting or any adjournments thereof. |

Our Board has fixed the close of business on Monday, April 22, 2019, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. As of that date, there were issued and outstanding 616,123,798 shares of our common stock, par value $0.01 per share. The holders of our common stock are entitled to one vote for each outstanding share on all matters submitted to our stockholders.

You will be able to participate in the annual meeting of stockholders online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/OPK2019. You also will be able to vote your shares electronically at the annual meeting. Stockholders will be able to listen, vote and submit questions from their home via the Internet or from any remote location with Internet connectivity. Stockholders will also be able to dial in to a listen-only conference call by calling 1-877-328-2502 (Toll Free) or 1-412-317-5419 (International), but those using the dial-in number will not be able to vote or submit questions. To participate in the annual meeting, you will need the 16-digit control number included on your notice of Internet availability of the proxy materials, on your proxy card or on the instructions that accompanied your proxy materials. The meeting webcast and listen-only conference call will begin promptly at 10:00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time. Online access will begin and the conference line will open at 9:45 a.m., Eastern Time. We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting and listen-only conference call. If you encounter any difficulties accessing the virtual meeting and listen-only conference call prior to or during the meeting time, please call 1-855-449-0991 (Toll Free) or 1-720-378-5962 (International).

The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. Participants should also give themselves plenty of time to dial-in to the conference call or log in and ensure that they can hear audio prior to the start of the meeting.

2

If you wish to submit a question, you may do so in two ways. If you want to submit a question before the meeting, then beginning May 1, 2019 and until 11:59 p.m. on June 19, 2019, you may log into www.proxyvote.com and enter your 16-digit control number. Once past the login screen, click on “Submit a Question” in the Question for Management section, type in your question, and click “Submit.” Alternatively, if you want to submit your question during the meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/OPK2019, type your question into the “Ask a Question” field, and click “Submit.”

Questions submitted via the webcast only that are pertinent to meeting matters will be answered during the meeting, subject to time constraints. Questions or comments that are not related to the proposals under discussion, are about personal concerns not shared by stockholders generally, or use blatantly offensive language may be ruled out of order and will not be answered. Additionally, the Company may not be able to answer multiple questions submitted by the same stockholder. Please note that no questions may be submitted via the listen-only conference call. Questions pertinent to meeting matters that cannot be answered during the meeting due to time constraints will be posted online and answered at www.opko.com, Investor Relations. The questions and answers will be available as soon as practicable after the meeting and will remain available until one week after posting.

If you encounter any technical difficulties with the virtual meeting platform on the meeting day, please call 1‑855-449-0991 (Toll Free) or 1-720-378-5962 (International). Technical support will be available starting at 9:30 a.m. on June 20, 2019 and will remain available throughout the duration of the meeting.

A nominee for director will be elected to the Board if the votes cast in favor of a nominee by the holders of shares of our common stock present or represented and entitled to vote at the Annual Meeting at which a quorum is present exceed the votes cast against a nominee. The amendment to the Company’s Certificate of Incorporation will be approved if the holders of a majority of the shares of our common stock outstanding and entitled to vote at the Annual Meeting vote in favor of the proposal. In addition, the advisory vote on the Say on Pay proposal will be approved if the votes cast in favor of the proposal by the holders of shares of our common stock present or represented and entitled to vote at the Annual Meeting at which a quorum is present exceed the votes cast against the proposal. Because your vote on the Say on Pay proposal is advisory, it will not be binding on the Board or the Company. However, the Compensation Committee of the Board will take into account the outcome of the Say on Pay vote when considering future executive compensation arrangements. The vote to ratify the appointment of Ernst & Young LLP as the independent auditor of the Company for the fiscal year ending December 31, 2019 will be approved if the votes cast in favor of the proposal by the holders of shares of our common stock present or represented and entitled to vote at the Annual Meeting in which a quorum is present exceed the votes cast against the proposal. Any other matter that may be submitted to a vote of our stockholders at the Annual Meeting will be approved if the number of shares of common stock voted for the proposal exceed the votes cast against the proposal, unless such matter is one for which a greater vote is required by law or our Amended and Restated Certificate of Incorporation or our Amended and Restated Bylaws.

The presence, in person via participation in the virtual meeting or by proxy, of holders of a majority of our outstanding common stock entitled to vote constitutes a quorum at the Annual Meeting. Those stockholders on our listen-only conference call will not be “present” for quorum purposes. Shares of our stock represented by proxies that reflect abstentions will be counted for the purpose of determining the existence of a quorum at the Annual Meeting, but will have no effect on the election of directors, the amendment to the Certificate of Incorporation, or the Say on Pay proposal. Shares of stock represented by proxies that reflect “broker non-votes” (i.e., stock represented at the Annual Meeting by proxies held by brokers or nominees as to which (i) the brokers or nominees have not received instructions from the beneficial owners or persons entitled to vote and (ii) the brokers, or nominees, do not have the discretionary voting power on a particular matter) will not be counted for the purpose of determining the existence of a quorum at the Annual Meeting and will have no effect on matters for which brokers or banks do not have discretionary authority. A broker does not have the discretion to vote on the election of directors, the amendment to the Certificate of Incorporation, or the non-binding advisory vote on the Say on Pay proposal. Thus, a broker non-vote will have no effect on the election of directors, the amendment to the Certificate of Incorporation, and the non-binding advisory vote on the Say on Pay proposal. A broker does have the discretion to vote on the ratification of the appointment of Ernst & Young LLP as independent auditor for the fiscal year ending December 31, 2019, and, therefore, if the broker exercises its discretion to vote on the ratification of the

3

appointment of Ernst & Young LLP as independent auditor for the fiscal year ending December 31, 2019, it will have an effect on the vote.

Any stockholder giving a proxy will have the right to revoke it at any time prior to the time it is voted. A proxy may be revoked by: (i) written notice to us on the date of or prior to the Annual Meeting at our executive offices located at 4400 Biscayne Blvd., Miami, Florida 33137, attention: Secretary; (ii) execution of a subsequent proxy; (iii) participating and voting electronically at the Annual Meeting by completing a ballot online during the live webcast; or (iv) re-voting by telephone or by Internet prior to the meeting (only your latest telephone or Internet vote will be counted). Please note that you cannot use the listen-only conference call to revoke your proxy or to vote. Participation at the Annual Meeting will not automatically revoke your proxy. If your shares are held in the name of a broker or nominee, you must follow the instructions of your broker or nominee to revoke a previously given proxy. All shares of our stock represented by effective proxies will be voted at the Annual Meeting or at any adjournment thereof. Unless otherwise specified in the proxy, shares of our stock represented by proxies will be voted: (i) FOR the election of the Board’s nominees for directors; (ii) FOR the approval of an amendment to the Company’s Certificate of Incorporation to increase the number of authorized shares of the common stock that may be issued from 750 million shares to 1 billion shares; (iii) FOR the approval of the Say on Pay proposal; (iv) FOR the proposal to ratify the appointment of Ernst & Young, LLP, an independent registered public accounting firm, as the independent auditor of the Company for the fiscal year ending December 31, 2019; and (v) in the discretion of the proxy holders with respect to such other matters as may properly come before the Annual Meeting.

The Company has mailed this proxy statement and our Annual Report to Stockholders for our fiscal year ended December 31, 2018 (“fiscal 2018”) to our stockholders of record on April 22, 2019. If you hold shares of the Company by brokers or nominees, the Company has made these materials available to you on the Internet or, upon your request, by delivery of printed versions of these materials. These materials were first sent or made available to stockholders on or around April 26, 2019.

Our executive offices are located at 4400 Biscayne Blvd., Miami, Florida 33137.

4

Security Ownership of Certain Beneficial Owners and Management

The following table contains information regarding the beneficial ownership of our voting stock as of April 22, 2019 held by (i) each stockholder known by us to beneficially own more than 5% of the outstanding shares of any class of voting stock; (ii) our directors and nominees; (iii) our Named Executive Officers as defined in the paragraph preceding the Summary Compensation Table and our current executive officers; and (iv) all current directors and executive officers as a group. Except where noted, all holders listed below have sole voting power and investment power over the shares beneficially owned by them. Unless otherwise noted, the address of each person listed below is c/o OPKO Health, Inc., 4400 Biscayne Blvd., Miami, FL 33137.

|

Name and Address of

Beneficial Owner

|

Class of Security |

Amount and Nature

Beneficial

Ownership

|

Percentage of Class** |

|||||||||

Directors and Named Officers: |

||||||||||||

|

Phillip Frost, M.D.

CEO & Chairman of the Board

|

Common Stock |

219,704,633 |

(1) |

35.29 |

% |

|||||||

|

Jane H. Hsiao, Ph.D., MBA

Vice Chairman of the Board & Chief

Technical Officer

|

Common Stock |

31,355,051 |

(2) |

5.07 |

% |

|||||||

|

Steven D. Rubin

Executive Vice President – Administration

and Director

|

Common Stock |

7,640,005 |

(3) |

1.24 |

% |

|||||||

|

Adam Logal

Senior Vice President and Chief Financial

Officer

|

Common Stock |

1,113,412 |

(4) |

* |

||||||||

Robert S. Fishel, M.D., Director |

Common Stock |

4,130,728 |

(5) |

* |

||||||||

John A. Paganelli, Director |

Common Stock |

498,515 |

(6) |

* |

||||||||

Richard A. Lerner, M.D., Director |

Common Stock |

338,881 |

(7) |

* |

||||||||

Richard C. Pfenniger, Jr., Director |

Common Stock |

340,000 |

(8) |

* |

||||||||

Alice Lin-Tsing Yu, M.D., Ph.D., Director |

Common Stock |

186,490 |

(9) |

* |

||||||||

Richard M. Krasno, Ph.D., Director |

Common Stock |

153,333 |

(10) |

* |

||||||||

|

All Executive Officers and Directors as a group

(10 persons)

|

Common Stock |

265,461,048 |

42.25 |

% |

||||||||

More than 5% Owners: |

||||||||||||

Frost Gamma Investments Trust |

Common Stock |

189,325,505 |

(11) |

30.48 |

% |

|||||||

|

The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355

|

Common Stock |

28,381,653 |

(12) |

5.06 |

% |

|||||||

____________

* |

Less than 1% |

** |

Percentages of common stock based upon 616,123,798 shares of our common stock issued and outstanding at April 22, 2019.

|

(1) |

Includes 164,234,443 shares of common stock and a convertible note, which is convertible into 5,000,000 shares of common stock, held by Frost Gamma Investments Trust. It also includes options to purchase 1,425,000 shares of common stock exercisable within 60 days of April 22, 2019 held by Dr. Frost. Dr. Frost is the trustee and Frost Gamma Limited Partnership is the sole and exclusive beneficiary of Frost Gamma Investments Trust. Dr. Frost is one of two limited partners of Frost Gamma Limited Partnership. The general partner of Frost Gamma Limited Partnership is Frost Gamma Inc. and the sole stockholder of Frost Gamma, Inc. is Frost-Nevada Corporation. Dr. Frost is also the sole stockholder of Frost-Nevada Corporation. The

|

5

number of shares included above also includes 25,885,177 shares of common stock owned directly by Frost Nevada Investments Trust, of which the Dr. Frost is the trustee and Frost-Nevada, L.P. is the sole and exclusive beneficiary. Dr. Frost is one of five limited partners of Frost-Nevada, L.P. and the sole shareholder of Frost-Nevada Corporation, the sole general partner of Frost-Nevada, L.P. The number of shares included above also includes 20,091,062 shares of common stock owned directly by The Frost Group, LLC. Frost Gamma Investments Trust is a principal member of The Frost Group, LLC. Dr. Frost and the Frost Gamma Investments Trust disclaim beneficial ownership of these shares of common stock. Does not include 2,851,830 shares of common stock held by the Phillip and Patricia Frost Philanthropic Foundation, Inc., of which Dr. Frost is one of three directors. Phillip Frost, M.D. has sole voting and dispositive power over 199,613,571 shares of the Company’s common stock and shared voting and dispositive power over 20,091,062 shares of the Company’s common stock.

(2) |

Includes a convertible note which is convertible into 1,000,000 shares of common stock. Also includes options to purchase 1,162,500 shares of common stock exercisable within 60 days of April 22, 2019. Also includes 4,727,404 shares of common stock held by Hsu Gamma Investment, L.P., for which Dr. Hsiao serves as General Partner. Does not include 20,091,062 shares of common stock held by The Frost Group, LLC, of which Dr. Hsiao is a member. Dr. Hsiao disclaims beneficial ownership of the shares of common stock held by The Frost Group, LLC.

|

(3) |

Includes options to purchase 1,920,858 shares of common stock exercisable within 60 days of April 22, 2019. Mr. Rubin is a member of the Frost Group, LLC, which holds 20,091,062 shares of common stock. Mr. Rubin disclaims beneficial ownership of the shares of common stock held by The Frost Group, LLC.

|

(4) |

Includes options to acquire 937,500 shares of common stock exercisable within 60 days of April 22, 2019.

|

(5) |

Includes options to acquire 60,000 shares of common stock exercisable within 60 days of April 22, 2019. Also includes 4,070,728 shares of common stock held by ALSAR Ltd. Partnership, for which Dr. Fishel is the President and Chief Executive Officer. The general partner of ALSAR Ltd. Partnership is SARAL Corporation. Dr. Fishel is the sole owner and beneficiary of SARAL Corporation.

|

(6) |

Includes options to acquire 140,000 shares of common stock exercisable within 60 days of April 22, 2019. Also includes 9,175 shares of common stock held by Mr. Paganelli’s spouse.

|

(7) |

Includes options to acquire 140,000 shares of common stock exercisable within 60 days of April 22, 2019. Also includes 178,881 shares of common stock held by the Lerner Family Trust, for which Richard Lerner and Nicola Lerner are Trustees and 20,000 shares of common stock held by Dr. Lerner’s spouse.

|

(8) |

Includes options to acquire 170,000 shares of common stock exercisable within 60 days of April 22, 2019.

|

(9) |

Includes options to acquire 120,000 shares of common stock exercisable within 60 days of April 22, 2019.

|

(10) |

Includes options to acquire 80,000 shares of common stock exercisable within 60 days of April 22, 2019. Also includes 73,333 shares of common stock held by the Richard M. Krasno Trust, for which Richard M. Krasno is Trustee.

|

(11) |

Includes a convertible note which is convertible into 5,000,000 shares of common stock. Also includes 20,091,062 shares of common stock held by The Frost Group, LLC, of which Frost Gamma Investments Trust is a principal member. Frost Gamma Investments Trust disclaims beneficial ownership of the common stock held by The Frost Group, LLC. The Frost Gamma Investments Trust has sole voting and dispositive power over 169,234,443 shares of the Company’s common stock and shared voting and dispositive power over 20,091,062 shares of the Company’s common stock. Does not include 3,068,951 shares of common stock held directly by Dr. Frost, 1,425,000 options to purchase shares of common stock exercisable within 60 days of April 22, 2019 held by Dr. Frost, 25,885,177 shares of common stock owned directly by Frost Nevada Investments Trust, and 2,851,830 shares of common stock held by the Phillip and Patricia Frost Philanthropic Foundation, Inc.

|

(12) |

Based solely on information reported on Schedule 13G filed by the stockholder on February 11, 2019. According to the information reported in the Schedule 13G, The Vanguard Group has sole voting power over 323,538 shares of the Company’s common stock, shared voting power over 43,950 shares of the Company’s common stock, sole dispositive power over 28,047,465 shares of the Company’s common stock, and shared dispositive power over 334,188 shares of the Company’s common stock. |

6

PROPOSAL ONE:

ELECTION OF DIRECTORS

Pursuant to the authority granted to our Board under Article III of our Amended and Restated Bylaws, the Board has fixed the number of directors constituting the entire Board at nine. All nine directors are to be elected at the Annual Meeting, each to hold office until the 2020 annual meeting of stockholders or until his successor is duly elected and qualified. Each stockholder of record on April 22, 2019 is entitled to cast one vote for each share of our common stock either in favor of or against the election of each nominee, or to abstain from voting on any or all nominees. Although management does not anticipate that any nominee will be unable or unwilling to serve as a director, in the event of such an occurrence, proxies may be voted in the discretion of the persons named in the proxy for a substitute designated by the Board, unless the Board decides to reduce the number of directors constituting the Board. Each nominee shall be elected if the votes cast in favor of a nominee by the holders of shares of our common stock present or represented and entitled to vote at the Annual Meeting at which a quorum is present exceed the votes cast against a nominee.

NOMINEES FOR DIRECTOR

The following sets forth information provided by the nominees as of April 22, 2019. All of the nominees are currently serving as directors for the Company. All of the nominees have consented to serve if elected by our stockholders.

Name of Nominee |

Age |

Year First

Elected/

Nominated

Director

|

Positions and Offices with the Company |

|||

Phillip Frost, M.D. |

82 |

2007 |

Chairman of the Board and Chief Executive Officer |

|||

Jane H. Hsiao, Ph.D., MBA |

71 |

2007 |

Vice Chairman of the Board and Chief Technical Officer |

|||

Steven D. Rubin |

58 |

2007 |

Director and Executive Vice President-Administration |

|||

Robert S. Fishel, M.D. |

57 |

2018 |

Director |

|||

Richard M. Krasno, Ph.D. |

77 |

2017 |

Director |

|||

Richard A. Lerner, M.D. |

80 |

2007 |

Director |

|||

John A. Paganelli |

84 |

2003 |

Director |

|||

Richard C. Pfenniger, Jr. |

63 |

2008 |

Director |

|||

Alice Lin-Tsing Yu, M.D., Ph.D. |

75 |

2009 |

Director |

|||

Phillip Frost, M.D. Dr. Frost has been the Chief Executive Officer of the Company and Chairman of the Board since March 2007. Dr. Frost serves as a director for Castle Brands (NYSE American:ROX), a developer and marketer of premium brand spirits, and Cocrystal Pharma, Inc. (NASDAQ GM:COCP), a publicly traded biotechnology company developing new treatments for viral diseases. He serves as a member of the Board of Trustees of the University of Miami, the Skolkovo Foundation Scientific Advisory Council in Russia, the Shanghai Institute for Advanced Immunochemical Studies in China, and The Florida Council of 100 and as a Trustee of each of the Miami Jewish Home for the Aged and the Mount Sinai Medical Center. He serves as Chairman of Temple Emanu-El, Governor of Tel Aviv University and is a member of the Executive Committee of The Phillip and Patricia Frost Museum of Science. Dr. Frost served as a director of Ladenburg Thalmann Financial Services Inc. (“Ladenburg Thalmann”) (NYSE American:LTS), an investment banking, asset management, and securities brokerage firm providing services through its principal operating subsidiary, Ladenburg Thalmann & Co. Inc., from 2004 to 2018 and had served as its Chairman from July 2006 until September 2018, a director of Teva Pharmaceutical Industries, Limited, or Teva (NYSE:TEVA) from January 2006 until February 2015 and had served as Chairman of the Board of Teva from March 2010 until December 2014. Dr. Frost previously served as Vice Chairman of Cogint, Inc., now known as Fluent, Inc. (NASDAQ:FLNT), and as a director for Sevion Therapeutics, Inc. prior to its merger with Eloxx Pharmaceuticals, Inc., and TransEnterix, Inc., (NYSE American:TRXC). Dr. Frost had served as Chairman of the Board of Directors and Chief Executive Officer of IVAX Corporation (“IVAX”) from 1987 until its acquisition by Teva in January 2006. Dr. Frost was Chairman of the Board of Directors of Key

7

Pharmaceuticals, Inc. from 1972 until the acquisition of Key Pharmaceuticals, Inc. by Schering Plough Corporation in 1986.

Dr. Frost has successfully founded several pharmaceutical companies and overseen the development and commercialization of a multitude of pharmaceutical products. This, combined with his experience as a physician and chairman and/or chief executive officer of large pharmaceutical companies, has given him insight into virtually every facet of the pharmaceutical business and drug development and commercialization process. He is a demonstrated leader with keen business understanding and is uniquely positioned to help guide our Company through its transition from a development stage company into a successful, multinational biopharmaceutical and diagnostics company.

Jane H. Hsiao, Ph.D., MBA. Dr. Hsiao has served as Vice-Chairman and Chief Technical Officer of the Company since May 2007 and as a director since February 2007. Dr. Hsiao has served as Chairman of the Board of Non-Invasive Monitoring Systems, Inc. (OTC US:NIMU), a medical device company, since October 2008 and was named Interim Chief Executive Officer of Non-Invasive Monitoring Systems, Inc. in February 2012. Dr. Hsiao is also a director of each of TransEnterix, Inc. (NYSE American:TRXC), a medical device company, Neovasc, Inc. (NASDAQ CM:NVCN), a company developing and marketing medical specialty vascular devices, and Cocrystal Pharma, Inc. (NASDAQ GM:COCP). Dr. Hsiao served as the Vice Chairman-Technical Affairs of IVAX from 1995 to January 2006. Dr. Hsiao served as Chairman, Chief Executive Officer and President of IVAX Animal Health, IVAX’s veterinary products subsidiary, from 1998 to 2006.

Dr. Hsiao’s background in pharmaceutical chemistry and strong technical expertise, as well as her senior management experience, allow her to play an integral role in overseeing our product development and regulatory affairs and in navigating the regulatory pathways for our products and product candidates. In addition, as a result of her role as director and/or chairman of other companies in the biotechnology and life sciences industry, she also has a keen understanding and appreciation of the many regulatory and development issues confronting pharmaceutical and biotechnology companies.

Steven D. Rubin. Mr. Rubin has served as Executive Vice President – Administration since May 2007 and as a director of the Company since February 2007. Mr. Rubin currently serves on the board of directors of Red Violet, Inc. (NASDAQ CM:RDVT), a software and services company, Non-Invasive Monitoring Systems, Inc. (OTC US:NIMU), a medical device company, Cocrystal Pharma, Inc. (NASDAQ GM:COCP), a publicly traded biotechnology company developing new treatments for viral diseases, Eloxx Pharmaceuticals, Inc. (NASDAQ:ELOX), a clinical stage biopharmaceutical company dedicated to treating patients suffering from rare and ultra-rare disease caused by premature termination codon nonsense mutations, Castle Brands, Inc. (NYSE American:ROX), a developer and marketer of premium brand spirits, Neovasc, Inc. (NASDAQ CM:NVCN), a company that develops and markets medical specialty vascular devices, and ChromaDex Corp. (NASDAQ CM:CDXC), a science-based, integrated nutraceutical company devoted to improving the way people age. Mr. Rubin previously served as a director of VBI Vaccines, Inc. (NASDAQ CM:VBIV), a biopharmaceutical company developing next generation vaccines, BioCardia, Inc.(OTC US:BCDA), clinical-stage regenerative medicine company developing novel therapeutics for cardiovascular diseases, Cogint, Inc. (NASDAQ GM:COGT), now known as Fluent, Inc. (NASDAQ:FLNT), an information solutions provider focused on the data-fusion market, prior to the spin-off of its data and analytics operations and assets into Red Violet, Inc., Kidville, Inc. (OTCBB:KVIL), which operates large, upscale facilities, catering to newborns through five-year-old children and their families and offers a wide range of developmental classes for newborns to five-year-olds, Sevion Therapeutics, Inc., prior to its merger with Eloxx Pharmaceuticals, Inc., Dreams, Inc. (NYSE American:DRJ), a vertically integrated sports licensing and products company, SciVac Therapeutics, Inc. prior to its merger with VBI Vaccines, Inc., and Tiger X Medical, Inc. prior to its merger with BioCardia, Inc. Mr. Rubin also served as the Senior Vice President, General Counsel and Secretary of IVAX from August 2001 until September 2006.

Mr. Rubin brings extensive leadership, business, and legal experience, as well as tremendous knowledge of our business and the pharmaceutical industry generally, to the Board. He has advised pharmaceutical companies in several aspects of business, regulatory, transactional, and legal affairs for more than 25 years. His experience as a practicing lawyer, general counsel, management executive and board member to multiple public companies,

8

including several pharmaceutical and life sciences companies, has given him broad understanding and expertise, particularly relating to strategic planning and acquisitions.

Robert S. Fishel, M.D. Dr. Fishel was appointed to the Company’s Board of Directors on April 3, 2018. Dr. Fishel serves as a director of several private companies. He is a director and founder of Florida Electrophysiology Associates, a premiere medical practice specializing in cardiac rhythm disorders, and has been the Chief Executive Officer and President since 1997, a director and senior managing partner of Renaissance Properties, a multi-faceted real estate development firm, since 1989, a director and founding partner of Catalyst Development Partners, a real estate development firm focused on multifamily acquisition and development opportunities, since 2009, a director and president of ALSAR Ltd Partnership since 1996, an investment partnership with investments in public equities, debt and derivatives, and a director, founder, and Chief Medical Officer of NewPace, Ltd., a company engaged in the research and development of medical equipment, including a novel implantable subcutaneous string defibrillator (ISSD) for preventing sudden cardiac death, since 2012. Dr. Fishel is director of cardiac electrophysiology at JFK Medical Center in West Palm Beach Florida and co-director of national electrophysiology research for the Hospital Corporation of America’s Cardiovascular Research Council. Dr. Fishel is an Affiliate Associate Professor of Medicine at the Charles E. Schmidt College of Medicine, Florida Atlantic University School of Medicine’s Division of Integrated Sciences.

Dr. Fishel’s business background and his training and experience as a practicing physician will be valuable in our efforts in the field of biotechnology. The insight he has gained as a practicing physician and from his investment and management experience with a number of business ventures will help drive the Company’s commercial efforts and strategic direction.

Richard M. Krasno, Ph.D. Dr. Krasno was appointed to the Company’s Board of Directors on February 9, 2017. Dr. Krasno has been a private investor in companies for the past five (5) years. Dr. Krasno also served as the executive director of the William R. Kenan, Jr. Charitable Trust (the “Trust”) from 1999 to 2014, and from 1999 to 2010, as President of the four affiliated William R. Kenan, Jr. Funds. Prior to joining the Trust, Dr. Krasno was the President of the Monterey Institute of International Studies in Monterey, California. From 2004 to 2012, Dr. Krasno also served as a Director of the University of North Carolina Health Care System and served as chairman of its board of directors from 2009 to 2012. From 1981 to 1998, he served as President and Chief Executive Officer of the Institute of International Education in New York. He also served as Deputy Assistant Secretary of Education in Washington, D.C. from 1979 to 1980. Dr. Krasno currently serves as a Director of Ladenburg Thalmann (NYSE American:LTS), Castle Brands, Inc. (NYSE American:ROX) and BioCardia, Inc. (OTC US:BCDA). Dr. Krasno holds a Bachelor of Science from the University of Illinois and a Ph.D. from Stanford University.

Dr. Krasno’s pertinent skills and experience, including his financial literacy and expertise, managerial experience and the knowledge he has attained through his service as a director of publicly-traded corporations have added and will continue to add valuable insight to our Board on a wide range of business and operational issues.

Richard A. Lerner, M.D. Dr. Lerner has served as a director of the Company since March 2007. Dr. Lerner has been a private investor in companies for the past five (5) years. Dr. Lerner served as President of The Scripps Research Institute, a private, non-profit biomedical research organization, from 1986 until 2011 and is currently serving as an institute professor. Dr. Lerner is a member of numerous scientific associations, including the National Academy of Science and the Royal Swedish Academy of Sciences. Dr. Lerner serves as director of Intra-Cellular Therapies, Inc. (NASDAQ:ITCI) a biotechnology company. He previously served as a director of Kraft Foods, Inc., Teva and Sequenom, Inc. and on the Advisory Board for Molecular Medicine of Siemens AG.

As a result of Dr. Lerner’s long tenure as president of a major biomedical research organization, he provides valuable business, scientific, leadership, and management expertise that helps drive strategic direction and expansion at OPKO. His experience and training as a physician and a scientist enables him to bring valuable advice to the Board, including a critical perspective on drug discovery and development and provide a fundamental understanding of the potential pathways contributing to disease.

John A. Paganelli. Mr. Paganelli has served as a director of the Company since December 2003. Mr. Paganelli served as the Company’s Interim Chief Executive Officer and Secretary from June 29, 2005 through March 27, 2007, the Company’s Interim Chief Financial Officer from June 29, 2005 through July 1, 2005, and Chairman of our

9

Board from December 2003 through March 27, 2007. Mr. Paganelli served as President and Chief Executive Officer of Transamerica Life Insurance Company of New York from 1992 to 1997. Since 1987, Mr. Paganelli has been a partner in RFG Associates, a financial planning organization. Mr. Paganelli is also the Managing Partner of Pharos Systems Partners, LLC, an investment company, and he is Chairman of the Board of Pharos Systems International, a software company. He was Vice President and Executive Vice President of PEG Capital Management, an investment advisory organization, from 1987 until 2000. Mr. Paganelli also serves as a director of Western New York Energy, LLC and is on the Board of Trustees of Paul Smith’s College.

With his significant experience in investment management and operations, Mr. Paganelli is able to add valuable expertise and insight to our Board on a wide range of operational and financial issues. As one of the longest tenured members of our Board, he also has substantial knowledge and familiarity regarding our historical operations.

Richard C. Pfenniger, Jr. Mr. Pfenniger is a private investor and has served as a director of the Company since January 2008. Mr. Pfenniger served as Interim CEO of Vein Clinics of America, Inc., a privately held company that specializes in the treatment of vein disease, from May 2014 to February 2015 and as Interim CEO of IntegraMed America, Inc., a privately held company that manages outpatient fertility medical centers, from January 2013 to June 2013. He served as Chief Executive Officer and President for Continucare Corporation, a provider of primary care physician and practice management services, from 2003 until 2011, and served as Chairman of the Board of Directors of Continucare Corporation from 2002 until 2011. Previously, Mr. Pfenniger served as the Chief Executive Officer and Vice Chairman of Whitman Education Group, Inc. from 1997 through June 2003. Prior to joining Whitman, he served as the Chief Operating Officer of IVAX from 1994 to 1997, and, from 1989 to 1994, he served as the Senior Vice President-Legal Affairs and General Counsel of IVAX Corporation. Prior thereto he was engaged in the private practice of law. Mr. Pfenniger currently serves as a director of GP Strategies Corporation (NYSE:GPX), a corporate education and training company, TransEnterix, Inc. (NYSE American:TRXC), a medical device company, BioCardia, Inc. (OTC US:BCDA), clinical-stage regenerative medicine company developing novel therapeutics for cardiovascular diseases, and IntegraMed America, Inc. (NASDAQ:INMD), a specialty healthcare services company offering products and services to patients and providers in the fertility and vein care segments of the health industry. He also serves as the Vice Chairman of the Board of Trustees and as a member of the Executive Committee of the Phillip and Patricia Frost Museum of Science. Mr. Pfenniger previously served as a director of Vein Clinics of America and Wright Investors’ Services Holdings, Inc. (OTC US:WISH), an investment management and financial advisory firm.

As a result of Mr. Pfenniger’s multi-faceted experience as chief executive officer, chief operating officer and general counsel, he is able to provide valuable business, leadership, and management advice to the Board in many critical areas. In addition, Mr. Pfenniger’s knowledge of the pharmaceutical and healthcare business has given him insights on many aspects of our business and the markets in which we operate. Mr. Pfenniger also brings financial expertise to the Board, including through his service as Chairman of our Audit Committee.

Alice Lin-Tsing Yu, M.D., Ph.D. Dr. Yu was appointed to the Company’s Board in April 2009. From mid-2013 to 2018, Dr. Yu served as Distinguished Chair Professor and Co-Director of The Institute of Stem Cell & Translational Cancer Research at Chang Gung Memorial Hospital. From 2003 to May, 2013, Dr. Yu served as Distinguished Research Fellow and Associate Director at the Genomics Research Center, Academia Sinica, in Taiwan. She has been a Professor of Pediatrics for the University of California in San Diego since 1994. Previously, she was the Chief of Pediatric Hematology Oncology at the University of California in San Diego. Dr. Yu has also served in several government-appointed positions and is a member of numerous scientific committees and associations.

Dr. Yu is an accomplished physician, professor, and researcher who brings a unique perspective to our Board on a variety of healthcare related issues. As a pioneer in immunotherapy of neuroblastoma, Dr. Yu was instrumental in developing a monoclonal anti-GD2 (Dinutuximab) from IND through early phase studies and phase III trials, and facilitating its FDA approval on March 10, 2015. The insight and experience gained from her distinguished record of achievement at several highly respected academic medical institutions, as well as her experience as a practicing physician, continues to be valuable to our efforts to develop and commercialize our pipeline of diagnostic and therapeutic products.

10

OUR BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES NAMED ABOVE.

11

Identification of Executive Officers

Set forth below is the name and age as of April 22, 2019 of each of our current executive officers, together with certain biographical information for each of them (other than Phillip Frost, Jane H. Hsiao, and Steven Rubin, for whom age, title and biographical information is included above under “Nominees for Election of Directors”):

Name of Executive Officer |

Age |

Position and Offices with the Company |

||

Adam Logal |

41 |

Senior Vice President and Chief Financial Officer |

||

Adam Logal. Mr. Logal has served as OPKO’s Senior Vice President and Chief Financial Officer since March 2014, Vice President of Finance, Chief Accounting Officer and Treasurer from July 2012 until March 2014, and Director of Finance, Chief Accounting Officer and Treasurer from March 2007 until July 2012. He currently serves as chairman of the board of directors of Xenetics Biosciences, Inc. (NASDAQ CM:XBIO), a clinical-stage biopharmaceutical company focused on discovery, research and development of next-generation biologic drugs and novel orphan oncology therapeutics. He previously served on the board of directors of VBI Vaccines, Inc. (NASDAQ:VBIV) until 2018. From 2002 to 2007, Mr. Logal served in senior management of Nabi Biopharmaceuticals, a publicly traded, biopharmaceutical company engaged in the development and commercialization of proprietary products. Mr. Logal held various positions of increasing responsibility at Nabi Biopharmaceuticals, last serving as Senior Director of Accounting and Reporting.

Identification of Certain Other Officers

Set forth below are certain other officers important to our organization and biographical information for each of them:

Charles W. Bishop, PhD. Dr. Bishop, age 67, has served as Chief Executive Officer of OPKO Renal since the acquisition of Cytochroma Inc. in March 2013. Dr. Bishop had served as President and Chief Executive Officer of Cytochroma since June 2006. Dr. Bishop co-founded Proventiv Therapeutics, LLC in September 2005 where he served as President until June 2006 when Proventiv and its lead drug, Rayaldee™, were acquired by Cytochroma. During the period from September 1987 to June 2005, Dr. Bishop held various senior management positions at Bone Care International, Inc. (“Bone Care”), a public specialty pharmaceutical company focused on developing and commercializing vitamin D hormone therapies. Dr. Bishop’s positions with Bone Care included President, Chief Executive Officer, Director, Executive Vice President of Research and Development, and Chief Scientific Officer. Bone Care was acquired for $720 million by Genzyme Corporation in July 2005. Prior to joining Bone Care, Dr. Bishop held various management positions in the Health Care Division of the Procter & Gamble Company. Dr. Bishop completed a four-year National Institutes of Health Postdoctoral Fellowship in vitamin D Biochemistry at the University of Wisconsin-Madison and received his PhD degree in Nutritional Biochemistry from Virginia Polytechnic Institute and State University, after earning an undergraduate degree in Chemistry from the University of Virginia.

Jon R. Cohen, M.D. Dr. Cohen, age 65, joined the Company in January 2019 as Executive Chairman of BioReference Laboratories. Dr. Cohen previously served for nearly a decade as a senior executive at Quest Diagnostics Incorporated. Prior to his tenure at Quest Diagnostics, he served as Chief Policy Advisor for Governor David Paterson and for six years as Chief Medical Officer for Northwell Health. Dr. Cohen is a vascular surgeon, having completed his residency in surgery at New York Presbyterian Hospital/Weill Cornell Medical Center and vascular surgery fellowship at the Brigham and Women's Hospital at Harvard Medical School. He has published over 100 peer-reviewed professional articles.

Geoff Monk. Mr. Monk, age 63, joined the Company in May 2018 as General Manager of BioReference Laboratories. He was promoted to President in early 2019. Mr. Monk is a highly accomplished professional with international operational, business strategy and technical experience in Healthcare and high volume and high technology industries. He previously served as Vice President of Operations for the East Region at Quest Diagnostics, following a time when he was the Managing Director for their New York/New Jersey region. Earlier in his healthcare career Mr. Monk served as Vice President Global Engineering and Vice President Operations for New

12

Jersey/Puerto Rico at Schering-Plough. Prior to this, he held positions of increasing responsibility for GlaxoWellcome, including engineering and operations. He is an engineer by training and has led teams to create facilities in many countries including Japan, Singapore, Brazil and most European nations. Mr. Monk received his M.A. in Engineering from Cambridge University.

Tony Cruz, Ph.D. Dr. Cruz, age 65, joined OPKO in August 2016 as Chief Executive Officer, Transition Therapeutics, at the time of our acquisition of Transition Therapeutics, Inc., a NASDAQ and TSX publicly traded company. Dr. Cruz had served as the Chairman and Chief Executive Officer of Transition Therapeutics, Inc. from 1998 to 2016. Dr. Cruz was Co-founder of Angiotech Pharmaceuticals Inc., which developed the Taxol-coated stent for cardiovascular restenosis marketed by Boston Scientific. He served as Vice-President of Research from 1991 to 1996 and as a member of the Board of Directors from 1991 to 1995. Dr. Cruz was a founding member and served as the Scientific Director and CEO of the Canadian Arthritis Network, a Network Centers of Excellence. Dr. Cruz has established numerous partnerships with Big Pharma, biotech companies and the investment community in the biotech sector over the last 25 years. Dr. Cruz also had a successful academic career from 1987 to 2008 with over 150 publications. He was a senior scientist at Mount Sinai Hospital and a Professor at the University of Toronto until 2008.

CORPORATE GOVERNANCE

Our common stock is listed on the NASDAQ Global Select Market (“NASDAQ”) and trades under the symbol “OPK”. Prior to its transfer to the NASDAQ in June 2016, OPKO’s stock was listed for trading on the New York Stock Exchange. Since August 2013, our common stock has been traded on the Tel-Aviv Stock Exchange (“TASE”). Pursuant to the Company’s Amended and Restated Bylaws and the Delaware General Corporation Law (“DGCL”), our business and affairs are managed under the direction of our Board. Directors are kept informed of the Company’s business through discussions with management, including our Chief Executive Officer, Chief Financial Officer, and other senior officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

The Company has adopted a Code of Business Conduct and Ethics that applies to all employees, officers, and directors of the Company. The Code of Business Conduct and Ethics is available on our website: www.opko.com under Investor Relations. If the Company makes any substantive amendments to, or grants a waiver (including an implicit waiver) from, a provision of our Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, and that relates to any element of the code of ethics definition enumerated in Item 406(b) of Regulation S-K, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we will disclose such amendment or waiver on our website.

Director Independence

In evaluating the independence of each of our directors and director nominees, the Board considers transactions and relationships between each director or nominee, or any member of his or her immediate family, and the Company and its subsidiaries and affiliates. The Board also examines transactions and relationships between directors and director nominees or their known affiliates and members of the Company’s senior management and their known affiliates. The purpose of this review is to determine whether any such relationships or transactions are inconsistent with a determination that the director is independent under applicable laws and regulations and NASDAQ listing standards. In 2018, the Board affirmatively determined that a majority of our directors serving at that time, including Messrs. John A. Paganelli, and Richard C. Pfenniger, Jr., and Drs. Robert S. Fishel, Richard M. Krasno, Richard A. Lerner and Alice Lin-Tsing Yu, were “independent” directors within the meaning of the listing standards of NASDAQ and applicable law. In making the independence determinations, the Board considered a number of factors and relationships, including without limitation: (i) Dr. Frost’s prior service as Chairman of the Board of Ladenburg Thalmann Financial Services Inc., an entity for which Dr. Krasno serves as a member of the Board of Directors and in which Dr. Frost currently holds less than 5% of its issued and outstanding shares, and for which Dr. Frost previously held up to 36.5% of its issued and outstanding shares; (ii) Drs. Frost’s and Krasno’s and Mr. Rubin’s service as members of the Board of Directors of Castle Brands, Inc., an entity in which Dr. Frost

13

beneficially owns more than ten percent (10%); (iii) Mr. Pfenniger’s and Dr. Krasno’s service as members of the Board of Directors of BioCardia, Inc., formerly Tiger X Medical, Inc., an entity in which Dr. Frost beneficially owns more than ten percent (10%); (iv) Mr. Rubin’s previous service as Interim Chief Executive Officer and Interim Chief Financial Officer and as a member of the Board of Directors of Tiger X Medical, Inc. until its merger with BioCardia, Inc. in October 2016; (v) the Company’s investments in Zebra Biologics, Inc. (“Zebra”), an entity for which Dr. Lerner is the founder and currently serves as a director and scientific advisor and Dr. Frost currently serves as a director; and (vi) Dr. Frost’s and Mr. Pfenniger’s service on the Board of Trustees and Mr. Pfenniger’s service as Vice Chairman of the Executive Committee of the Board of the Frost Museum of Science, an entity in which the Company has pledged to contribute an aggregate of $1 million.

Board Leadership Structure

The Company is led by Dr. Frost, who has served as Chief Executive Officer and Chairman of the Board since March 2007. Six of our current directors satisfy NASDAQ independence requirements. Our Board also includes two management directors other than Dr. Frost. The Company does not have a member of our Board who is formally identified as the lead independent director. However, independent directors head each of our Board’s standing committees — the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee. A chairman has not yet been appointed for the Independent Investment Committee. Each of the committees is comprised solely of independent directors.

Although the Board does not have a formal policy on whether the roles of Chief Executive Officer and Chairman of the Board should be separated, we believe that our current Board leadership structure is suitable for us. The Chief Executive Officer is the individual selected by the Board to manage our Company on a day to day basis, and his direct involvement in our business operations makes him best positioned to lead productive Board strategic planning sessions and determine the time allocated to each agenda item in discussions of our Company’s short- and long-term objectives.

Board Role in Risk Oversight

The Board’s role in the risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal and regulatory, and strategic and reputational risks. In connection with its reviews of the operations of the Company’s business units and corporate functions, the Board considers and addresses the primary risks associated with those units and functions. Our full Board regularly engages in discussions of the most significant risks that the Company is facing and how these risks are being managed.

In addition, each of the Board’s committees, and particularly the Audit Committee, plays a role in overseeing risk management issues that fall within each committee’s areas of responsibility as described below under the heading “Standing Committees of the Board of Directors.” Senior management reports on at least a quarterly basis to the Audit Committee on the most significant risks facing the Company from a financial reporting perspective and highlights any new risks that may have arisen since the Audit Committee last met. The Audit Committee also meets regularly in executive sessions with the Company’s independent registered public accounting firm and reports any findings or issues to the full Board. In performing its functions, the Audit Committee and each standing committee of the Board has full access to management, as well as the ability to engage advisors. The Board receives regular reports from each of its standing committees regarding each committee’s particularized areas of focus.

Meetings and Committees of the Board of Directors

Our Board met eight times and took action by written consent on two occasions during fiscal 2018. In fiscal 2018, all incumbent directors attended 75% or more of the Board meetings and meetings of the committees on which they served.

Although we encourage each member of our Board to attend our annual meetings of stockholders, we do not have a formal policy requiring the members of our Board to attend. All members of our Board attended the annual meeting of stockholders held in fiscal 2018.

14

Executive Sessions; Presiding Director

Our non-management directors meet separately from the Board on a regular basis. Our independent directors meet in executive session from time to time as needed, but not less than twice annually. Our non-management or independent directors, as applicable, may choose a presiding director by majority vote for each session. The presiding director would be responsible for, among other things, presiding at the executive session for which he or she is chosen to serve and apprising the Chairman of the issues considered at such meetings.

Standing Committees of the Board of Directors

Our Board maintains several standing committees, including a Compensation Committee, a Nominating and Governance Committee, an Independent Investment Committee, and a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act, and the rules and regulations promulgated thereunder. These committees and their functions are described below. Our Board may also establish various other committees to assist it in its responsibilities. Our Board has adopted a written charter for each of its standing committees. The full text of each charter is available on our website at http://www.opko.com.

The following table shows the current members (indicated by an “X” or “Chair”) of each of our standing Board committees:

Audit |

Compensation |

Corporate

Governance

and

Nominating

|

Independent Investment |

|||||

Phillip Frost, M.D. |

— |

— |

— |

— |

||||

Jane H. Hsiao, Ph.D., MBA |

— |

— |

— |

— |

||||

Robert S. Fishel, M.D. |

— |

X |

— |

X |

||||

Richard M. Krasno, Ph.D. |

X |

X |

— |

X |

||||

Richard A. Lerner, M.D. |

— |

Chair |

X |

— |

||||

John A. Paganelli |

X |

— |

Chair |

X |

||||

Richard C. Pfenniger, Jr. |

Chair |

— |

— |

— |

||||

Steven D. Rubin |

— |

— |

— |

— |

||||

Alice Lin-Tsing Yu, M.D., Ph.D. |

— |

— |

— |

— |

||||

Audit Committee

Our Audit Committee oversees our corporate accounting and financial reporting process. Our Audit Committee met sixteen times during fiscal 2018. The responsibilities of our Audit Committee are set forth in a written charter adopted by our Board of Directors and reviewed and reassessed on an annual basis by the Audit Committee. Among other things, our Audit Committee:

• |

appoints, compensates, retains, and oversees the work of our independent registered public accounting firm; |

• |

approves the retention of our independent registered public accounting firm to perform any proposed permissible non-audit services; |

• |

reviews our systems of internal controls established for finance, accounting, legal compliance, and ethics; |

• |

reviews our accounting and financial reporting processes; |

• |

provides for effective communication between our Board of Directors, our senior and financial management, and our independent auditors; |

• |

discusses with management and our independent auditors the results of our annual audit and the review of our quarterly financial statements; |

15

• |

reviews the audits of our financial statements; |

• |

implements a pre-approval policy for certain audit and non-audit services performed by our registered independent public accounting firm; |

• |

reviews risks relating to financial statements, auditing and financial reporting process, key credit risks, liquidity risks and market risks; |

• |

discusses policies with respect to risk assessment and risk management and reports to our Board of Directors; |

• |

establishes procedures for receipt, retention, and treatment of complaints regarding accounting, internal controls, or auditing matters; and |

• |

reviews and approves any related party transactions that we are involved in. |

Our Audit Committee is composed of Messrs. Pfenniger (Chairman) and Paganelli, and Dr. Krasno. Our Board of Directors has determined that Mr. Pfenniger, who is independent (as independence for audit committee members is defined in NASDAQ listing standards and applicable Securities and Exchange Commission (“SEC”) rules), is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K.

Compensation Committee

Our Compensation Committee reviews and approves, on behalf of the Board, (i) annual salaries, bonuses, and other compensation for our executive officers, and (ii) employee benefit plans for our employees and executive officers. Our Compensation Committee recommends to the Board for approval, (i) compensation for the Company’s directors, and (ii) incentive compensation plans, equity plans and deferred compensation plans. Our Compensation Committee also oversees our compensation policies and practices. Our Compensation Committee met five times during fiscal 2018. Our Compensation Committee may from time to time establish a subcommittee to perform any action required to be performed by a committee of “non-employee directors” pursuant to Rule 16b-3 under the Exchange Act and “outside directors” pursuant to Rule 162(m) under the Internal Revenue Code (the “Code”).

Our Compensation Committee also performs the following functions related to executive compensation:

• |

reviews and approves the annual salary, bonus, stock options, and other benefits, direct and indirect, of our executive officers, including our Chief Executive Officer; |

• |

reviews and recommends new executive compensation programs; reviews the operation and efficacy of our executive compensation programs; |

• |

establishes and periodically reviews policies in the area of senior management perquisites; |

• |

reviews and approves material changes in our employee benefit plans; and |

• |

administers our equity compensation and employee stock purchase plans. |

The Compensation Committee relies heavily on the recommendations of our Chief Executive Officer concerning compensation actions for our other executive officers and may engage compensation consultants if the Compensation Committee deems it appropriate. In deciding upon the appropriate level of compensation for our executive officers, the Compensation Committee also reviews our compensation programs relative to our strategic objectives and market practice and other changing business and market conditions. To date, neither the Compensation Committee nor management has engaged a compensation consultant in determining or recommending the amount or form of director or officer compensation.

Our Compensation Committee is composed of Drs. Lerner (Chairman), Fishel, and Krasno. We believe that the composition and functioning of our Compensation Committee complies with all applicable requirements of the

16

Sarbanes-Oxley Act of 2002, the NASDAQ, and the SEC’s rules and regulations, including those regarding the independence of our Compensation Committee members.

Compensation Committee Interlocks and Insider Participation

Drs. Richard A. Lerner, Robert S. Fishel and Richard M. Krasno served on the Company’s Compensation Committee during fiscal year 2018. None of the individuals serving on the Compensation Committee during fiscal year 2018 were at any time during fiscal year 2018, an officer or employee of the Company and none have served as an officer of the Company. No member of the Compensation Committee had any relationship with the Company or any of its subsidiaries during fiscal year 2018 pursuant to which disclosure would be required under applicable SEC rules pertaining to the disclosure of transactions with related persons. During fiscal year 2018, none of our executive officers or directors was a member of the board of directors of any other company where the relationship would be considered a compensation committee interlock under SEC rules.

Corporate Governance and Nominating Committee

Our Corporate Governance and Nominating Committee’s responsibilities include the selection of potential candidates for our Board, making recommendations to our Board concerning the structure and membership of the other Board committees, and considering director candidates recommended by others, including our Chief Executive Officer, other Board members, third parties, and stockholders. Our Corporate Governance and Nominating Committee is composed of Dr. Lerner and Mr. Paganelli. Our Corporate Governance and Nominating Committee met two times during fiscal 2018. We believe that the composition of our Corporate Governance and Nominating Committee complies with applicable requirements of the Sarbanes-Oxley Act of 2002, the NASDAQ, and the SEC’s rules and regulations, including those regarding the independence of our Corporate Governance and Nominating Committee members.

The Corporate Governance and Nominating Committee identifies director nominees through a combination of referrals, including by existing members of the Board, management, third parties, stockholders, and direct solicitations, where warranted. Once a candidate has been identified, the Corporate Governance and Nominating Committee reviews the individual’s experience and background, and may discuss the proposed nominee with the source of the recommendation. The Corporate Governance and Nominating Committee usually believes it to be appropriate for committee members to interview the proposed nominee before making a final determination on whether to recommend the individual as a nominee to the entire Board to stand for election to the Board. The Committee does not plan to evaluate candidates identified by the Corporate Governance and Nominating Committee differently from those recommended by a stockholder or otherwise.

The Corporate Governance and Nominating Committee recommended to the Board that it nominate each of Drs. Frost, Hsiao, Fishel, Krasno, Lerner and Yu and Messrs. Rubin, Paganelli, and Pfenniger for election at the 2019 Annual Meeting.

Independent Investment Committee

Our Board of Directors established the Independent Investment Committee in February 2019. The Independent Committee’s purpose is (i) to review, approve, and monitor the acquisition, disposition, voting, exercise, conversion, exchange of, and other transactions related to the Company’s minority investments, (ii) appoint members of the Company’s management investment committee which makes recommendations regarding such investments, and (iii) provide oversight over the Company’s minority investment programs.

The Independent Investment Committee’s responsibilities include monitoring and approving acquisitions and dispositions of certain strategic minority investments, overseeing the Company’s compliance with Section 13 and Section 16 of the Securities and Exchange Act of 1934, as amended, and executing other responsibilities delegated to it by the Board, consistent with the Company’s bylaws and applicable laws. Our Independent Investment Committee is composed of Mr. Paganelli and Drs. Fishel and Krasno, each of whom we believe to be independent directors under applicable law.

Director Selection Criteria

17

The Corporate Governance and Nominating Committee reviews and makes recommendations to the Board regarding the appropriate qualifications, skills, and experience expected of individual members and of the Board as a whole with the objective of having a Board with sound judgment and diverse backgrounds and experience to represent stockholder interests.

The Corporate Governance and Nominating Committee believes that nominees for election to the Board should possess sufficient business or financial experience and a willingness to devote the time and effort necessary to discharge the responsibilities of a director. This experience can include, but is not limited to, service on other boards of directors or active involvement with other boards of directors, experience in the industries in which the Company conducts its business, audit and financial expertise, clinical experience, operational experience, or a scientific or medical background. The Corporate Governance and Nominating Committee does not believe that nominees for election to the Board should be selected through mechanical application of specified criteria. Rather, the Corporate Governance and Nominating Committee believes that the qualifications and strengths of individuals should be considered in their totality with a view to nominating persons for election to the Board whose backgrounds, integrity, and personal characteristics indicate that they will make a positive contribution to the Board.

While we do not have a formal diversity policy with respect to Board composition, the Board believes it is important for the Board to have diversity of knowledge base, professional experience and skills, and the Corporate Governance and Nominating Committee takes these qualities into account when considering director nominees for recommendation to the Board.

Stockholder Nominations

The Corporate Governance and Nominating Committee does not have a written policy with regard to consideration of director candidates recommended by stockholders. Nevertheless, it is the Corporate Governance and Nominating Committee’s policy to consider director candidates recommended by stockholders. Stockholders who wish to recommend candidates for election to the Board must do so in writing. The recommendation should be sent to the Secretary of the Company, OPKO Health, Inc., 4400 Biscayne Boulevard, Miami, Florida 33137, who will forward the recommendation to the Corporate Governance and Nominating Committee. The recommendation must set forth (i) the name and address as they appear on the Company’s books of the stockholder making the recommendation, the telephone number of such stockholder, and the name, address and telephone number of any beneficial owner, and the class and number of shares of capital stock of the Company owned of record by such stockholder and beneficially owned by such beneficial owner, (ii) the name of the candidate and all information relating to the candidate that is required to be disclosed in solicitations of proxies for election of directors under the SEC’s proxy rules, (iii) a description of all relationships between the candidate and the recommending stockholder and any agreements or understandings between the recommending stockholder and the candidate regarding the nomination, and (iv) a description of all relationships between the candidate and any of the Company’s competitors, customers, suppliers, labor unions (if any) and any other persons with special interests regarding the Company. The recommendation must be accompanied by the candidate’s written consent to being named in the Company’s proxy statement as a nominee for election to the Board and to serving as a director, if elected, and by a representation from the stockholder and beneficial owner, if any, that such stockholder and beneficial owner intend to appear at the Annual Meeting and intend to continue to hold the reported shares through the date of the Company’s next annual meeting of stockholders. Stockholders must also comply with all requirements of the Company’s Amended and Restated Bylaws with respect to nomination of persons for election to the Board.

Communications with the Board

All interested parties may initiate in writing any communication with our Board, the presiding member of the non-management directors, or any individual director by sending the correspondence to OPKO Health, Inc., 4400 Biscayne Blvd., Miami, Florida 33137, Attention: Secretary. This centralized process assists our Board in reviewing and responding to communications in an appropriate manner. If an interested party would like the letter to be forwarded directly to one of the Chairmen of the three standing committees of the Board, he or she should so indicate. If no specific direction is indicated, the Secretary’s office will review the letter and forward it to the appropriate Board member(s).

18

Employee Communications with the Audit Committee

The Audit Committee has established procedures for the receipt, retention, and treatment of complaints regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting and auditing matters. These procedures are described in our OPKO Health, Inc. Policy on Reporting Unlawful Conduct and Prohibiting Retaliation Against Reporting Employees.

Involvement in Certain Legal Proceedings

As previously disclosed, the Company and its CEO, Dr. Frost, along with several other entities and individuals, were named defendants (each, a “Defendant”) in a complaint filed by the SEC on September 7, 2018 in the Southern District of New York (the “Complaint”), in which the SEC alleged that the Company (i) aided and abetted a purported “pump and dump” scheme in connection with one company perpetrated by a number of the Defendants, and (ii) failed to file required Schedules 13D or 13G with the SEC. The Complaint also alleged that Dr. Frost (i) participated in the alleged market manipulation in connection with two companies, (ii) failed to file required Schedule 13Ds with the SEC, and (iii) sold unregistered securities without an applicable exemption. Following the SEC’s announcement of the Complaint, a number of class action and derivative suits were filed against the Company and its directors and officers, including Dr. Frost, concerning the allegations in the Complaint and related matters.

In December 2018, the Company and Dr. Frost entered into settlements with the SEC, which, upon approval by the court in January 2019, resolved the claims against the Company and Dr. Frost raised in the Complaint. Pursuant to the settlement between us and the SEC, and without admitting or denying any of the allegations of the Complaint, we agreed to an injunction from violations of Section 13(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), a strict liability claim, and to pay a $100,000 penalty, which has been paid. We also agreed to, within certain stipulated time periods, enact certain corporate governance measures, including the establishment of the Independent Investment Committee.

Under the terms of the settlement between the SEC and Dr. Frost, and without admitting or denying any of the allegations in the Complaint, Dr. Frost agreed to injunctions from violations of Sections 5(a) and (c) and 17(a)(2) of the Securities Act of 1933, as amended, claims which may be satisfied by strict liability and negligence, respectively, and Section 13(d) of the Exchange Act, also a strict liability claim; to pay approximately $5.5 million in penalty, disgorgement and pre-judgment interest, which has been paid; and to be prohibited, with certain exceptions, from trading in penny stocks. The settlements include no restriction on Dr. Frost’s ability to continue to serve as our CEO and Chairman.