EX-99.1

Published on September 11, 2013

Exhibit 99.1

Corporate Presentation September 2013

Safe Harbor Statement

This presentation contains forward-looking statements, including statements regarding the results of current clinical studies and pre-clinical experiments and the effectiveness of OPKOs and PROLORs programs are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that forward-looking statements involve risks and uncertainties that may affect OPKOs and PROLORs business and prospects, that OPKO and PROLOR may not succeed in developing any commercial products, and that ongoing studies may not show substantial activity; and other risks and uncertainties that may cause results to differ materially from those set forth in the forward-looking statements. A number of the matters discussed in this presentation that are not historical or current facts deal with potential future circumstances and developments. The discussion of such matters is qualified by the inherent risks and uncertainties surrounding future expectations generally and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. In addition to the risks described above, investors should consider the economic, competitive, governmental, technological and other factors discussed in OPKOs filings with the Securities and Exchange Commission.

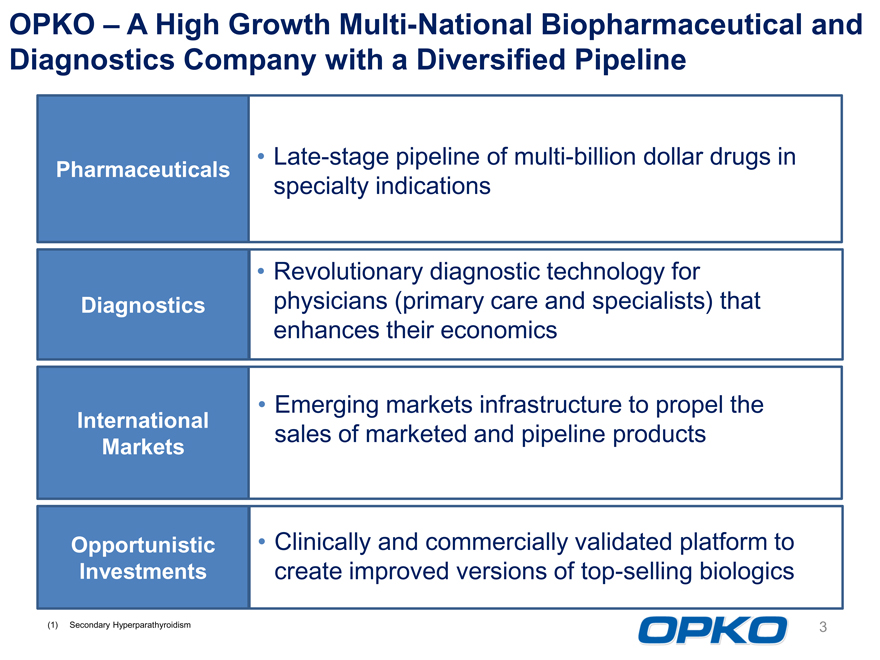

OPKO A High Growth Multi-National Biopharmaceutical and Diagnostics Company with a Diversified Pipeline

Pharmaceuticals

Late-stage pipeline of multi-billion dollar drugs in specialty indications

Diagnostics

Revolutionary diagnostic technology for physicians (primary care and specialists) that enhances their economics

International Markets

Emerging markets infrastructure to propel the sales of marketed and pipeline products

Opportunistic Investments

Clinically and commercially validated platform to create improved versions of top-selling biologics

| (1) |

|

Secondary Hyperparathyroidism |

| 3 |

|

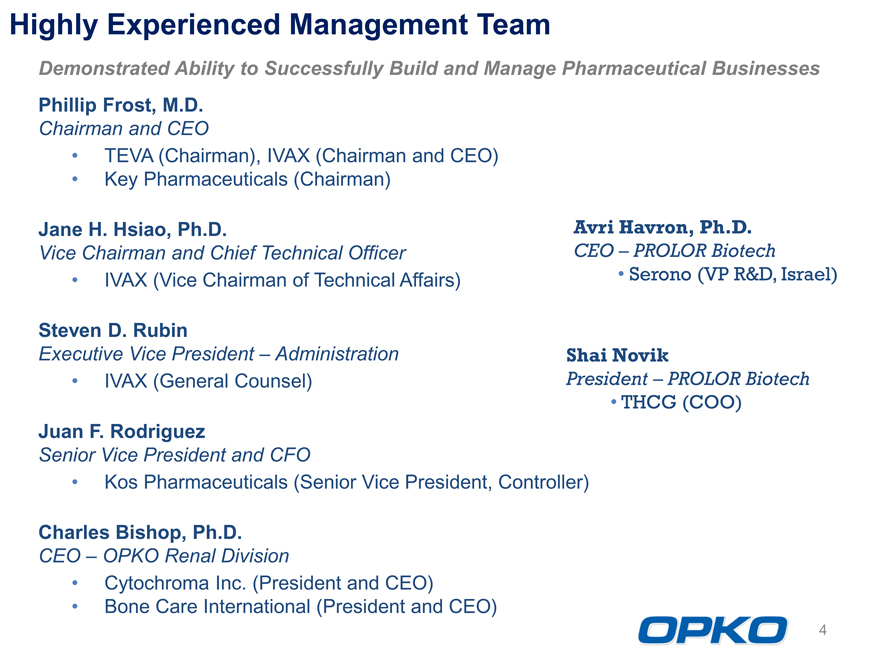

Highly Experienced Management Team

Demonstrated Ability to Successfully Build and Manage Pharmaceutical Businesses

Phillip Frost, M.D.

Chairman and CEO

TEVA (Chairman), IVAX (Chairman and CEO) Key Pharmaceuticals (Chairman)

Jane H. Hsiao, Ph.D. Avri Havron, Ph.D.

Vice Chairman and Chief Technical Officer CEO PROLOR Biotech IVAX (Vice Chairman of Technical Affairs) Serono (VP R&D, Israel)

Steven D. Rubin

Executive Vice President Administration Shai Novik IVAX (General Counsel) President PROLOR Biotech

THCG (COO)

Juan F. Rodriguez

Senior Vice President and CFO Kos Pharmaceuticals (Senior Vice President, Controller)

Charles Bishop, Ph.D.

CEO OPKO Renal Division Cytochroma Inc. (President and CEO) Bone Care International (President and CEO)

| 4 |

|

Financial Highlights (June 2013, Pro-Forma)

Cash & Marketable Securities $193 mm

Total Assets $1.25 bn

Current Liabilities 62mm

3% Convertible Notes, Due 2023 $188 mm

Other Long-Term Liabilities $81 mm

Total Shareholders Equity $924 mm

Shares Outstanding 400 mm

Warrants, Options, Convertible Debt 79 mm

Market Cap ~ $3.3 bn

Total OPKO Share Purchases by Dr. Frost $240 mm

Average Daily Trading NYSE 2.4 mm shares

Employees 600

| 5 |

|

Pharmaceuticals

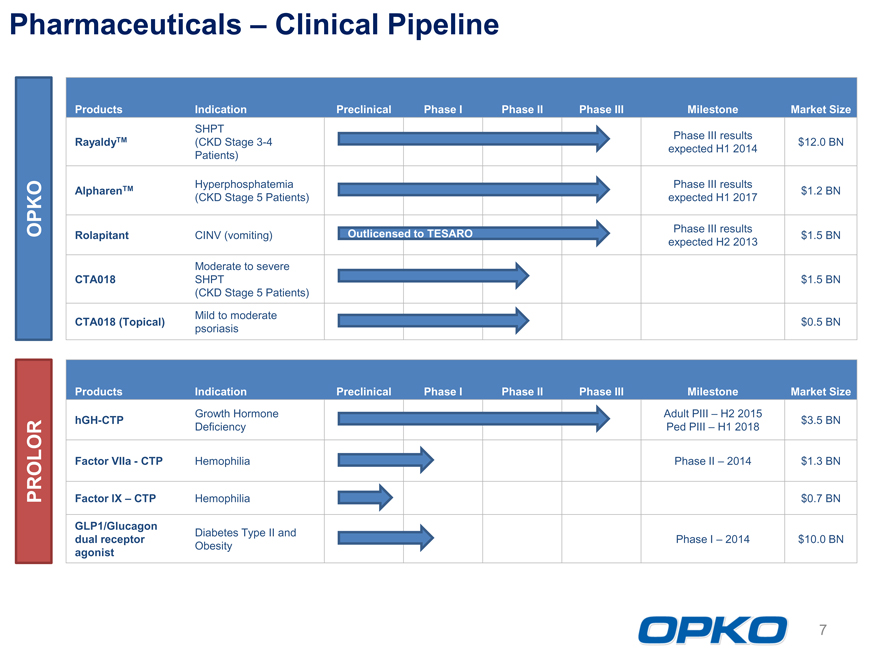

Pharmaceuticals Clinical Pipeline

Products Indication Preclinical Phase I Phase II Phase III Milestone Market Size

SHPT Phase III results

RayaldyTM (CKD Stage 3-4 $12.0 BN

Patients) expected H1 2014

Hyperphosphatemia Phase III results

AlpharenTM $1.2 BN

(CKD Stage 5 Patients) expected H1 2017

Phase III results

Rolapitant CINV (vomiting) Outlicensed to TESARO $1.5 BN

expected H2 2013

Moderate to severe

CTA018 SHPT $1.5 BN

(CKD Stage 5 Patients)

Mild to moderate

CTA018 (Topical) $0.5 BN

psoriasis

OPKO

Products Indication Preclinical Phase I Phase II Phase III Milestone Market Size

Growth Hormone Adult PIII H2 2015

hGH-CTP $3.5 BN

Deficiency Ped PIII H1 2018

Factor VIIaCTP Hemophilia Phase II 2014 $1.3 BN

Factor IX CTP Hemophilia $0.7 BN

GLP1/Glucagon Diabetes Type II and

dual receptor Phase I 2014 $10.0 BN

agonist Obesity

PROLOR

| 7 |

|

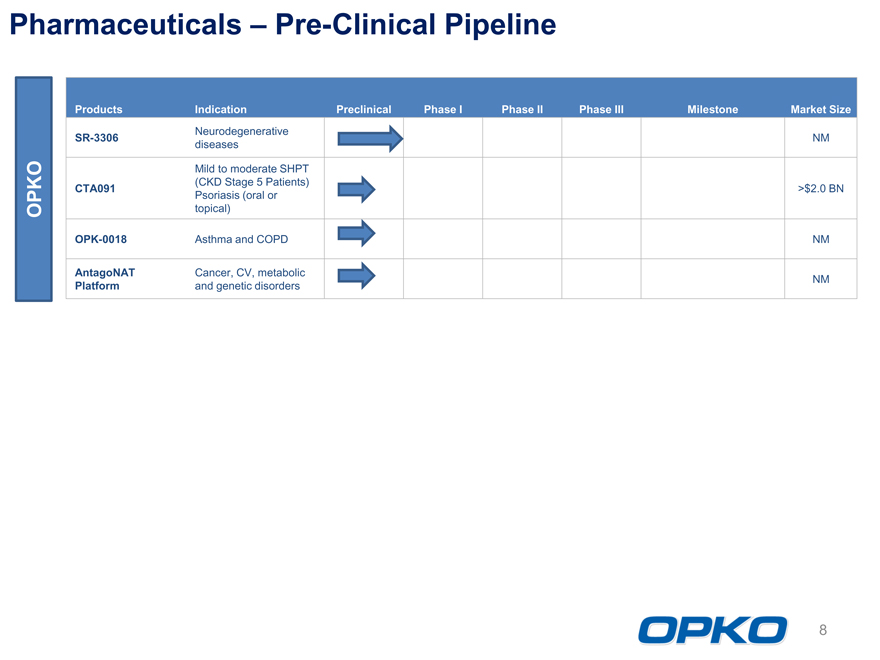

Pharmaceuticals Pre-Clinical Pipeline

Products Indication Preclinical Phase I Phase II Phase III Milestone Market Size

Neurodegenerative

SR-3306 NM

diseases

Mild to moderate SHPT

(CKD Stage 5 Patients)

CTA091 >$2.0 BN

Psoriasis (oral or

topical)

OPK-0018 Asthma and COPD NM

AntagoNAT Cancer, CV, metabolic

Platform and genetic disorders NM

OPKO

| 8 |

|

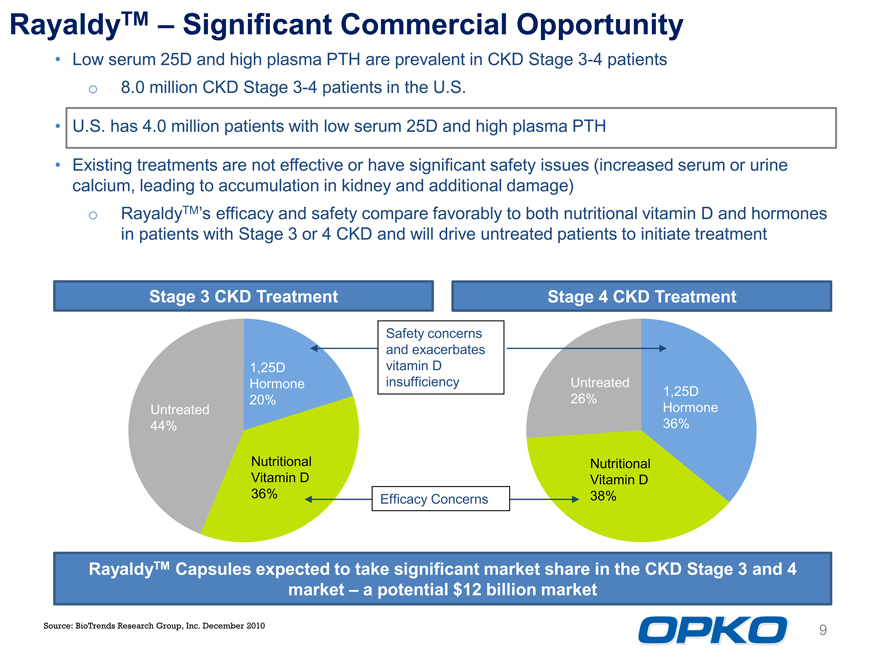

RayaldyTM Significant Commercial Opportunity

Low serum 25D and high plasma PTH are prevalent in CKD Stage 3-4 patients o 8.0 million CKD Stage 3-4 patients in the U.S. U.S. has 4.0 million patients with low serum 25D and high plasma PTH Existing treatments are not effective or have significant safety issues (increased serum or urine calcium, leading to accumulation in kidney and additional damage) o RayaldyTMs efficacy and safety compare favorably to both nutritional vitamin D and hormones in patients with Stage 3 or 4 CKD and will drive untreated patients to initiate treatment

Stage 3 CKD Treatment

Stage 4 CKD Treatment

Safety concerns and exacerbates vitamin D insufficiency

Untreated 26%

1,25D Hormone 36%

Nutritional Vitamin D 38%

Untreated 44%

1,25D Hormone 20%

Nutritional Vitamin D 36%

Efficacy Concerns

RayaldyTM Capsules expected to take significant market share in the CKD Stage 3 and 4 market a potential $12 billion market

Source: BioTrends Research Group, Inc. December 2010

9

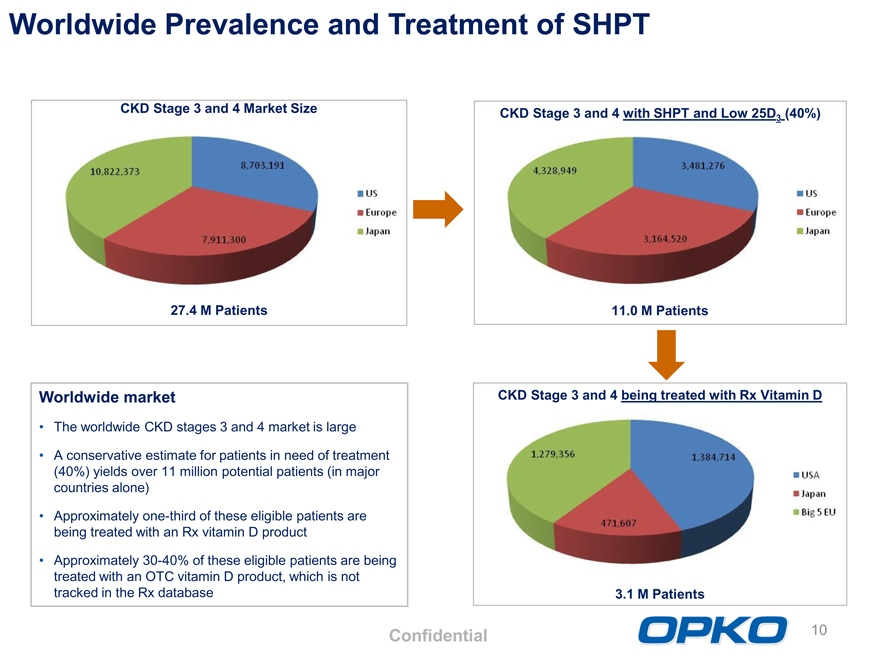

Worldwide Prevalence and Treatment of SHPT

CKD Stage 3 and 4 Market Size

27.4 M Patients

CKD Stage 3 and 4 with SHPT and Low 25D3 (40%)

11.0 M Patients

Worldwide market The worldwide CKD stages 3 and 4 market is large A conservative estimate for patients in need of treatment (40%) yields over 11 million potential patients (in major countries alone) Approximately one-third of these eligible patients are being treated with an Rx vitamin D product Approximately 30-40% of these eligible patients are being treated with an OTC vitamin D product, which is not tracked in the Rx database

CKD Stage 3 and 4 being treated with Rx Vitamin D

3.1 M Patients

Confidential

10

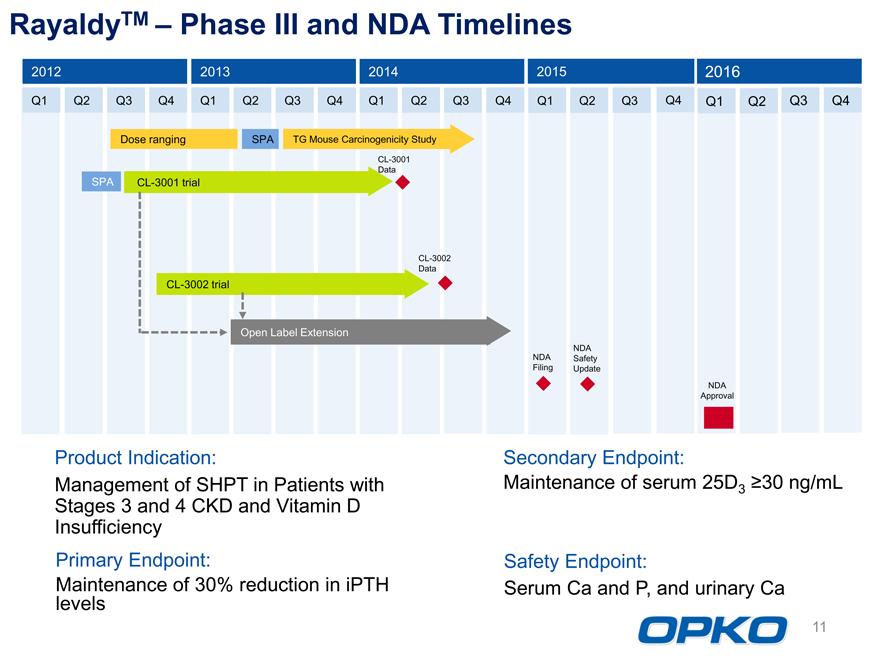

RayaldyTM Phase III and NDA Timelines

2012 2013 2014 2015 2016

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Dose ranging SPA TG Mouse Carcinogenicity Study

SPA CL-3001 trial CL-3001

DataCL-3002 trial

CL-3002

Data

Open Label Extension

NDA

NDA Safety

Filing Update

NDA Approval Product Indication:

Management of SHPT in Patients with Stages 3 and 4 CKD and Vitamin D Insufficiency Primary Endpoint: Maintenance of 30% reduction in iPTH levels

Secondary Endpoint:

Maintenance of serum 25D3 ?30 ng/mL

Safety Endpoint:

Serum Ca and P, and urinary Ca

11

Pharmaceuticals: PROLOR

Lead Product hGH-CTP BioBetter to Reduce Injection Frequency $3.5 billion market Growing 5% annually Requires daily injections Growth hormone deficient children Growth hormone deficient adults

13

GH Effect in GH Deficient Adults

Proper hGH treatment results in: Increase in

bone density

Decrease

in fat mass Improved cardiac function,

lower risk of cardiac

Increase in diseases

lean body mass

Improved overall

physical

performance

14

hGH-CTP Phase II Positive Data

Analysis and Conclusions A single weekly injection of hGH-CTP can replace 7 daily injections of commercially available GH

Identified kick-start dosing for Phase III trial

Post-Phase II hGH-CTP Pilot Study Supports two hGH-CTP Injections Per Month Very Good safety and tolerability profile Only 50-65% of the cumulative daily GH dosing was required to maintain the majority of the patients within the normal range of IGF-1 Estimated COG 50-75% of commercially available GH

15

hGH-CTP Phase II and III Pediatric GHD Phase II trial (ongoing)

40-50 patients

4 cohorts; 3 receiving once weekly hGH-CTP at different doses, one control daily commercial

12 months efficacy and safety

Key outcome: Height velocity Adult Pivotal Phase III trial (initiated June 2013)

189 patients, estimated $20 million study

6 months efficacy and 6 months safety

Key outcome: Improvement in truncal fat

Confirmed by FDA as pivotal, planned for BLA submission in 2015 Received U.S. orphan drug status for children and adults First ever to receive E.U. orphan drug status for children and adults

16

hGH-CTP Competitive Advantages Needle size 31G

No additional drug product viscosity that is typically associated with long-acting formulations Highly concentrated formulation

No need for 2 injections sites, once per week Superb clinical, safety and immunogenicity profile Low COGS

50-75% of commercial products Robust manufacturing process Orphan drug designation in the U.S., Europe

17

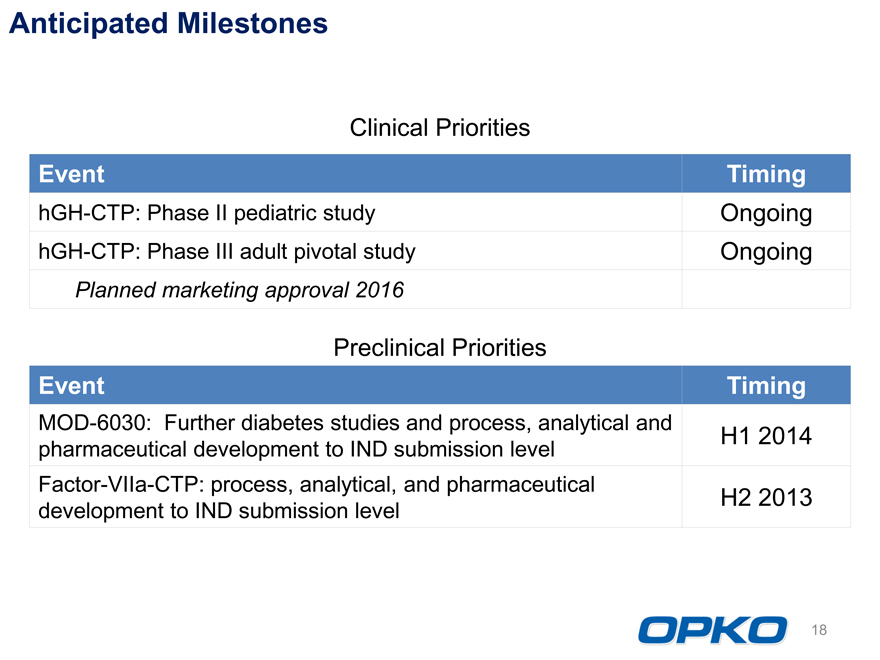

Anticipated Milestones

Clinical Priorities

Event Timing

hGH-CTP: Phase II pediatric study Ongoing

hGH-CTP: Phase III adult pivotal study Ongoing

Planned marketing approval 2016

Preclinical Priorities

Event Timing

MOD-6030: Further diabetes studies and process, analytical and H1 2014

pharmaceutical development to IND submission level

Factor-VIIa-CTP: process, analytical, and pharmaceutical H2 2013

development to IND submission level

18

Diagnostics

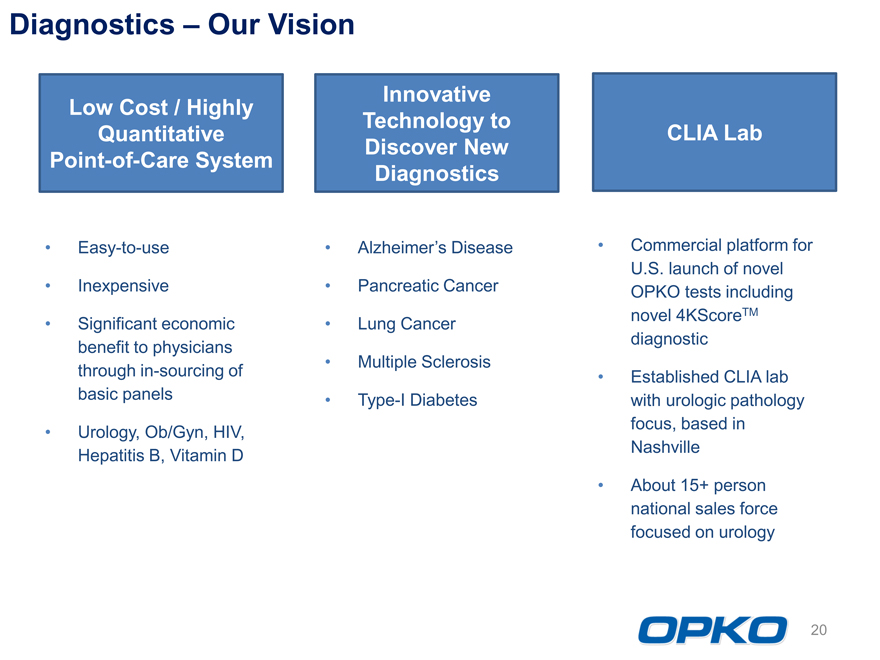

Diagnostics Our Vision

Innovative Low Cost / Highly Technology to

Quantitative CLIA Lab Discover New

Point-of-Care System

Diagnostics Easy-to-use Alzheimers Disease Commercial platform for U.S. launch of novel Inexpensive Pancreatic Cancer OPKO tests including novel 4KScoreTM Significant economic Lung Cancer diagnostic benefit to physicians Multiple Sclerosis through in-sourcing of Established CLIA lab basic panels Type-I Diabetes with urologic pathology focus, based in Urology, Ob/Gyn, HIV, Nashville Hepatitis B, Vitamin D About 15+ person national sales force focused on urology

20

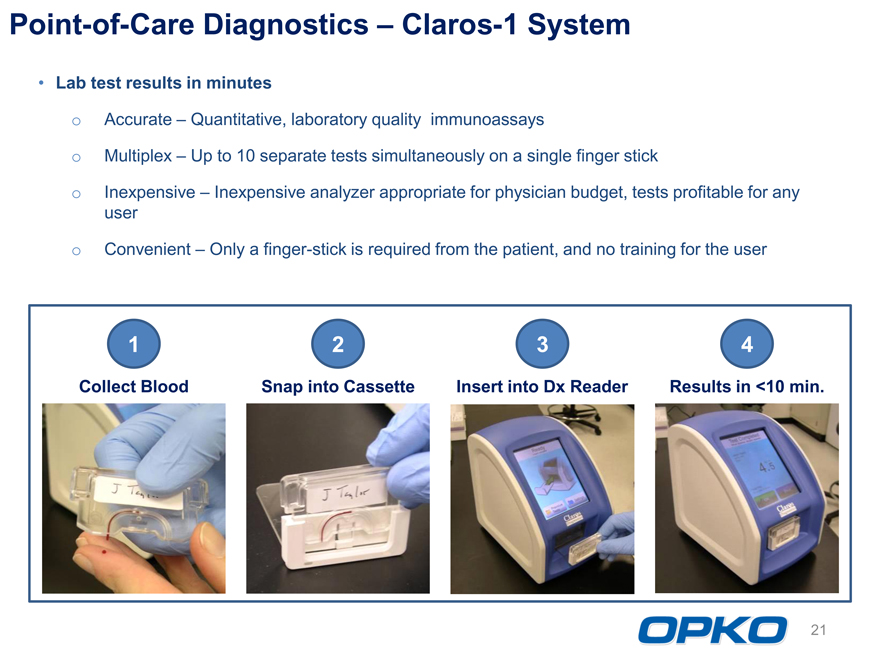

Point-of-Care Diagnostics Claros-1 System Lab test results in minutes o Accurate Quantitative, laboratory quality immunoassays o Multiplex Up to 10 separate tests simultaneously on a single finger stick

Inexpensive Inexpensive analyzer appropriate for physician budget, tests profitable for any user

Convenient Only a finger-stick is required from the patient, and no training for the user

11 2 3 4

Collect Blood Snap into Cassette Insert into Dx Reader Results in <10 min.

21

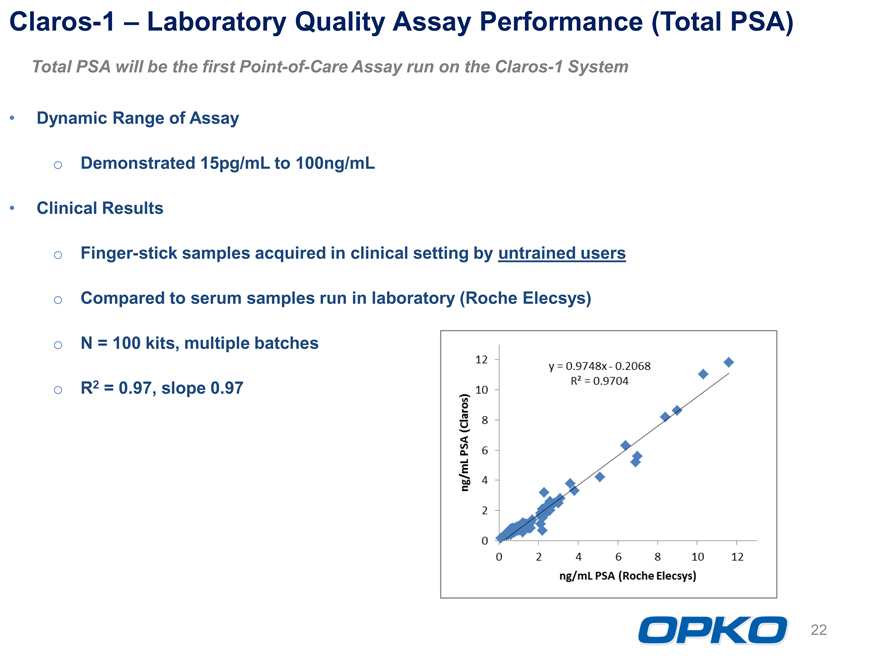

Claros-1 Laboratory Quality Assay Performance (Total PSA)

Total PSA will be the first Point-of-Care Assay run on the Claros-1 System Dynamic Range of Assay o Demonstrated 15pg/mL to 100ng/mL Clinical Results o Finger-stick samples acquired in clinical setting by untrained users

Compared to serum samples run in laboratory (Roche Elecsys)

N = 100 kits, multiple batches

R2 = 0.97, slope 0.97

22

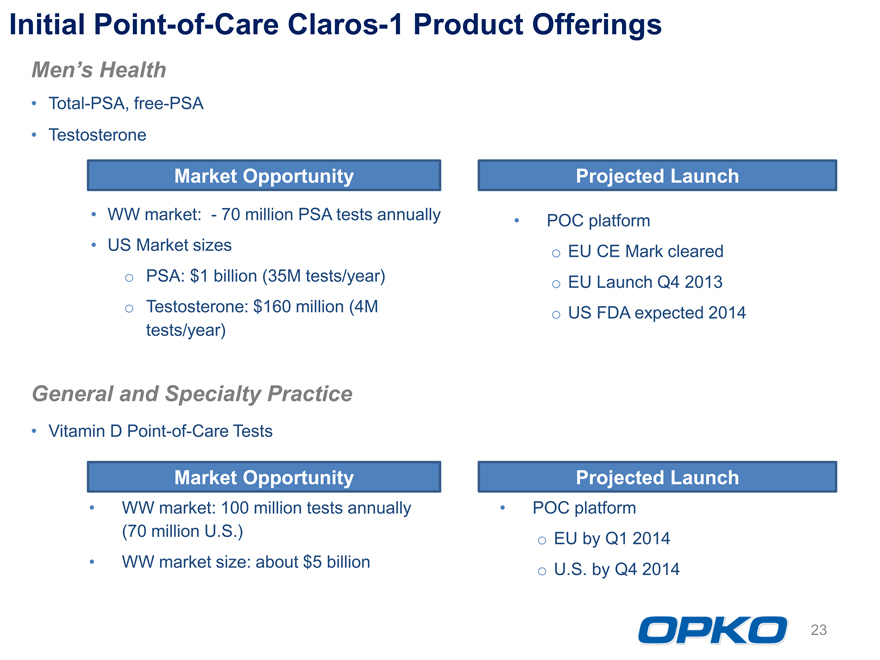

Initial Point-of-Care Claros-1 Product Offerings

Mens Health Total-PSA, free-PSA Testosterone

Market Opportunity Projected Launch

WW market: 70 million PSA tests annually POC platform US Market sizes o EU CE Mark cleared o PSA: $1 billion (35M tests/year) o EU Launch Q4 2013 o Testosterone: $160 million (4M o US FDA expected 2014 tests/year)

General and Specialty Practice Vitamin D Point-of-Care Tests

Market Opportunity Projected Launch WW market: 100 million tests annually POC platform (70 million U.S.) EU by Q1 2014 o WW market size: about $5 billion o U.S. by Q4 2014

23

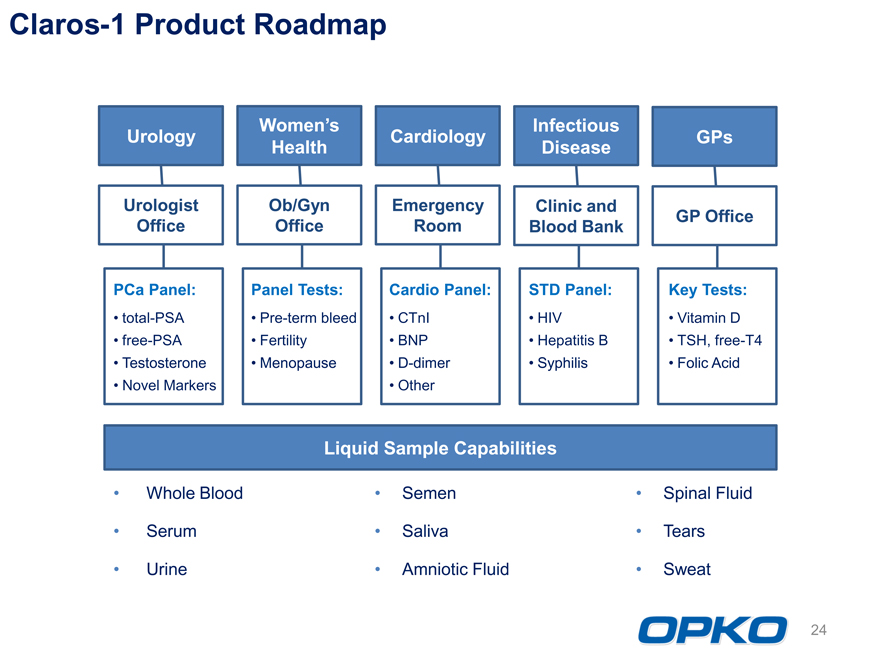

Claros-1 Product Roadmap

Womens Infectious

Urology Cardiology GPs

Health Disease

Urologist Ob/Gyn Emergency Clinic and

GP Office

Office Office Room Blood Bank

PCa Panel: Panel Tests: Cardio Panel: STD Panel: Key Tests: total-PSA Pre-term bleed CTnI HIV Vitamin D free-PSA Fertility BNP Hepatitis B TSH, free-T4 Testosterone Menopause D-dimer Syphilis Folic Acid Novel Markers Other

Liquid Sample Capabilities Whole Blood Semen Spinal Fluid Serum Saliva Tears Urine Amniotic Fluid Sweat

24

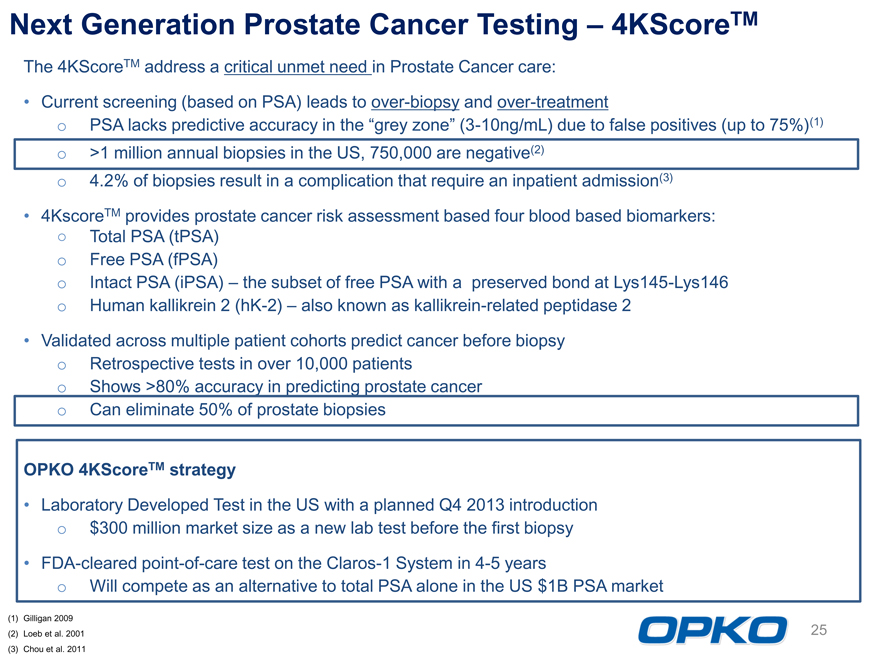

Next Generation Prostate Cancer Testing 4KScoreTM

The 4KScoreTM address a critical unmet need in Prostate Cancer care:

Current screening (based on PSA) leads to over-biopsy and over-treatment o PSA lacks predictive accuracy in the grey zone (3-10ng/mL) due to false positives (up to 75%)(1) o >1 million annual biopsies in the US, 750,000 are negative(2) o 4.2% of biopsies result in a complication that require an inpatient admission(3) 4KscoreTM provides prostate cancer risk assessment based four blood based biomarkers:

Total PSA (tPSA) o Free PSA (fPSA) o Intact PSA (iPSA) the subset of free PSA with a preserved bond at Lys145-Lys146 o Human kallikrein 2 (hK-2) also known as kallikrein-related peptidase 2 Validated across multiple patient cohorts predict cancer before biopsy o Retrospective tests in over 10,000 patients o Shows >80% accuracy in predicting prostate cancer o Can eliminate 50% of prostate biopsies

OPKO 4KScoreTM strategy Laboratory Developed Test in the US with a planned Q4 2013 introduction o $300 million market size as a new lab test before the first biopsy FDA-cleared point-of-care test on the Claros-1 System in 4-5 years o Will compete as an alternative to total PSA alone in the US $1B PSA market

Gilligan 2009

Loeb et al. 2001

Chou et al. 2011

25

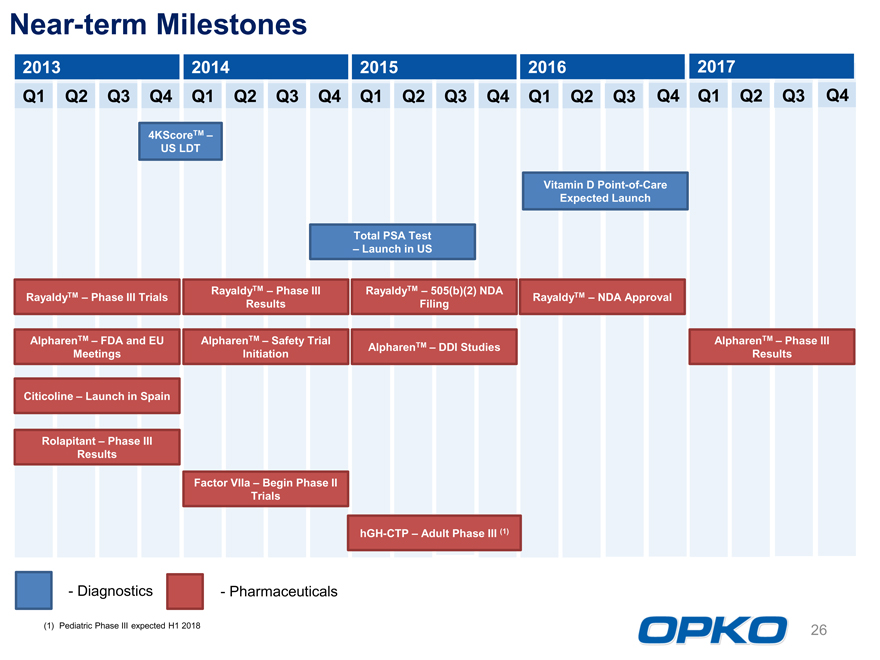

Near-term Milestones

2013 2014 2015 2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

4KScoreTM US LDT

Vitamin D Point-of-Care Expected Launch

Total PSA Test

Launch in US

RayaldyTM Phase III Trials RayaldyTM Phase III RayaldyTM 505(b)(2) NDA RayaldyTM NDA Approval Results Filing

AlpharenTM FDA and EU AlpharenTM Safety Trial AlpharenTM DDI Studies AlpharenTM Phase III Meetings Initiation Results

Citicoline Launch in Spain

Rolapitant Phase III Results

Factor VIIa Begin Phase II Trials

hGH-CTP Adult Phase III (1)

- DiagnosticsPharmaceuticals

| (1) |

|

Pediatric Phase III expected H1 2018 |

26

International Markets

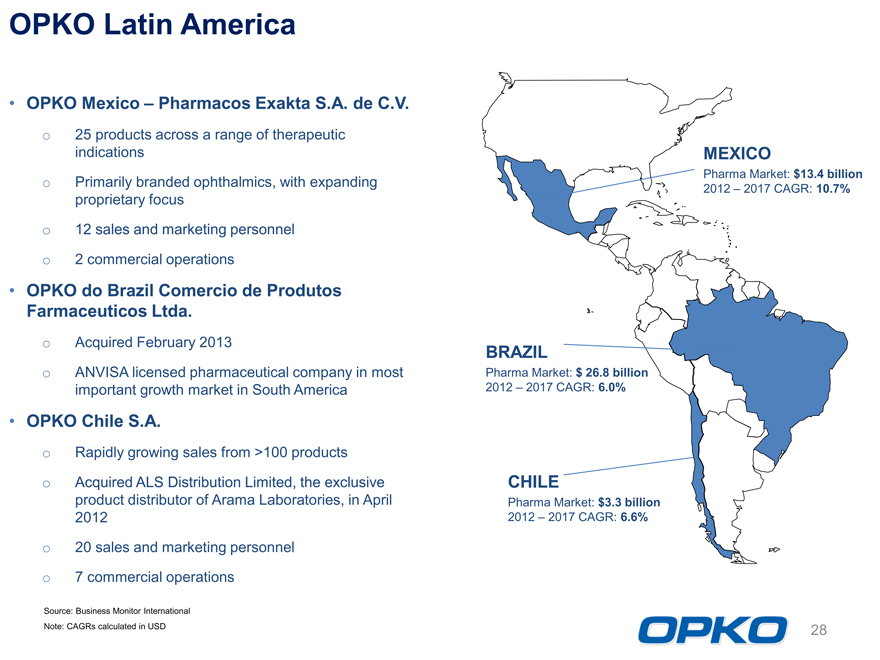

OPKO Latin America OPKO Mexico Pharmacos Exakta S.A. de C.V.

o 25 products across a range of therapeutic indications

o Primarily branded ophthalmics, with expanding proprietary focus

o 12 sales and marketing personnel

o 2 commercial operations OPKO do Brazil Comercio de Produtos Farmaceuticos Ltda.

o Acquired February 2013

o ANVISA licensed pharmaceutical company in most important growth market in South America OPKO Chile S.A.

o Rapidly growing sales from >100 products

o Acquired ALS Distribution Limited, the exclusive product distributor of Arama Laboratories, in April 2012

o 20 sales and marketing personnel

o 7 commercial operations

BRAZIL

Pharma Market: $ 26.8 billion

2012 2017 CAGR: 6.0%

CHILE

Pharma Market: $3.3 billion 2012 2017 CAGR: 6.6%

MEXICO

Pharma Market: $13.4 billion 2012 2017 CAGR: 10.7%

Source: Business Monitor International Note: CAGRs calculated in USD

28

OPKO European Union

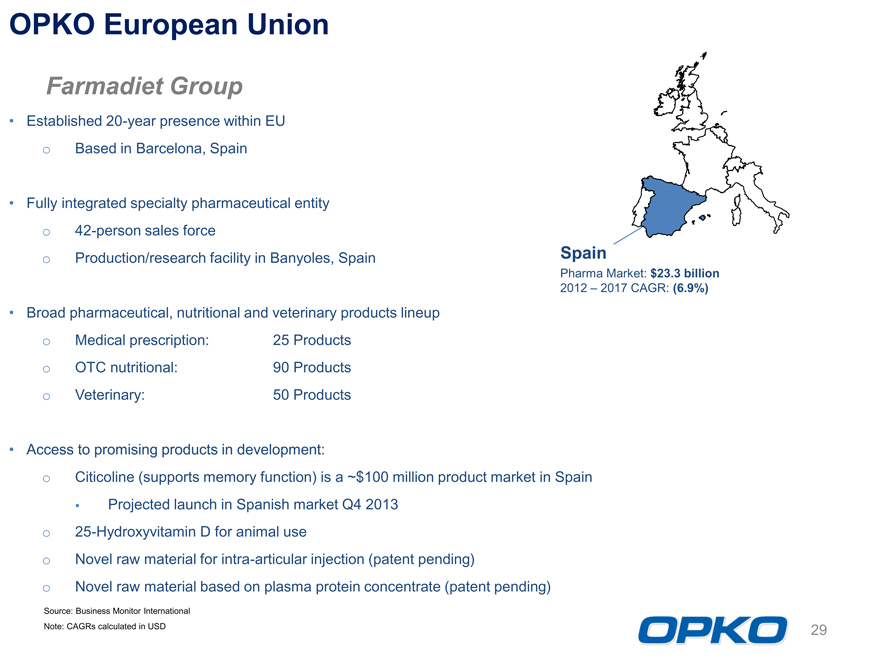

Farmadiet Group Established 20-year presence within EU

o Based in Barcelona, Spain Fully integrated specialty pharmaceutical entity

o 42-person sales force

o Production/research facility in Banyoles, Spain Broad pharmaceutical, nutritional and veterinary products lineup

o Medical prescription: 25 Products

o OTC nutritional: 90 Products

o Veterinary: 50 Products Access to promising products in development:

o Citicoline (supports memory function) is a ~$100 million product market in Spain

? Projected launch in Spanish market Q4 2013

o 25-Hydroxyvitamin D for animal use

o Novel raw material for intra-articular injection (patent pending)

o Novel raw material based on plasma protein concentrate (patent pending)

Spain

Pharma Market: $23.3 billion 2012 2017 CAGR: (6.9%)

Source: Business Monitor International Note: CAGRs calculated in USD

29

Strategic Investments

Strategic Investments

Proprietary Technologies with Significant Upside Potential CoCrystal Discovery, Inc. (~16% equity interest(1)) o Founded by Nobel Laureate, Roger Kornberg, Ph.D. o New approach to develop broad spectrum anti-viral drugs o Development program with Teva for Hepatitis C drug RXi, Inc. (~21% equity interest(1)) o RNA interference platform that down-regulates abnormal gene expression o RXI-109 in development to reduce or inhibit scar formation in the skin following surgery Sorrento Therapeutics (~20% equity interest(1)) o New technology to produce human monoclonal antibodies libraries that are more complete Fabrus, LLC (~13% equity interest(1)) o Next gen technology to identify therapeutic antibody targets Pharmsynthez, Inc. (~10% equity interest) o Manufactures and sells branded pharmaceutical products, primarily in Russia and Baltic countries o Develop and commercialize OPKO products in Eastern Europe Tesaro, Inc. (~1% equity interest(1)) o Oncology-focused biopharmaceutical company founded by former executives of MGI Pharma Neovasc, Inc. (~ 4% equity interest(1)) o Developing innovative vascular devices ChromaDex, Inc. (~1% equity interest(1)) o Dietary supplement BlueScience and antioxidant pterostilbene pTeroPure o OPKO distribution rights in Latin America

| (1) |

|

As of March 31, 2013 |

31