EX-99.1

Published on June 3, 2014

Jefferies 2014 Global Healthcare Conference

June 3, 2014

Exhibit 99.1 |

2 |

OPKO

Important Products Available or Coming to Market Near Term

3

Diagnostics

4Kscore

Test blood test for personalized risk of high-grade

prostate cancer

CLIA-certified urological specialty laboratory

Pharmaceuticals

Vitamin

D

therapeutics

for

SHPT

*

Platform technology to make peptides and proteins long acting to

treat growth hormone deficiency, hemophilia, obesity, etc.

Calcium-free, magnesium-based phosphate binder

Approved third generation hepatitis B vaccine

*Secondary Hyperparathyroidism

Claros

®

1

immunoassay

system

for

rapid,

lab

quality

in-office

testing

(PSA,

Testosterone,

Vitamin

D) |

OPKO

Diagnostics Addressing Large Dx Markets

4

4Kscore

Test

Initially targeting pre-prostate biopsy market

PSA market 60 million tests globally

Recently launched in US at $395

Highly significant clinical data on 1,012 patients presented at AUA

plenary session May 18, 2014

Launch in Europe: September 2014

Claros

®

1 Analyzer and Sangia

Microfluidic Test Card

In office finger-stick blood analysis

Initial target assays in US:

PSA: 30 million tests, $750 M

Testosterone: 15 million tests, $525 M

Vitamin D: 70 million tests, $3.5 B |

5

DELIVERING BETTER

HEALTHCARE

CONVENIENT

LAB QUALITY

ACCURACY |

Finger stick blood

sample

Convenience

1-2

mins

10

mins

6 |

| Claros

1 Update

Testosterone

FDA: Pre-submission comments received from FDA

On track to file 510(k) in 2014

CE Mark: 4Q2014

PSA

FDA: Pre-submission response expected in August

Timing of 510k submission based on longitudinal trial requirements

CE Mark Update (Formulation and Chemistry): 4Q2014

Vitamin D

On track to support launch of Rayaldee 1Q2016

7 |

Challenges in Prostate Cancer Screening

High false positive rate of PSA

Patient Anxiety

1M Prostate biopsies in US

75% Negative or Low-Grade

Pain, bleeding, infection,

hospitalization

Recommendations to stop PSA

screening

8 |

4Kscore Test

Avoiding Unnecessary Prostate

Biopsies

The only

test to identify men with high-grade prostate

cancer from a blood sample

Combines results of multiple biomarkers to create a

patients personal risk score

Based on 10 years of clinical research by scientists at

Memorial Sloan-Kettering Cancer Center and leading

European cancer centers

Tested in over 10,000 men in 9 separate clinical studies

demonstrating a 27% -

82% biopsy reduction

Validated by OPKO in a prospective, blinded study of

1,012 men

9 |

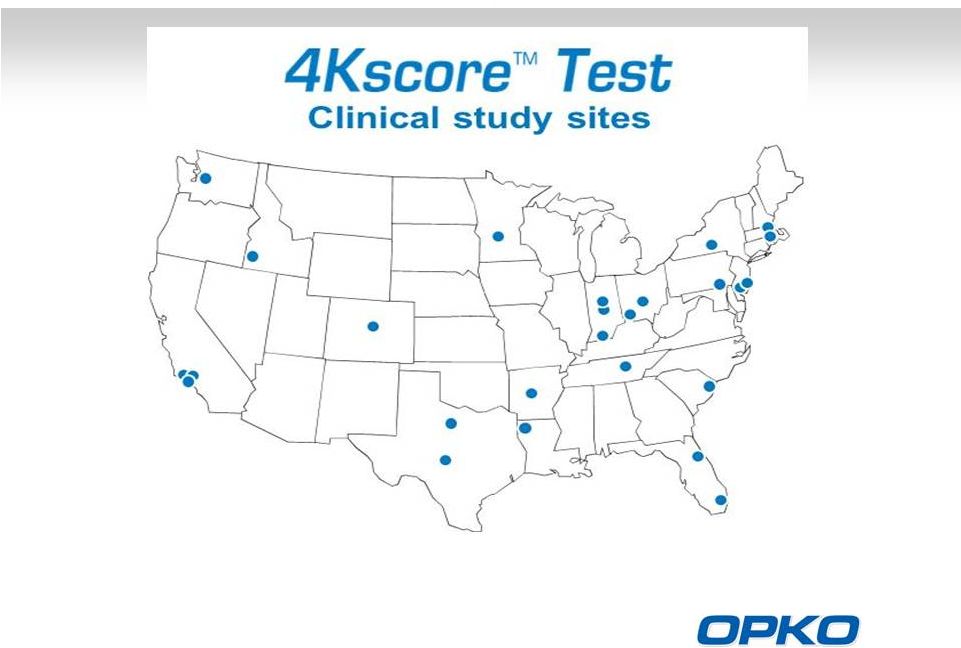

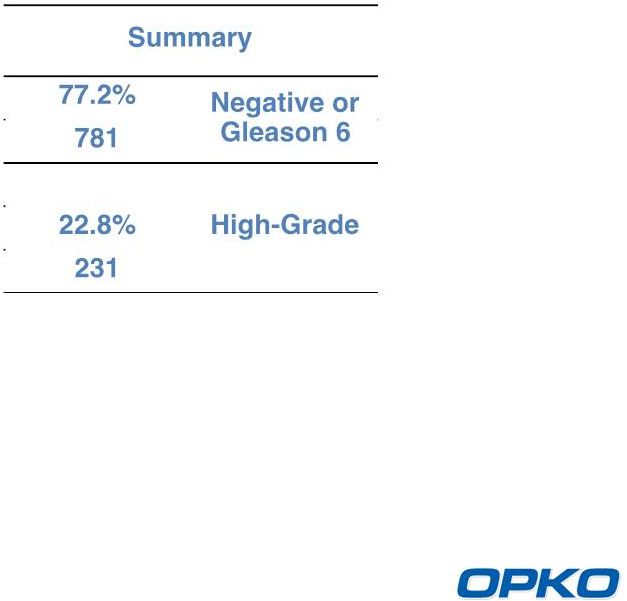

4Kscore Test US Clinical Study

10

1,012 Patients Enrolled

Prospective Clinical Trial |

11

4Kscore Test Clinical Study Results in 1,012 Men

Discrimination: AUC = 0.82

Risk Calibration

Decision Curve Analysis

Biopsy reduction of 30% to 58% |

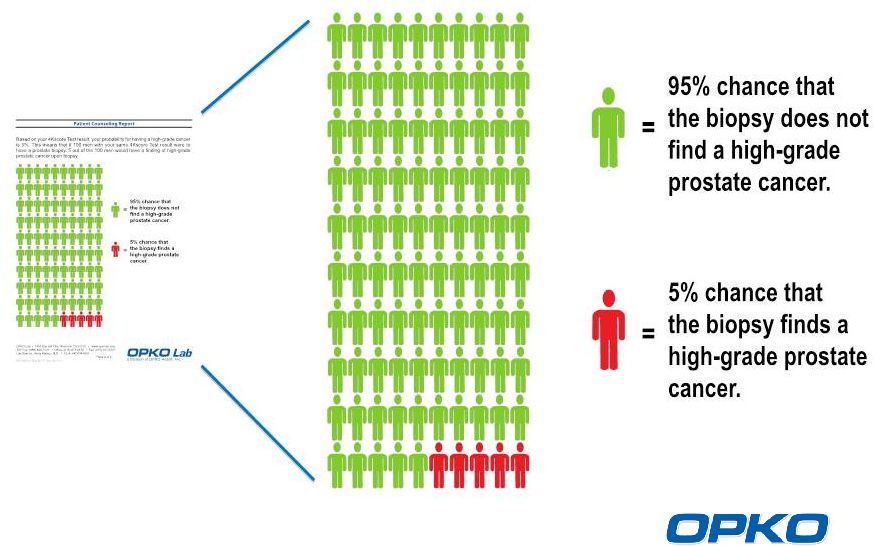

The

4Kscore Patient Counseling Report for a Result of 5%

12 |

The

4Kscore Test Conclusions Validated test based on a decade of clinical

research and a prospective, multi-institutional,

contemporary US clinical trial

Convenient blood test, cost $395

Excellent discrimination for high-grade cancer

(AUC = 0.82) and high net benefit for clinical use

Reduces 30

58% of biopsies

Provides a calibrated score for informed, shared

decision-making between urologist and patient

13 |

OPKO

Pharmaceuticals Advanced, Deep Pipeline

Product

Indication

Preclinical

Phase 1

Phase 2

Phase 3

Milestone

Market Size

Rayaldee

(CTAP101)

SHPT

(CKD Stage 3-4 Patients)

Phase 3 results

expected mid-

2014

$12.0 BN

hGH-CTP

hGH deficiency

$3.5 BN

Alpharen

(Fermagate)

Hyperphosphatemia

(CKD Stage 5 Patients)

$1.2 BN

Rolapitant

CINV

NDA submission

targeted mid-2014

$1.5 BN

Sci-B-Vac

Hepatitis B

(CKD Stage 5 Patients)

$0.2BN

Lunacalcipol

(CTA018)

Moderate to severe SHPT

(CKD Stage 5 Patients) &

Psoriasis

$1.5 BN

CTAP201

Mild to moderate SHPT

(CKD Stage 5 Patients)

$1.1 BN

Factor VIIa-CTP

Hemophilia

$1.7 BN

AntagoNAT

Platform

Cancer, CV, metabolic

and orphan disease

$1.0 BN

Oxyntomodulin

Diabetes, Obesity

$15 BN

Outlicensed to TESARO

14 |

15

Rayaldee (CTAP101)

A Late-Stage Investigational Drug

Product Overview

Oral formulation of 25D3*

addresses significant unmet need

Safe and effective treatment for

elevated PTH (SHPT) associated

with low 25D levels in Stage 3-4

CKD

Achieves reliable increases in

serum 25D and reductions in

plasma PTH

Lower risk of side effects

compared to active 1,25D

**

products

Potential for additional

indications including elderly,

osteoporosis & cancer

Clinical Status

Intellectual Property

* 25-Hydroxyvitamin D

** 1,25-Dihydroxyvitamin D

Clinical development guided by

prominent Scientific Advisory

Board

Top line phase 3 data available

in mid-2014

NDA filing in 1Q 2015

Rayaldee US patents issued,

protected through 2028

Additional global patents

allowed or pending

3 |

16

Rayaldee -

Commercial Opportunity

Source: BioTrends Research Group, Inc. December 2010

Untreated

26-44%

Vitamin D

Hormone

20-36%

Nutritional

Vitamin D

36-38%

Untreated

26-44%

Safety

concerns;

exacerbates

vitamin D

insufficiency

Efficacy

Concerns

Stage 3 & 4 CKD Treatment

Low

serum

25D

and

elevated

plasma

PTH

are

prevalent

in

CKD

Stage

3-4

patients

8 million CKD Stage 3-4 patients in the US

4 million patients with low serum 25D and high plasma PTH

Rayaldee is expected to take significant market share in Stage 3 and 4 CKD

patients suffering from SHPT a potential $12 billion revenue

opportunity

|

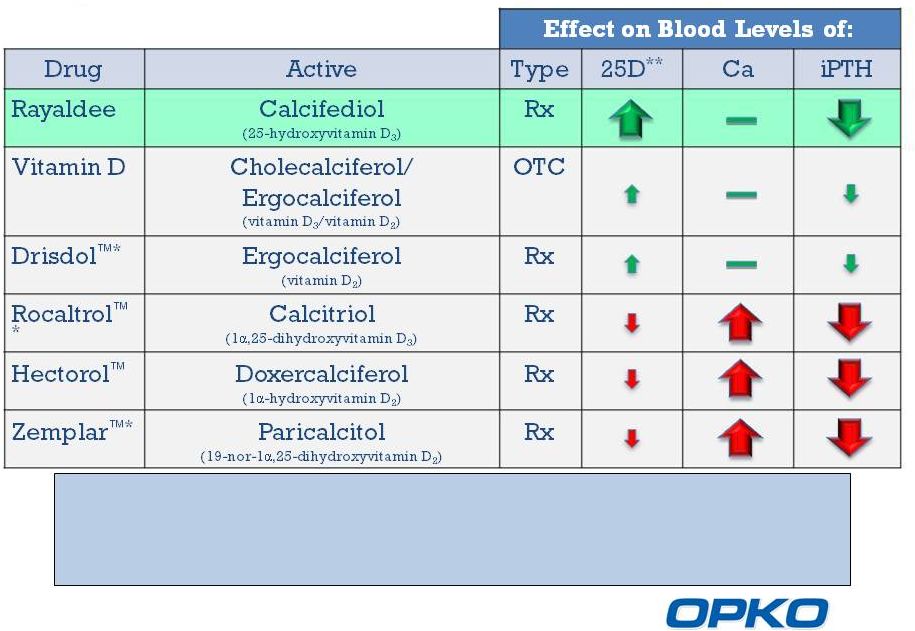

Rayaldee is expected to raise serum total 25-hydroxyvitamin D (25D) and

lower

plasma

iPTH

more

effectively

than

any

currently

marketed

over-the-

counter (OTC) or prescription (Rx) product without the risk of

hypercalcemia.

Comparison of Vitamin D Therapies for Stage 3-4 CKD

*And generics

**25-hydroxyvitamin D

17 |

CTP increases protein circulation time

Mercks long acting FSH-CTP (Elonva

):

o

Received EU marketing authorization in 2010; NDA filed Q3 2013

o

Single FSH-CTP injection replaces 7 daily FSH injections in fertility

treatment

Two licensees of CTP technology for human therapeutics:

o

Merck (holds license for 4 fertility-focused proteins )

o

OPKOs Biologics (holds license for all other rights)

18

CTP Technology: Clinically Validated Proprietary Platform

CTP

a natural sequence

created during evolution

to enhance the longevity

of peptides and proteins

without increasing toxicity

Any Short Acting

Protein

CTP

Long Acting

Protein |

|

$3.5 billion market, growing 5% annually

Once-a-week injection (current products require daily injections)

Small needle size (31 gauge) due to low viscosity

Competitive long acting formulations have high viscosity

Superb clinical, safety and immunogenicity profile

Human growth hormone is used for:

Growth hormone deficient children

Growth hormone deficient adults

Short stature

Off label

Orphan drug designation in the US & EU for children & adults

19

hGH-CTP Opportunity |

| hGH-CTP Clinical Development

Adult Pivotal Phase 3 trial (ongoing)

189 patients

Primary

efficacy

endpoint:

reduction

in

truncal

fat

mass

after

6

months

vs.

placebo

Secondary efficacy endpoints include:

Reduction in total body fat

Increase in lean body mass

Single pivotal trial required by FDA for BLA submission in 2016

Pediatric GHD Phase 2 trial (advanced stage)

Enrollment completed March 2014

4 cohorts:

3 dose levels of once-weekly hGH-CTP

Commercially available standard daily rhGH treatment

Key outcome: height velocity

Positive clinical data to be presented at ENDO meeting June 21-24,

2014

Phase 3 to commence by 1H2015

20 |

| FVIIa CTP: Long Acting for Treating Hemophilic Patients

21

$1.7 billion market

Growing 7% annually

Only 25% of patients are treated

Current product (NovoSeven®) requires frequent IV doses

3-4 times a day during bleeding episodes

1-2 times a day for prophylactic treatment

Pharmacological studies in hemophilic mice and dogs FVIIa-

CTP demonstrated:

Potential for substantial improvement in the quality of life of patients via

subcutaneous administration

Reduce frequency of injection during on-demand therapy

Enable prophylactic treatment while reducing the frequency of injections to

2-3 times a week

Phase 2a study in hemophilic patients: initiated H2 2014

Orphan drug designation in the US |

| MOD-6031: Long Acting Oxyntomodulin for Obesity

22

>$15 billion market

Growing rapidly

Oxyntomodulin

Natures Appetite Control Mechanism

Natural appetite suppressor

Secreted by the digestive system following food intake and induces satiety in

the brain

Increases glucose tolerance

Short acting

requires 3 injections per day

MOD-6031 Long Acting Oxyntomodulin-

weekly injection

studies in mutant obese mice and diet induced obese mice

demonstrated:

Significantly inhibited food intake and reduced body weight by reducing fat

Reduced cholesterol levels

Improved glycemic control

Phase 1 study to be initiated 1H2015

MOD-6031 is expected to provide superior long-term therapy

for obesity and diabetes type II patients |

Rolapitant

Potential Near-term Revenue Driver

Rolapitant out-licensed to Tesaro in December 2010

Payments of up to $121 million

Double-digit tiered royalties

Differentiated cancer supportive care product with $1.5B US Market

Opportunity

Potent neurokinin-1(NK-1) receptor antagonist for

chemotherapy-induced nausea and vomiting (CINV)

Opportunity to differentiate on convenience, market access and safety

Single dose

Lack of CYP 3A4 drug-drug interactions

Long acting

Oral and

IV formulations allow full market access

NDA submission targeted for mid-2014

All three Phase 3 trials (MEC

*

and HEC

**

) achieved primary endpoint

Primary endpoint: complete response (no emesis and no use of rescue

medication)

Third

Phase

3

trial

(HEC)

also

achieved

all

secondary

endpoints,

including:

Complete response in acute (0-24 hrs) and overall (0-120 hrs) phase of

CINV

No significant nausea

23

*Moderately emetogenic chemotherapy **Highly emetogenic

chemotherapy |

| Strategic Investments

ARNO Therapeutics,

Inc. (OTC: ARNI) (~5% equity interest)

Anti-progestins for breast (phase 2) , endometrial and prostate

cancers

Zebra Biologics,

Inc. (~19% equity interest)

Combinatorial antibody libraries based on function in human cell

screens

OAO Pharmsynthez

(MICE: LIFE) (~17% equity interest)

Russian developer and marketer of new drugs

RXi Pharmaceuticals

Corporation (NASDAQ: RXII)

(~17% equity interest)

sRNA to prevent hypertrophic scars (phase 2)

Cocrystal Pharma,

Inc. (OTC: COCP) (~16% equity interest)

New anti-virals (Hepatitis C, flu, dengue fever)

Fabrus,

Inc.

(~12% equity interest*)

Antibodies against difficult targets (e.g., G protein-coupled receptor, ion

channels)

Neovasc,

Inc. (NASDAQ: NVCN) (~ 6% equity interest)

Cardiology devices

ChromaDex,

Inc.

(OTC: CDXC) (~2% equity interest)

New nutritional supplement APIs

24

Proprietary Technologies with Significant Upside Potential

(As of March 31, 2014)

*

Merger with Senesco Technologies, Inc. (OTC: SNTI) completed May 19, 2014

|