EX-99.1

Published on January 14, 2015

33

rd

Annual J.P. Morgan Healthcare Conference

January 2015

Exhibit 99.1 |

| 2

Cautionary Statement

This presentation contains "forward-looking statements, as that

term is defined under the Private Securities Litigation Reform Act of 1995

(PSLRA), which statements may be identified by words such as expects,

plans, projects, will, may, anticipates, believes,

should, intends, estimates,

"potential" and other words of similar meaning, including statements regarding our estimated revenues

and financial projections, our ability to achieve high levels of growth, the

potential for our products under development, the potential of the

4Kscore to reduce prostate biopsies by 30-58% and predict the risk of

aggressive prostate cancer, our ability to develop, test and launch new

products, the expected timing of the clinical studies and regulatory submissions relating to our products under development, the

outcome of our clinical trials and validation studies and that such outcomes

will support commercialization, the expected market penetration and size

of the market for our products under development, including without limitation, Rolapitant, Rayaldee (CTAP-101), hGH-CTP,

the 4Kscore, and our point-of-care diagnostic products for

Total-PSA, testosterone, and Vitamin D, the potential benefits of our products

under development, including whether the 4Kscore will improve selection of

candidates for prostate biopsy, predict the risk of distant

metastases, and result in $2 to 4 billion in healthcare savings, whether

MOD-6031 will provide superior long-term therapy for obesity and

Type II diabetes patients, our ability to successfully commercialize our product

candidates such as Rolapitant, the 4Kscore, Rayaldee (CTAP- 101) and

hGH-CTP, as well as products for other markets such as urology, womens health, cardiology, oncology, iPTH, and infectious

disease, whether we will be able to develop Rayaldee (CTAP-101) for

additional indications and whether Rayaldee (CTAP-101) will take

significant market share in Stage 3 and 4 CKD patients with SHPT, whether

Rayaldee (CTAP-101) will raise serum total 25-hydroxyvitamin D

(25D) more effectively than any over-the-counter (OTC) or prescription

(Rx) product currently marketed without the risk of hypercalcemia,

whether we can reach more than half of the CKD population with a small sales

force, expectations regarding patent coverage, the expected timing for

commencing, completing and obtaining results for our clinical trials, the timing for release of trial data and seeking and obtaining

FDA and European regulatory approvals, and the timing of commercial launch of

our product candidates, as well as other non-historical statements.

These forward-looking statements are only predictions and reflect our views as of the date they were made, and we undertake

no obligation to update such statements. Such statements are subject to many

risks and uncertainties that could cause our activities or actual results

to differ materially from the activities and results anticipated in forward-looking statements, including risks inherent in funding,

developing and obtaining regulatory approvals of new, commercially-viable

and competitive products and treatments, general market factors,

competitive product development, product availability, federal and state regulations and legislation, and integration issues arising

from the transactions, delays associated with development of novel technologies,

unexpected difficulties and delays in validating and testing product

candidates, the regulatory process for new products and indications, manufacturing issues that may arise, the cost of funding

lengthy research programs, the need for and availability of additional capital,

the possibility of infringing a third partys patents or other

intellectual property rights, the uncertainty of obtaining patents covering our

products and processes and in successfully enforcing them against third

parties, and the possibility of litigation, among other factors, including all of the risks identified under the heading Risk Factors

in our Annual Report on Form 10-K and other filings with the Securities and

Exchange Commission.

|

OPKO Health

Focus on Large Market Potential Products

Diagnostics

Claros

®

1 immunoassay system for rapid, lab quality in-office testing

4Kscore

blood test for aggressive prostate cancer risk

Pharmaceuticals

New Vitamin D products for SHPT

Platform technologies to make peptides and proteins long-acting

for growth hormone deficiency, hemophilia, obesity

Calcium-free, magnesium-based phosphate binder

Approved third generation hepatitis B vaccine

Opportunistic

Investments

Innovative technologies

Antibodies

RNAi

Anti-virals

Cardiovascular devices

International

Markets

Established businesses in:

Mexico

Chile

Spain

Brazil

Israel

Uruguay

3 |

4Kscore Test to Identify Risk for Aggressive

Prostate Cancer

Two types of prostate cancer:

Low grade, non-lethal

Aggressive, lethal

4Kscore: ONLY

blood test to predict risk of aggressive form

Backed by 10 years of clinical research at Memorial Sloan-

Kettering Cancer Center

Validated by OPKO in a prospective, blinded study of 1,012

men

Global market for pre-biopsy test (not screening): $800M

Use of 4Kscore would reduce 30-58% of unnecessary prostate

biopsies

Healthcare savings of $2-4 billion in the US

4 |

| 4Kscore Commercial Update

4Kscore US clinical trial manuscript in press (Eur. Urol.)

4Kscore CPT code application accepted by AMA CPT

Editorial Board (MAAA Category 3)

4Kscore was discussed at NCCN Guidelines meeting

Nov. 2014 for potential inclusion in 2015 guidelines

Over 465 US urologists have used the 4Kscore test in

routine practice

Launched by OPKO in Europe September 15, 2014;

samples tested at University of Barcelona

barnaclinic+

Mexico launch in January 2015; samples will be tested at

OPKO Lab in Nashville, TN

5 |

Claros

®

1: Rapid Testing in the Physician Office

10

mins

6

Finger stick blood

sample

1-2

mins |

| Claros

1 Platform Addresses Large Dx Markets

Testosterone

15 million US tests: $525 M

510(k) filing in 2Q2015

PSA

30 million US tests: $750 M

Intended use to focus on screening (early detection) claim

PMA filing in 1Q2016

Vitamin D

70 million US tests: $3.5 B

On track to support launch of Rayaldee 1Q2016

Lyme Disease

Claros 1 selected as platform for NIH funded development

OPKO has exclusive option to diagnostic test ($120M US Market)

7 |

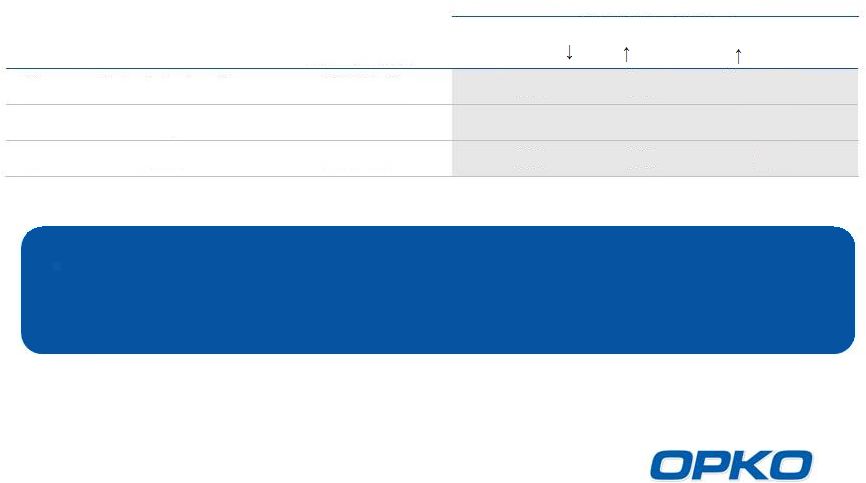

OPKO

Pharmaceuticals Advanced, Deep Pipeline

Product

Indication

Preclinical

Phase 1

Phase 2

Phase 3

Milestone

Market Size

Rayaldee

(CTAP101)

SHPT

(CKD Stage 3-4 Patients)

Phase 3 results

reported

3Q 2014

$12.0 BN

hGH-CTP

hGH deficiency

$3.5 BN

Alpharen

(Fermagate)

Hyperphosphatemia

(CKD Stage 5 Patients)

$1.2 BN

Rolapitant

CINV

NDA accepted

November, 2014

$1.5 BN

Sci-B-Vac

Hepatitis B

(CKD Stage 5 Patients)

$0.2BN

Lunacalcipol

(CTA018)

Moderate to severe

SHPT

(CKD Stage 5 Patients) &

Psoriasis

$1.5 BN

CTAP201

Mild to moderate SHPT

(CKD Stage 5 Patients)

$1.1 BN

Factor VIIa-CTP

Hemophilia

$1.7 BN

AntagoNAT

Platform

Cancer, CV, metabolic

and orphan disease

$1.0 BN

Oxyntomodulin

Diabetes, Obesity

$15 BN

Collaboration with Pfizer

Outlicensed to TESARO

8 |

Rayaldee (CTAP101)

A Late-Stage Investigational Drug

Product Overview

Oral formulation of 25D

3

*

addresses significant unmet

need

Achieves reliable increases in

serum 25D and reductions in

plasma PTH in Stage 3-4 CKD

Lower risk of side effects

compared to active 1,25D

**

products

Phase 1 cancer trail begun

Clinical Status

Intellectual Property

* 25-Hydroxyvitamin

D3

**

1,25-Dihydroxyvitamin D

Clinical development guided

by prominent Scientific

Advisory Board

Positive Phase 3 data

NDA submission target:

1Q2015

Rayaldee US patents issued,

protected through 2028

Additional global patents

allowed or pending

9 |

Market Opportunity: Chronic Kidney Disease (U.S.)

*US Renal Data Service 2013 Annual Data Report

Sources: Levin, A et al., Kidney International 2007; 71:

pp.31-38.

Gonzalez, E et al. Am J Nephrol 2004;24:503-510.

LaClair, R et al. Am J Kidney Dis 2005;45:1026-1033.

The CKD patient population is large and growing as a result of:

Obesity

Hypertension

Diabetes

Over half of the CKD population can be reached with a small

sales force targeting nephrologists and endocrinologists

10

% of CKD Patients with:

Stage

Kidney Function

CKD Prevalence

Vitamin D

Insufficiency( 25D)

SHPT

( PTH)

Hyperphosphatemia

( Phosphorus)

3

Moderate impairment

18.7

Million*

70%

56%

37%

4

Severe impairment

1.4 Million*

80%

60%

50%

Failure

0.5 Million*

90%

90%

70%

5 |

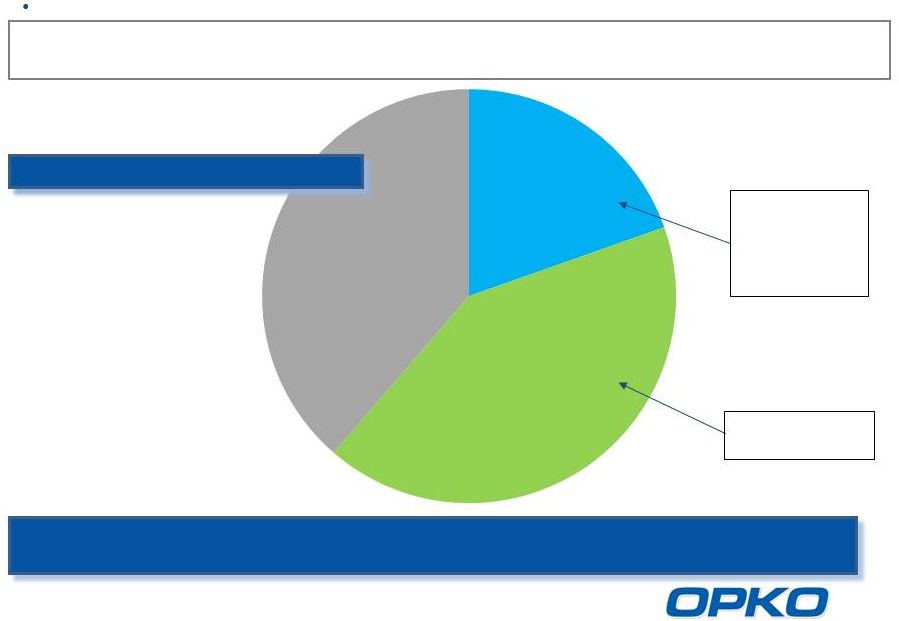

Rayaldee -

Commercial Opportunity

Source: BioTrends Research Group, Inc. December 2013

Untreated

26-44%

Vitamin D

Hormone

14-25%

Nutritional

Vitamin D

39-44%

Untreated

31-47%

Safety

concerns;

exacerbates

vitamin D

insufficiency

Efficacy

Concerns

Stage 3 & 4 CKD Treatment

11

Low

serum

25D

and

elevated

plasma

PTH

are

prevalent

in

CKD

Stage

3-4

patients

20 million CKD Stage 3-4 patients in the US

8 million patients with low serum 25D and high plasma PTH

Rayaldee is expected to take significant market share in Stage 3 and 4 CKD

patients suffering from SHPT a potential $12 billion revenue

opportunity

|

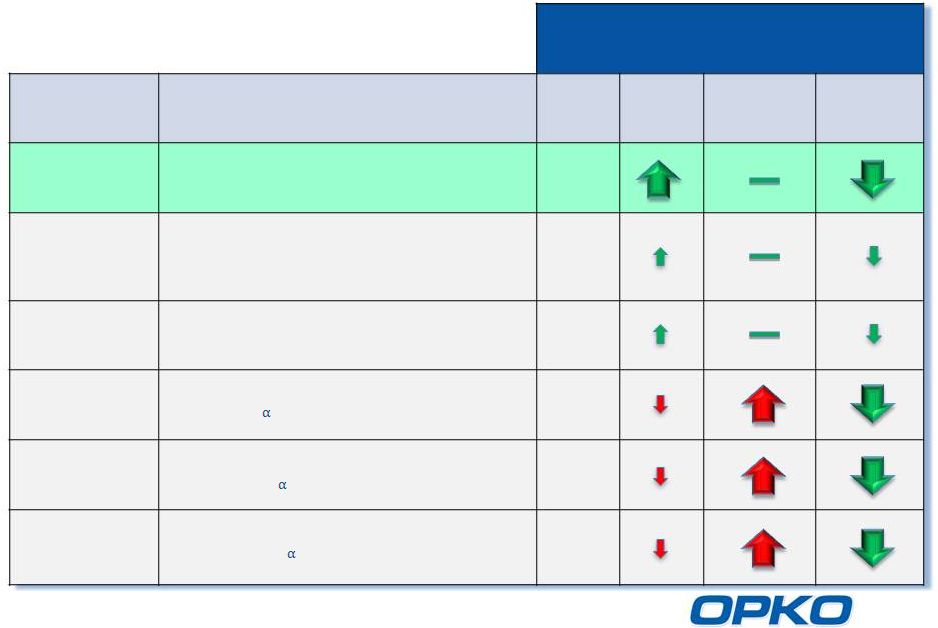

Comparison of Vitamin D Therapies for Stage 3-4 CKD

*And generics

**25-hydroxyvitamin D

12

Drug

Active

Type

25D

**

Ca

iPTH

Rayaldee

Calcifediol

(25-hydroxyvitamin D

3

)

Rx

Vitamin D

Cholecalciferol/Ergocalciferol

(vitamin D

3

/vitamin D

2

)

OTC

Rx

Rx

Rx

Rx

Drisdol

*

Ergocalciferol

(vitamin D

2

)

Rocaltrol

*

Calcitriol

(1 ,25-dihydroxyvitamin D

3

)

Hectorol

*

Zemplar

*

Paricalcitol

(19-nor-1 ,25-dihydroxyvitamin D

2

)

Doxercalciferol

(1 -hydroxyvitamin D

2

)

Effect on Blood Levels of: |

OPKO Biologics: Leader in BioBetter Drugs

Reversible Pegylation Technology

(Peptides and small molecules)

CTP Technology

(Recombinant Proteins)

Developing biobetter long acting proteins and peptides

Dramatically reduce injection frequency

Reduce drug load

Reduce potential side-effects for most proteins, peptides and

small molecules

Maintain drug bio-activity

Validated

platform

technologies

safe

and

effective

-

Preclinical & clinical proof-of-concept in multiple compounds

13 |

Natural sequence

No need for linker

hGH-CTP

The Long Acting hGH

14

+

=

Any Short-Lasting

Protein

CTP

Long-Lasting Protein |

Global Collaboration with Pfizer for OPKOs Long-

Acting Human Growth Hormone (hGH-CTP)

15

Collaboration Terms:

$295 M up-front payment

$275 M for achievement of regulatory based milestones

OPKO responsible for funding development program for the key

indications:

Adult and Pediatric Growth Hormone Deficiency (GHD)

Pediatric Short for Gestational Age

Pfizer responsible for funding:

Development programs for additional indications

All Post Marketing Studies

All Commercialization Activities

Initial double digit tiered royalties on sales of Adult GHD

Profit sharing commencing upon launch for Pediatric GHD

encompassing combined sales for all indications of OPKOs hGH-CTP

and Pfizers Genotropin

Pfizer Genotropin represents about 25% of the world market with

annual revenues exceeding $700 M

Financial

Commercial

Development |

|

$3.5 billion market, growing 5% annually

Once-a-week injection (current products require daily injections)

Small needle size (31 gauge) due to low viscosity

Competitive long acting formulations have high viscosity

Superb clinical, safety and immunogenicity profile

Human growth hormone is used for:

Growth hormone deficient children

Growth hormone deficient adults

Short stature

Off label

Orphan drug designation in the US & EU for children & adults

hGH-CTP Opportunity

16 |

| hGH-CTP Clinical Development

Adult Pivotal Phase 3 trial (ongoing)

Primary efficacy endpoint: reduction in truncal fat mass

after 6 months vs. placebo

Secondary efficacy endpoints include:

Reduction in total body fat

Increase in lean body mass

Single pivotal trial required by FDA for BLA submission

17 |

| hGH-CTP Clinical Development

Pediatric GHD Phase 2 trial (advanced stage)

4 Cohorts:

3 dose levels of once-weekly hGH-CTP

Commercially available standard daily rhGH treatment

Key outcome: height velocity

Positive clinical data presented at ENDO meeting June 2014

All doses provided excellent growth response compared to control

group and historical controls

Promising safety profile

hGH-CTP mean annualized height velocity at 6m ranged from 12.25-

14.37cm, compared to annual height velocity of ~10cm as published by

Bakker (2008) and Ranke (2010) for the same GHD patient population

(peak GH, age)

18 |

| FVIIa

CTP:

Long Acting for Treating Hemophilic Patients

$1.7 billion market

Growing 7% annually

Only 25% of patients are treated

Current product (NovoSeven®) requires frequent IV doses

3-4 times a day during bleeding episodes

1-2 times a day for prophylactic treatment

Pharmacological

studies

in

hemophilic

mice

and

dogs

FVIIa-CTP

demonstrated:

Reduce injection frequency during on-demand therapy

Enable prophylactic treatment while reducing the frequency of

injections to 2-3 times a week

Potential for substantial improvement in the quality of life of patients via

subcutaneous administration

Phase 2a study in hemophilic patients to be initiated 1Q 2015

Orphan drug designation in the US and EU

19 |

| MOD-6031: Long Acting Oxyntomodulin for Obesity

WHO estimates 500 million severely overweight or obese people

>$15 billion market -

growing rapidly

Oxyntomodulin: Natures Appetite Control Mechanism

Natural appetite suppressor

Secreted by the digestive system following food intake and induces

satiety

Increases glucose tolerance

Short acting

requires 3 injections per day

MOD-6031 Long Acting Oxyntomodulin-

weekly injection studies in

mutant obese mice and diet induced obese mice demonstrated:

Significantly inhibited food intake and reduced body weight by

reducing fat

Reduced cholesterol levels

Improved glycemic control

Phase 1 study to be initiated mid 2015

MOD-6031 is expected to provide SAFE long-term therapy for

obesity and diabetes type II patients

20 |

| Rolapitant

Potential Near-term Revenue Driver

Rolapitant out-licensed to Tesaro in December 2010

Payments of up to $121 million

Double-digit tiered royalties

Differentiated cancer supportive care product with $1.5B US Market

Opportunity

Potent neurokinin-1(NK-1) receptor antagonist for

chemotherapy- induced nausea and vomiting (CINV)

Opportunity to differentiate on convenience, market access and safety

Single dose

Long acting

NDA accepted November 2014

All three Phase 3 trials (MEC* and HEC**) achieved primary endpoint

Primary endpoint: complete response (no emesis and no use of rescue

medication)

Third Phase 3 trial (HEC) also achieved all secondary endpoints,

including:

Complete response in acute (0-24 hrs) and overall (0-120 hrs) phase of

CINV

Also effective to prevent nausea

21

*Moderately emetogenic chemotherapy **Highly emetogenic

chemotherapy

Oral and IV formulations allow full market access

Lack of drug-drug interactions |

| Strategic Investments

ARNO Therapeutics, Inc. (OTC: ARNI) (~4% equity interest)

Anti-progestins for breast (phase 2), endometrial and prostate cancers

Zebra Biologics, Inc. (~19% equity interest)

Combinatorial

antibody

libraries

based

on

function

in

human

cell

screens

OAO Pharmsynthez (MICE: LIFE) (~17% equity interest)

Russian developer and marketer of new drugs

RXi Pharmaceuticals Corporation (NASDAQ: RXII) (~11% equity interest)

sRNA to prevent hypertrophic scars (phase 2)

Cocrystal Pharma, Inc. (OTC: COCP) (~15% equity interest)

New anti-virals (Hepatitis C, flu, dengue fever)

Sevion Therapeutics, Inc. (OTC: SVON) (~ 4% equity interest*)

Antibodies against difficult targets (e.g., G protein-coupled receptor, ion

channels)

Neovasc, Inc. (NASDAQ: NVCN) (~ 6% equity interest)

Cardiology devices

ChromaDex, Inc. (OTC: CDXC) (~ 2% equity interest)

New nutritional supplement APIs

22

Proprietary Technologies with Significant Upside Potential

(As of September 30, 2014) |