EX-99.1

Published on September 1, 2015

September 2015 1 Exhibit 99.1 |

2 |

| Whats New? Completed Acquisition of Bio-Reference Laboratories August 20,

2015

Acquired EirGen Pharma, a Growing, Profitable Specialty Pharmaceutical Developer and Manufacturer Rayaldee PDUFA Date March 29, 2016 4Kscore® Included in NCCN Guidelines - CPT Code Became Active on July 1, 2015 Company Began Billing Insurance for the Test Enrolling Patients for Long-Acting Factor VIIa-CTP Phase IIa Clinical Trial to Commence Q4 3 |

A High-Growth Diversified Medical Products Company - Innovative technologies: Antibodies Anti-virals Cardiovascular devices RNAi 4 Diagnostics - Bio Reference Laboratories a unique clinical lab - 4Kscore® blood test for aggressive prostate cancer risk

- Claros 1® immunoassay system for rapid, lab quality in-office

testing

Pharmaceuticals

- Vitamin D therapeutics for SHPT - Platform technology to make peptides and proteins long-

acting for treatment of growth hormone deficiency,

hemophilia, obesity, etc.

- Calcium-free, magnesium-based phosphate binder Opportunistic Investments - Established businesses in: United States Chile Spain Uruguay Israel Mexico International Markets Ireland |

| Acquired EirGen Pharma, Ltd. Developer of High Potency Specialty Pharmaceutical Products

Growing, profitable and cash flow positive Cancer chemotherapy and other niche, high potency drugs require

special expertise and infrastructure -

significant barriers to entry

Rich Pipeline of Products 10 product applications filed with the FDA, 3 approved, 4 filings in

Europe, all approved, and 5 in Japan, 4 approved

Over 27 additional drugs in development Opportunities to commercialize products through OPKO operations

world-wide

Product registrations by OPKO Chile with others expected State-of-the-Art High Containment R&D and Manufacturing Facility

Approved by the FDA, EMEA (European Health Authorities) and PMDA

(Japan)

Potential to manufacture OPKOs current and future products with

resulting higher gross margins

Co-Founded by Former IVAX Pharmaceuticals Executives 5 |

| Bio-Reference is a Unique Clinical Lab Asset Acquisition closed August 20, 2015 6 Demonstrated strong, consistent organic growth - 21 years of ~20% compound annual revenue growth Created and expanded franchises in multiple specialty markets including oncology,

womens health and genetics in lab testing and healthcare

provider communities Commercialized

innovations in clinical testing and informatics: GenPap,

PanEthnic Carrier Screen, OnkoSight, Genome DX,

Next-Gen Clinical Testing, Whole Exome

Sequencing, PsiMedica

and CareEvolve

Positioned

itself securely on the cutting edge of Genetic Medicine through

GeneDx Built

a strong corporate culture with an outstanding industry leading

medical and scientific team with long company

tenure and strong commitment to BRLI 1

2 3 4 5 |

Transaction Rationale: Near-term Extensive phlebotomy draw stations offer synergistic opportunity for efficient

commercialization of 4Kscore test for high-grade prostate

cancer ~175 BRLI patient service centers located

throughout the US for collection of patient

specimens

Leverage

the

national

marketing,

sales,

and

distribution

resources

of

BRLI

to

enhance

sales

of

OPKOs diagnostic platforms

~420 sales and marketing personnel

~5,000 people working together to support the needs of clients

and patients Near-term profitability supports

the development of existing pharmaceutical pipeline 7

Leverage BRLIs channels to accelerate the adoption of

OPKOs diagnostic products 1 |

Transaction Rationale: Longer-term 8 Utilization of genomic data for personalized therapy 2 BRLIs vast array of genetics and genomics data should benefit OPKO in its drug discovery

and clinical trial programs

GeneDx

was

the

first

commercial

laboratory

to

offer

next

generation

sequencing

for

panels

Offers 620+ single gene tests along with numerous panel-based

tests, including inherited cancers, to over 250

providers in 25 countries, many unique to GeneDx

Performs more whole exome testing than any other commercial

laboratory in the world OPKOs research

capabilities deepen the insights into the genetic information and further strengthen the GeneDx offering |

Shared Resources: infrastructure and senior management, scientific expertise and clinical acumen Unique Specialty Capabilities: market (product) specific expertise, specialized clinical connection and applications and focused product managers and marketing materials Each Specialty Sales unit shares some resources but distinctly identifies itself by specialty

Target Markets:

Hematologists Oncologists Hospital Pathologists Key Services: Bone Marrow Morphology Flow Cytometry Cancer Genetics MicroArray, FISH NextGen Seq for Bloods and Solid tumors Special Coagulation Studies Oncology Routine Clinical Testing Target Markets: Physician Offices Health Facilities FQHCs Key Services: Automated, High Volume, Routine Testing HIV, HepC and Other Molecular Tests GCI Informatics Heart Health Regulatory Reporting Womens Health Target Markets: Obstetricians Gynecologists Key Services: Image Directed Paps HPV Genotyping GenPap STI Testing NonInvasive PreNatal Reproductive Genetics Prenatal Cytogenetics Special Coagulation Studies Genetics Target Markets: Geneticists

Medical Centers Childrens

Hospitals

Clinicians with Specialties Affected by Genetics Key Services: DNA

Sequencing aCGH Array Testing NextGen

Sequencing

Laboratorio

Buena

Salud

Target Markets:

Medical Clinics Diabetes Programs Latino Physicians Key Services: Automated, High Volume, Routine Testing GCI Informatics HIV, HepC and Other Molecular Tests Formularies Regulatory Reporting Bio-Reference has Developed Capability in Specialty Areas |

The 4Kscore Test as a Minimally Invasive Alternative to Prostate Biopsy Clinical utility is based on three decades of clinical biomarker research and over 20,000

men tested in Europe and the US

Identifies

the

actual

risk

of

aggressive

prostate

cancer

for

the

individual

patient

with:

High grade prostate cancer pathology

Poor prostate cancer clinical outcomes within 20

years Has

high

sensitivity

and

high

negative

predictive

value

for

aggressive

prostate

cancer

4056% cost savings to potentially avoid unnecessary MRI and

prostate biopsies The

only

blood

test

that

accurately

identifies

risk

for

aggressive

prostate

cancer

10 1 million U.S. biopsy patients per year; over 2 million patients world-wide |

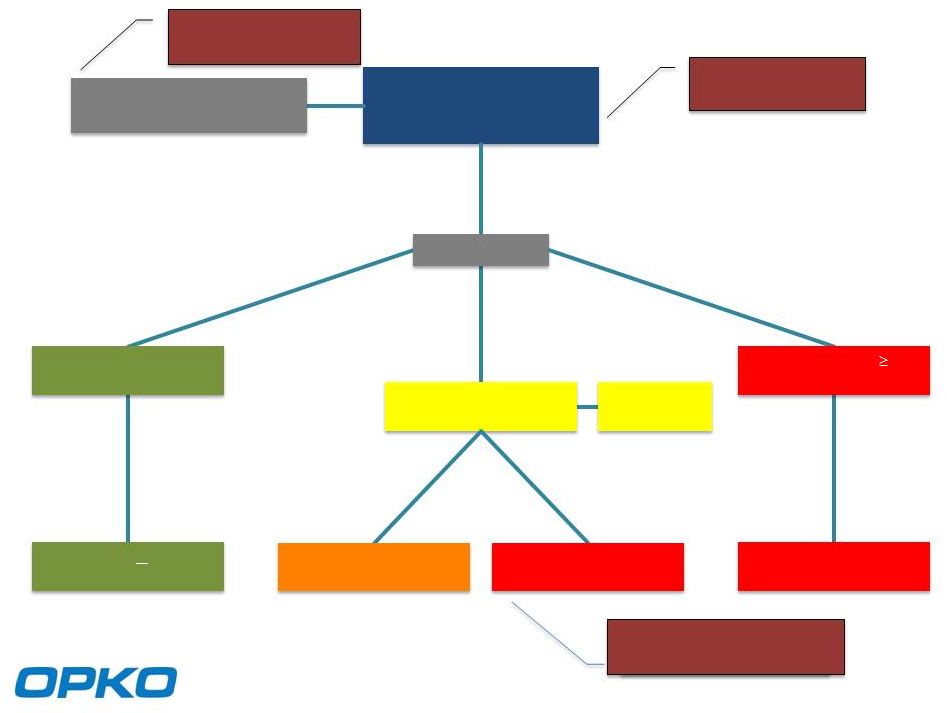

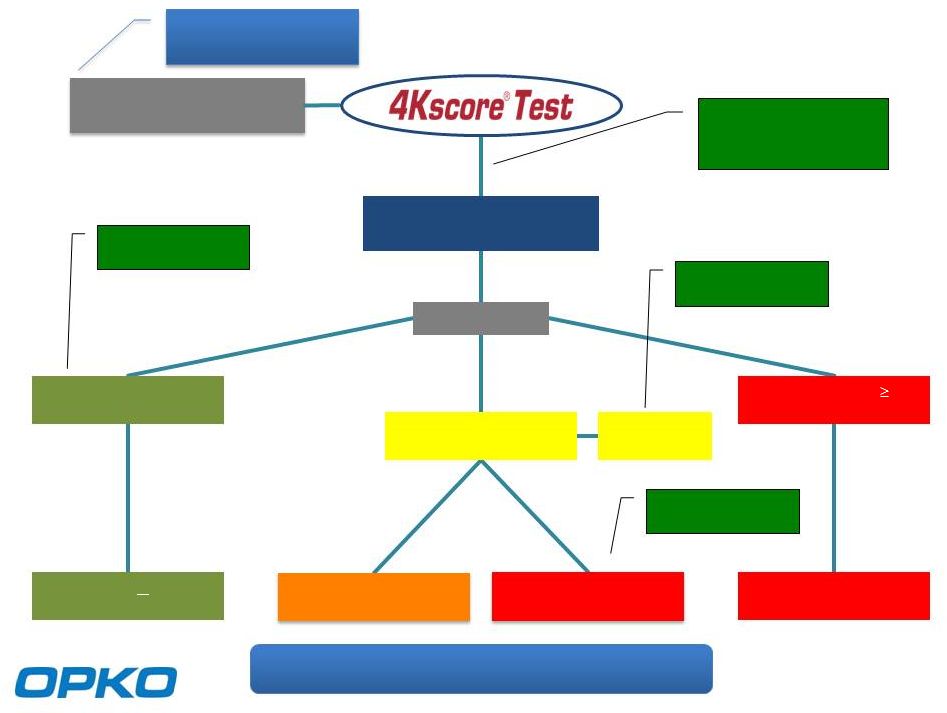

What is the 4Kscore Test? 11 + Age, DRE, and prior biopsy status % risk of having aggressive prostate cancer for an individual patient Components Components OPKO { 4 kallikrein levels: Total PSA Free PSA Intact PSA hK2 Results Results OPKO ALGORITHM |

Monitor w PSA or PCA3, ConfirmMDx OncotypeDx or Prolaris 100,000 Standard TRUS or mp MRI-Guided Biopsy Negative Biopsy Histopathology 55,000 25,000 Gleason score 6 Histopathology Biopsy Result Primary Treatment Surgery / Radiation Gleason score 7 Histopathology 20,000 140,000 Abnormal PSA or DRE 700,000 PSA Screenings 12,000 with Confirmed Indolent Disease Active Surveillance 7,500 Primary Treatment Surgery / Radiation 17,500 12 4,000 Serious Infections |

Monitor w PSA if abnormal, 4Kscore Biopsy Result Primary Treatment Surgery / Radiation Active Surveillance Primary Treatment Surgery / Radiation Negative Biopsy Histopathology Gleason score 7 Histopathology Gleason score 6 Histopathology OncotypeDx or Prolaris Standard TRUS or mp MRI-Guided Biopsy 36% Biopsy Reduction $78M Savings 29% Reduction$16 M Savings 29% Reduction$146 M Savings $143 M net savings / $1,400 per patient 100,000 Prostate Biopsy Patients 700,000 PSA Screenings 13 51% Reduction$22 M Savings |

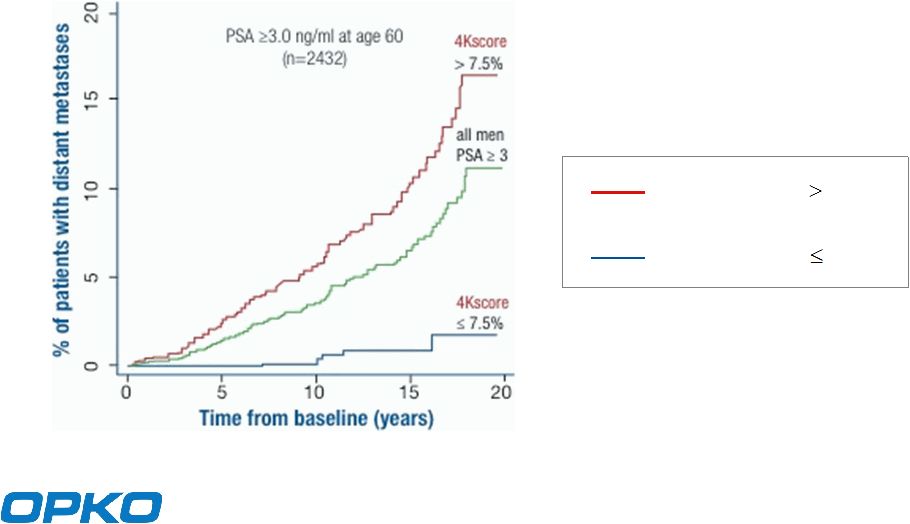

The 4Kscore Test Predicts Metastases Within 20 years¹ 16% < 2% 4Kscore Test 7.5% 4Kscore Test 7.5% ¹ Improving the Specificity of Screening for Lethal Prostate Cancer Using Prostate-specific

Antigen and a Panel of Kallikrein Markers: A Nested

CaseControl Study European Urology (in

press) 14 |

| 4Kscore Commercial Update 4Kscore ProtecT study published over 6,000 subjects Total now 22,000 subjects studied with 4K panel Over 1,000 US urologists have used the 4Kscore test in routine practice American Urological Society Meeting in New Orleans May, 2015 six podium or poster presentations NCCN Early Detection Guidelines Published July 2015 Next milestone: Medicare and private insurance coverage for test: 2015/16

15 |

Claros ® 1: Rapid Testing in the Physician Office 1-2 mins 10 mins 16 Quantitative Results Insert cassette into Claros®1 analyzer Snap cartridge into Sangia cassette Finger stick blood sample |

| Claros 1 Platform Addresses Large Testing Markets PSA US test volume: 30 million tests, $750 M Intended use to focus on detection claim Modular PMA filing with FDA in 2016 Other Test Menus in Development Aligned with BRL specialty sales focus Sectors Oncology Womens Health Health and Wellness 17 |

OPKO PharmaceuticalsAdvanced, Deep Pipeline 18 Product Indication Preclinical Phase 1 Phase 2 Phase 3 Milestone Market Size Rayaldee (CTAP101) SHPT (CKD Stage 3-4 Patients) PDUFA date March 29, 2016 $12.0 BN hGH-CTP hGH deficiency $3.0 BN Alpharen (Fermagate) Hyperphosphatemia (CKD Stage 5 Patients) $1.2 BN Rolapitant CINV PDUFA date September 5, 2015 $1.5 BN CTAP201 Mild to moderate SHPT (CKD Stage 5 Patients) $1.1 BN Factor VIIa- CTP Hemophilia Phase 2a trial expected in 4Q 2015 $1.7 BN Oxyntomodulin Diabetes, Obesity Phase I trial targeted for Q1 2016 $15 BN AntagoNAT Platform Cancer, CV, metabolic and orphan disease $1.0 BN CYP24 Inhibitors SHPT, CKD, cancer $1.0 BN Collaboration with Pfizer Outlicensed to TESARO |

Rayaldee A Late-Stage Investigational Drug Modified-release (MR) oral formulation of 25D 3 * addresses significant unmet market need Safe and effective treatment for elevated PTH (SHPT) associated with

low 25D levels in Stages 34 CKD

Achieves more reliable increases in serum 25D and reductions in

plasma PTH than nutritional vitamin D

Lower risk of side effects compared to active 1,25D ** products Preserves protective renal feedback mechanism, reducing upregulation of CYP24 which limits effectiveness of current hormone

replacement therapies

Additional potential for new indications including stage 5 CKD,

institutionalized elderly, osteoporosis & cancer

19

Product Overview

Product Overview

* 25-Hydroxyvitamin

D3 or Calcifediol ** 1,25-Dihydroxyvitamin

D3 or Calcitriol |

Market Opportunity: Chronic Kidney Disease (US) The CKD patient population is large and growing as a result of:

Obesity Hypertension Diabetes 20 *US Renal Data Service 2013 Annual Data Report Sources: Levin, A et al., Kidney International 2007; 71: pp.31-38; Gonzalez, E et al. Am J Nephrol 2004;24:503-510; LaClair, R et al. Am J

Kidney Dis 2005;45:1026-1033; Tentori, F et al., Clin J Am Soc Nephrol

2015; 10:98-109 % of CKD Patients

with Stage

Kidney Function

CKD Prevalence Vitamin D Insufficiency ( 25D) SHPT (

PTH)

Hyperphosphatemia

( Phosphorus)

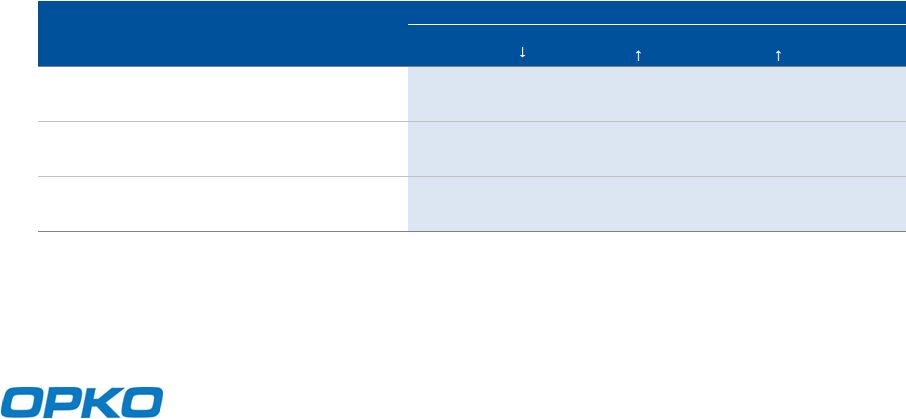

3 Moderate impairment 18.7 Million* 71% 40% 37% 4 Severe impairment 1.4 Million* 83% 82% 50% 5 Failure 0.5 Million* 97% 95% 70% |

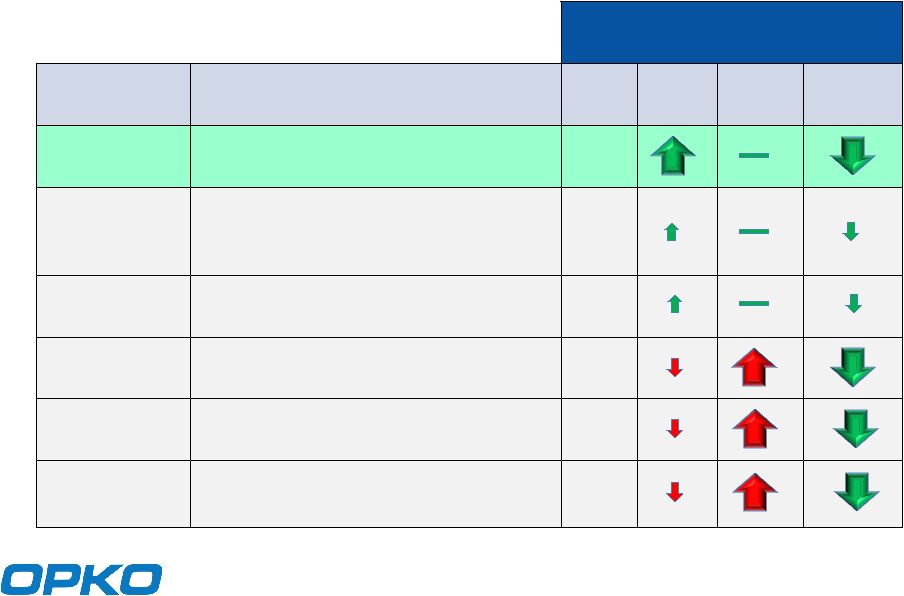

Comparison of Vitamin D Therapies for Stage 3-4 CKD Effect on Blood Levels of: Drug Active Type 25D ** Ca iPTH Rayaldee Calcifediol (25-hydroxyvitamin D3) Rx Vitamin D Cholecalciferol/Ergocalciferol (vitamin D3/vitamin D2)

OTC

Drisdol

*

Ergocalciferol

(vitamin

D2)

Rx

Rocaltrol

*

Calcitriol

(1a,25-dihydroxyvitamin

D3)

Rx

Hectorol

*

Doxercalciferol

(1a-hydroxyvitamin

D2)

Rx

Zemplar

*

Paricalcitol

(19-nor-1a,25-dihydroxyvitamin D2) Rx *And generics **25-hydroxyvitamin D 21 |

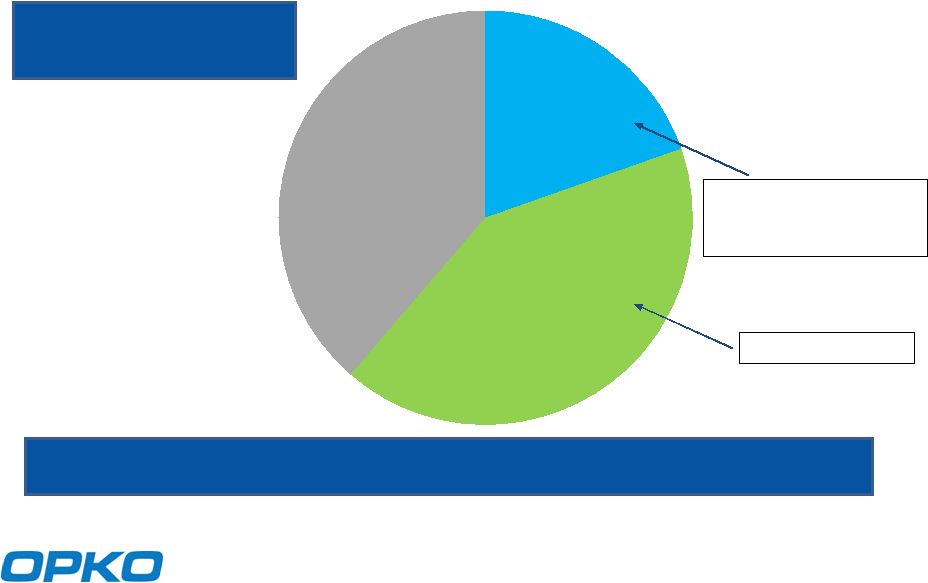

Rayaldee - Commercial Opportunity Source: BioTrends Research Group, Inc. December 2013 Untreated 26-44% Vitamin D Hormone 14-25% Nutritional Vitamin D 39-44% Untreated 31-47% Safety concerns; exacerbates vitamin D insufficiency Efficacy Concerns Stage 3 & 4 CKD Treatment for SHPT Rayaldee is expected to take significant market share in Stage 3 and 4 CKD patients

suffering

from

SHPT

a

potential

$12

billion

revenue

opportunity

22 |

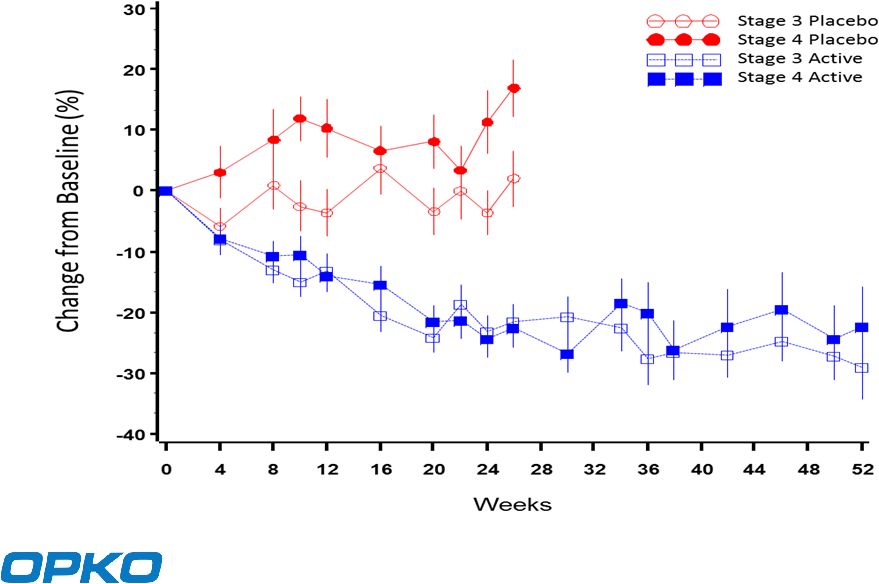

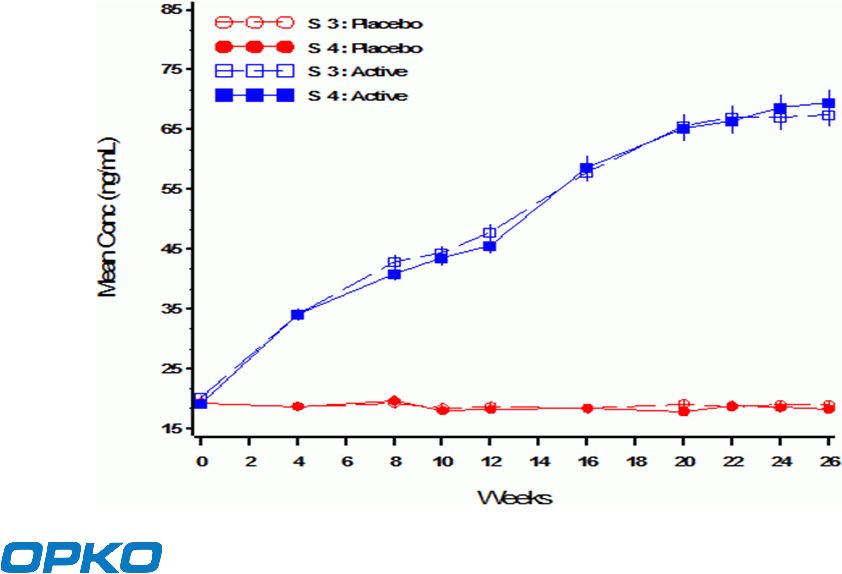

Rayaldee Top-Line Phase 3 Data: Plasma iPTH 23 |

Rayaldee Top-Line Phase 3 Data: Serum 25D 24 |

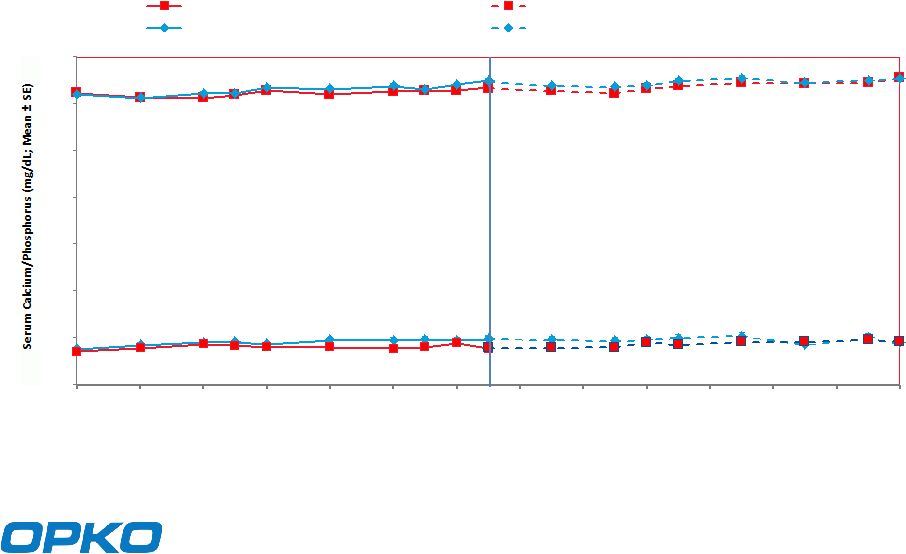

Rayaldee Top-Line Phase 3 Data: Serum Ca & P 25 * Significantly different from placebo, p < 0.05 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 0 4 8 12 16 20 24 28 32 36 40 44 48 52 Time (Weeks) Placebo Placebo to Modified-Release Calcifediol Modified-Release Calcifediol Modified-Release Calcifediol Continuation Placebo-Controlled Extension Serum Calcium Serum Phosphorus * * * * * * * |

| Rayaldee Steps to Commercialization NDA filing (accepted for full FDA review) in late July

Marketing & sales management team to be hired in Q3-Q4 2015

PDUFA date: March 29, 2016 Launch expected within 3 months of PDUFA date Initial line extension plans: Additional phase 3 clinical trial(s) planned in stage 5 CKD

Initial clinical trial ongoing for new oncology indication

Other indications being evaluated 26 |

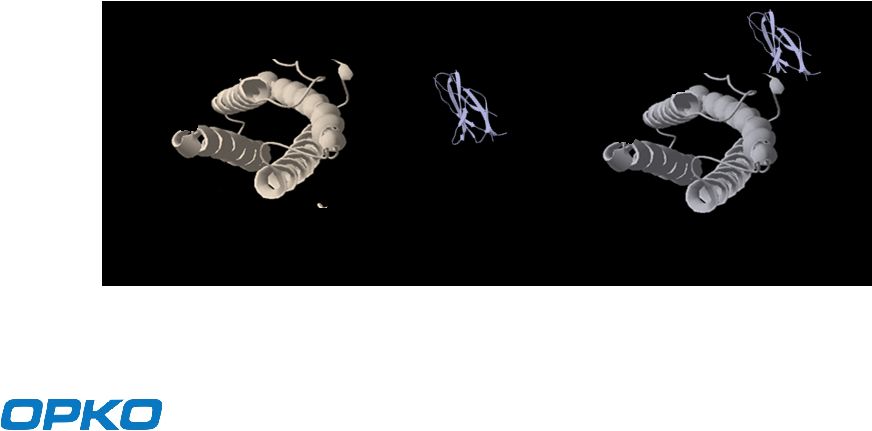

OPKO Biologics: Extends the Half-Life of Protein Drugs Significant reduction in injection frequency Safety profile comparable to non-modified active therapeutic agents

Potential expanded prophylactic uses with longer half life agents, in

addition to short-term treatment

Maintain drug bio-activity 27 Reversible Pegylation Technology CTP Technology Developing biobetter long acting proteins and peptides |

CTP Increases Protein Circulation Time 28 + = Any Short-Lasting Protein CTP Long-Lasting Protein CTP A Natural Chemical Entity Created During Evolution to Enhance Longevity of the Hormone hCG |

Global Collaboration with Pfizer for OPKOs Long- Acting Human Growth Hormone (hGH-CTP) 29 Collaboration Terms: $295 M up-front payment $275 M for achievement of regulatory based milestones OPKO responsible for funding development program for the key

indications:

Adult and Pediatric Growth Hormone Deficiency (GHD) Pediatric Short for Gestational Age Pfizer responsible for funding: Development programs for additional indications All Post Marketing Studies All Commercialization Activities Initial double digit tiered royalties on sales of Adult GHD

Profit sharing commencing upon launch for Pediatric GHD encompassing combined sales for all indications of OPKOs hGH-CTP

and Pfizers Genotropin

Pfizer Genotropin represents about 25% of the world market with annual revenues exceeding $700 M Financial Commercial Development |

| hGH-CTP Competitive Advantages New molecular entity and maintain natural native sequence of GH

Human growth hormone is used for: Growth hormone deficient children Growth hormone deficient adults SGA, PWS, ISS Once-a-week injection (current products require daily injections)

Final Presentation: The drug product will be a refrigerated, liquid non viscous formulation

Injected using a disposable easy to handle pen device with a thin

needle and low injection volume

Pivotal Phase 3 study in growth hormone deficient adults (on-going)

Phase 2 study in naive growth hormone deficiency pediatric

population has been completed

Orphan drug designation in the US & EU for the treatment of children

& adults with GHD

30 |

Daily hGH Market is $3B, Undifferentiated and Growing 31 Established and growing Established and growing Fragmented Fragmented Daily 2013 Daily 2018 Long-acting potential market Projected market growth Projected market growth Competition based on history, service and device innovation Competition based on history, service and device innovation $3B+ ~$4B Pediatric GHD Pediatric GHD ($1.5B)

Adult GHD

ISS, Turner

Syndrome

Other

80%

Source: Market Research 2013 & 2014

Novo Nordisk

(Norditropin)

31%

Pfizer

(Genotropin)

23%

Eli Lilly

(Humatrope)

12%

Sandoz

(Omnitrope)

8%

Merck KGaA

(Saizen,

Serostim)

8%

Roche

(Nutropin)

12%

Others

6% |

| MOD-5014: Long-acting Factor VIIa for Hemophilia A & B $1.7 billion market Growing 7% annually Only 25% of patients are treated Current product (NovoSeven®) requires frequent IV doses

3-4 times a day during bleeding episodes 1-2 times a day for prophylactic treatment Pharmacological studies in hemophilic mice and dogs FVIIa-CTP demonstrated: Potential for via subcutaneous administration Reduced frequency of injection during on-demand therapy

Enable prophylactic treatment while reducing the frequency of

injections to 2-3 times a week

Phase 2a study to Commence Q4 Orphan drug designation in the US and EU 32 |

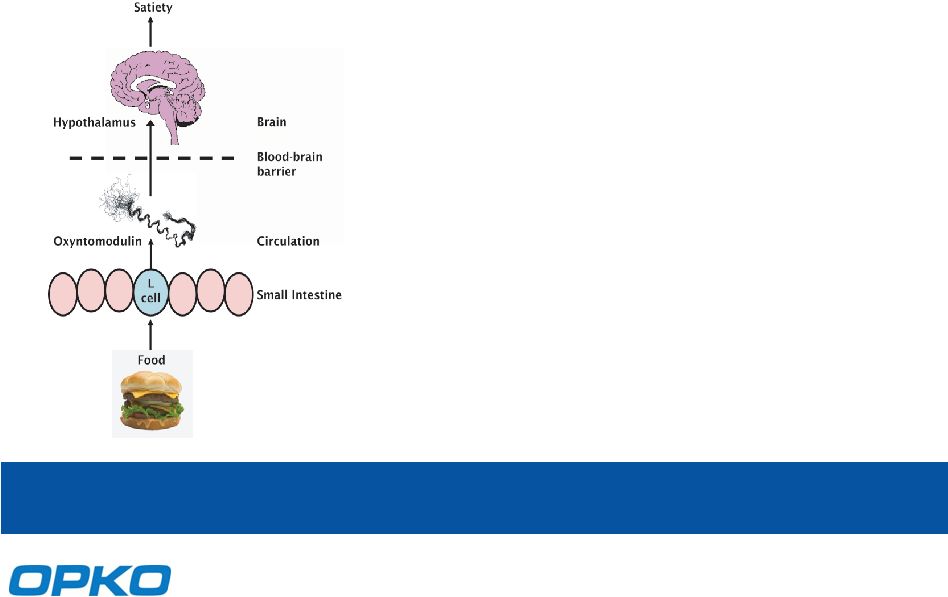

Oxyntomodulin Natures Appetite Control Mechanism Natural appetite suppressor Oxyntomodulin is a dual GLP-1/Glucagon receptor agonist Secreted by the digestive system following food intake and induces satiety in the brain Crosses blood-brain barrier to induce satiety Increases glucose tolerance in insulin resistance pre-diabetic state associated with obesity 33 Development challenge: Oxyntomodulin has short half-life which requires multiple daily injections

OPKO solution: MOD-6030, a reversible PEG

30

formulation which provides 12-fold reduction in dosing

frequency |

| MOD 6031: Meets Unmet Market Need MOD-6031 significantly inhibits food intake and reduces body

weight by reduction in fat

MOD-6031 improves glycemic control by inducing glucose

dependent insulin secretion (direct mechanism) and by reducing

fat (indirect mechanism)

MOD-6031 improves lipid profile MOD-6031 is expected to provide effective long-term therapy for

obese and type II diabetes patients

A battery of comprehensive toxicological studies have been

completed confirming the safety of MOD-6031 following a

single injection

Phase 1 study evaluating the safety and pk-pd profile of MOD-6031 in overweight or obese health volunteers is scheduled to be initiated

in early Q1 2016

34 |

| Rolapitant Potential Near-Term Revenue Driver Rolapitant out-licensed to Tesaro in December 2010 Payments of up to $121 million Double-digit tiered royalties Differentiated cancer supportive care product with $1.5B US Market

Opportunity

Potent neurokinin-1(NK-1) receptor antagonist for chemotherapy-induced nausea

and vomiting (CINV)

Opportunity to differentiate on convenience, market access and safety

Single dose Lack of CYP 3A4 drug-drug interactions Long acting Oral and IV formulations allow full market access PDUFA Date September 5, 2015 All three Phase 3 trials (MEC* and HEC**) achieved primary endpoint

Primary endpoint: complete response (no emesis and no use of rescue

medication)

Third Phase 3 trial (HEC) also achieved all secondary endpoints, including:

Complete response in acute (0-24 hrs) and overall (0-120 hrs) phase of CINV

No significant nausea Successful completion of bioequivalence study for intravenous formulation

35

¹ Moderately

emetogenic chemotherapy ² Highly

emetogenic chemotherapy |

| Strategic Investments ARNO Therapeutics, Inc. (OTC: ARNI) (~4% equity interest) Anti-progestin therapy for breast (phase 2) , endometrial and prostate cancers

Zebra Biologics, Inc. (~27% equity interest) Combinatorial antibody libraries based on function in human cell screens

OAO Pharmsynthez (MICE: LIFE) (~17% equity interest) Russian developer and marketer of new drugs RXi Pharmaceuticals Corporation (NASDAQ: RXII) (~10% equity interest)

sRNA to prevent hypertrophic scars (phase 2) Cocrystal Pharma, Inc. (OTC: COCP) (~8% equity interest) New anti-virals (Hepatitis C, flu) superior molecules for combination therapy (pan-genotypic)

Sevion Therapeutics, Inc. (OTC: SVON) (~ 4% equity interest*)

Antibodies against difficult targets (e.g., G protein-coupled receptor, ion channels)

Neovasc, Inc. (NASDAQ: NVCN) (~ 5% equity interest) Cardiology devices (transcutaneous mitral valve) ChromaDex, Inc. (OTC: CDXC) (~ 2% equity interest) New nutritional supplement APIs MabVax Therapeutics Holdings, Inc. (OTC: MBVX) (~7% equity interest)

Cancer Immunotherapy Company SciVac Therapeutics, Inc (TSX: VAC) (~25% equity interest) Third-generation hepatitis B vaccine As of June 30, 2015

Proprietary

Technologies with Significant

Upside Potential 36 |