EX-99.1

Published on September 24, 2015

| Exhibit 99.1

|

Exhibit 99.1

SEPTEMBER 2015

Advancing Our Deep Pipeline of Pharmaceuticals and Diagnostics

|

|

CAUTIONARY STATEMENT

This presentation contains forward-looking statements, as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as expects, plans, projects, will, may, anticipates, believes, should, intends, estimates, potential, and other words of similar meaning, including statements regarding our estimated revenues and financial projections, our ability to achieve high levels of growth, the potential for our products under development, the potential of the 4Kscore® to reduce prostate biopsies and predict the risk of aggressive prostate cancer, our ability to develop, test and launch new products, the expected timing of the clinical studies and regulatory approval for our products under development, the outcome of our clinical trials and validation studies and that such outcomes will support commercialization, the expected market penetration and size of the market for our products under development, including without limitation, Rolapitant, Rayaldee, hGH-CTP, the 4Kscore, Factor VIIa-CTP, oxyntomodulin, and our point-of-care diagnostic product for PSA, the potential benefits of our products under development, including whether the 4Kscore will improve selection of candidates for prostate biopsy, predict the risk of distant metastases, and result in 40-55% cost savings, the expected PMA submission date for PSA, expected per patient savings, that MOD-6031 will provide superior long-term therapy for obesity and Type II diabetes patients, our ability to successfully commercialize our product candidates such as Rolapitant, the 4Kscore, hGH-CTP and Rayaldee and whether Rayaldee will take significant market share in Stage 3 and 4 CKD patients with SHPT, whether Rayaldee will raise serum total 25-hydroxyvitamin D (25D) more effectively than any over-the-counter (OTC) or prescription (Rx) product currently marketed without the risk of hypercalcemia, whether we can reach more than half of the CKD population with a small sales force, our ability to establish a sales and marketing and clinical support infrastructure for Rayaldee and the timeline for doing so, the expected PDUFA date and launch date for Rayaldee, expectations regarding patent coverage, the expected timing for commencing, completing and obtaining results for our clinical trials, the timing for release of trial data and seeking and obtaining FDA and European regulatory approvals as well as reimbursement coverage, and the timing of commercial launch of our product candidates, expectations about near term profitability, that EirGen will manufacture our current and future products resulting in higher margins, that Bio-References vast array of genetics and genomics data will benefit OPKO, as well as other non-historical statements. These forward looking statements are only predictions and reflect our views as of the date they were made, and we undertake no obligation to update such statements. Such statements are subject to many risks and uncertainties that could cause our activities or actual results to differ materially from the activities and results anticipated in forward looking statements, including integration challenges with Bio-Reference, risks inherent in funding, developing and obtaining regulatory approvals of new, commercially-viable and competitive products and treatments, the success of our collaboration with Pfizer, general market factors, competitive product development, product availability, federal and state regulations and legislation, and integration issues arising from the transactions, delays associated with development of novel technologies, unexpected difficulties and delays in validating and testing product candidates, the regulatory process for new products and indications, manufacturing issues that may arise, the cost of funding lengthy research programs, the need for and availability of additional capital, the possibility of infringing a third partys patents or other intellectual property rights, the uncertainty of obtaining patents covering our products and processes and in successfully enforcing them against third parties, and the possibility of litigation, among other factors, including all of the risks identified under the heading Risk Factors in our Annual Report on Form 10-K and other filings with the Securities and Exchange Commission.

| 2 |

|

|

|

OPKO is a multinational biopharmaceutical and diagnostics company that seeks to establish industry-leading positions in large growth markets by leveraging its discovery, development, and commercialization expertise

OPKO is positioned for strength and growth in large target markets with significant unmet needs

| 3 |

|

|

|

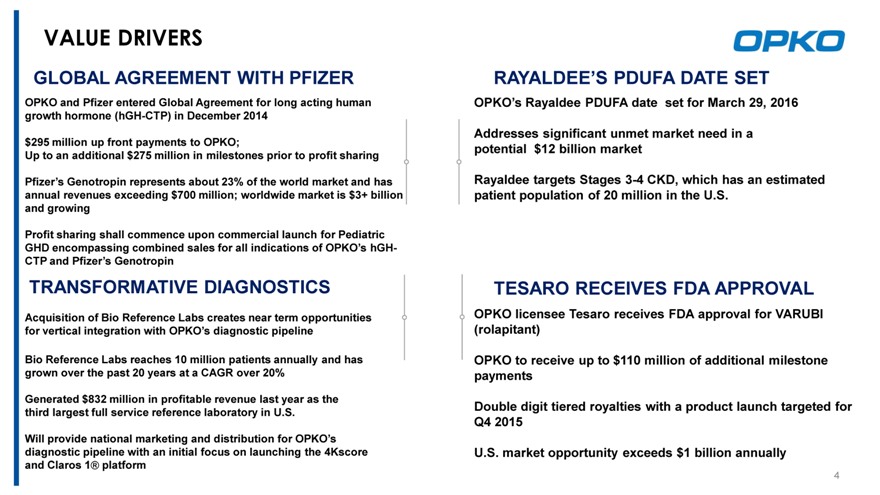

VALUE DRIVERS

GLOBAL AGREEMENT WITH PFIZER

OPKO and Pfizer entered Global Agreement for long acting human growth hormone (hGH-CTP) in December 2014

$295 million up front payments to OPKO;

Up to an additional $275 million in milestones prior to profit sharing

Pfizers Genotropin represents about 23% of the world market and has annual revenues exceeding $700 million; worldwide market is $3+ billion and growing

Profit sharing shall commence upon commercial launch for Pediatric

GHD encompassing combined sales for all indications of OPKOs hGH-CTP and Pfizers Genotropin

TRANSFORMATIVE DIAGNOSTICS

Acquisition of Bio Reference Labs creates near term opportunities for vertical integration with OPKOs diagnostic pipeline

Bio Reference Labs reaches 10 million patients annually and has grown over the past 20 years at a CAGR over 20%

Generated $832 million in profitable revenue last year as the third largest full service reference laboratory in U.S.

Will provide national marketing and distribution for OPKOs diagnostic pipeline with an initial focus on launching the 4Kscore and Claros 1® platform

RAYALDEES PDUFA DATE SET

OPKOs Rayaldee PDUFA date set for March 29, 2016

Addresses significant unmet market need in a potential $12 billion market

Rayaldee targets Stages 3-4 CKD, which has an estimated patient population of 20 million in the U.S.

TESARO RECEIVES FDA APPROVAL

OPKO licensee Tesaro receives FDA approval for VARUBI (rolapitant)

OPKO to receive up to $110 million of additional milestone payments

Double digit tiered royalties with a product launch targeted for Q4 2015

U.S. market opportunity exceeds $1 billion annually

| 4 |

|

|

|

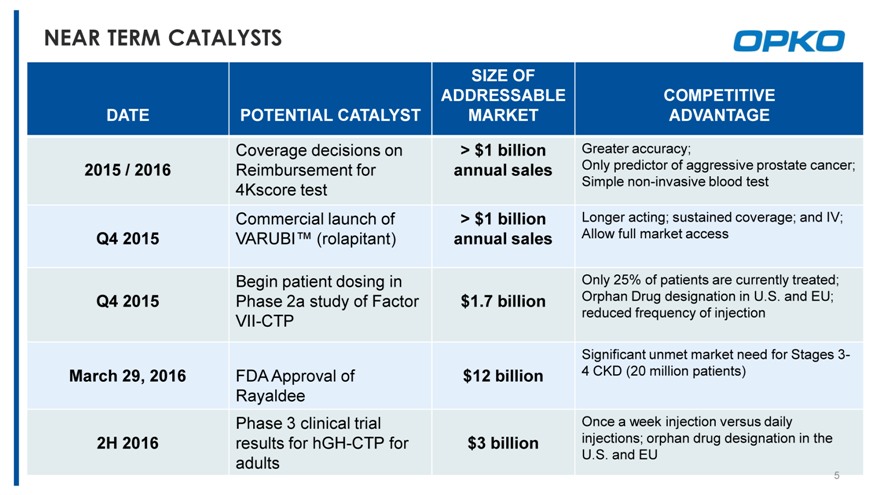

NEAR TERM CATALYSTS

SIZE OF

ADDRESSABLE COMPETITIVE

DATE POTENTIAL CATALYST MARKET ADVANTAGE

Coverage decisions on > $1 billion Greater accuracy;

2015 / 2016 Reimbursement for annual sales Only predictor of aggressive prostate cancer;

4Kscore test Simple non-invasive blood test

Commercial launch of > $1 billion Longer acting; sustained coverage; and IV;

Q4 2015 VARUBI (rolapitant) annual sales Allow full market access

Begin patient dosing in Only 25% of patients are currently treated;

Q4 2015 Phase 2a study of Factor $1.7 billion Orphan Drug designation in U.S. and EU;

VII-CTP reduced frequency of injection

Significant unmet market need for Stages 3-

March 29, 2016 FDA Approval of $12 billion 4 CKD (20 million patients)

Rayaldee

Phase 3 clinical trial Once a week injection versus daily

2H 2016 results for hGH-CTP for $3 billion injections; orphan drug designation in the

adults U.S. and EU

| 5 |

|

|

|

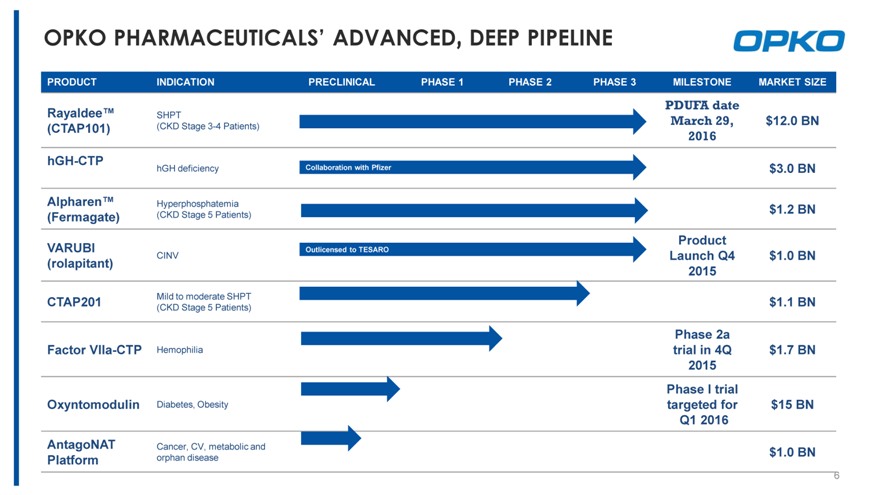

OPKO PHARMACEUTICALS ADVANCED, DEEP PIPELINE

PRODUCT INDICATION PRECLINICAL PHASE 1 PHASE 2 PHASE 3 MILESTONE MARKET SIZE

PDUFA date

Rayaldee SHPT March 29, $12.0 BN

(CTAP101) (CKD Stage 3-4 Patients) 2016

hGH-CTP hGH deficiency Collaboration with Pfizer $3.0 BN

Alpharen Hyperphosphatemia $1.2 BN

(Fermagate) (CKD Stage 5 Patients)

VARUBI Outlicensed to TESARO Product

CINV Launch Q4 $1.0 BN

(rolapitant) 2015

CTAP201 Mild to moderate SHPT $1.1 BN

(CKD Stage 5 Patients)

Phase 2a

Factor VIIa-CTP Hemophilia trial in 4Q $1.7 BN

2015

Phase I trial

Oxyntomodulin Diabetes, Obesity targeted for $15 BN

Q1 2016

AntagoNAT Cancer, CV, metabolic and $1.0 BN

Platform orphan disease

| 6 |

|

|

|

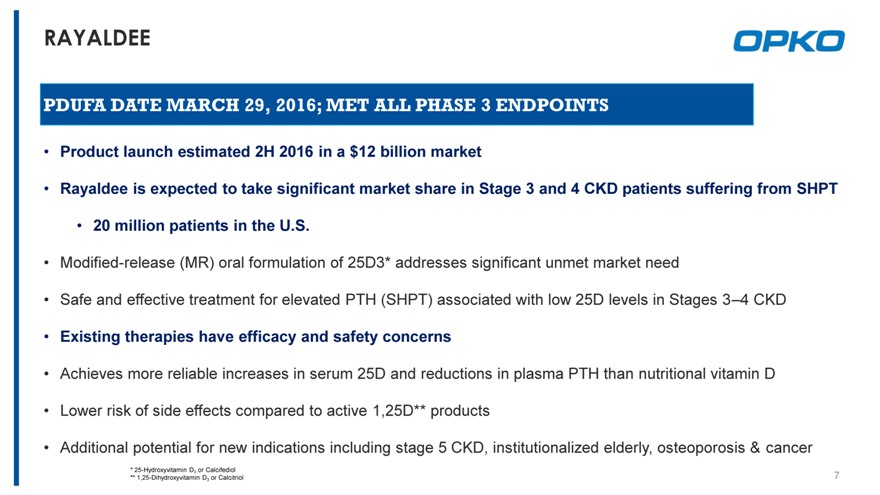

RAYALDEE

PDUFA DATE MARCH 29, 2016; MET ALL PHASE 3 ENDPOINTS

Product launch estimated 2H 2016 in a $12 billion market

Rayaldee is expected to take significant market share in Stage 3 and 4 CKD patients suffering from SHPT

20 million patients in the U.S.

Modified-release (MR) oral formulation of 25D3* addresses significant unmet market need

Safe and effective treatment for elevated PTH (SHPT) associated with low 25D levels in Stages 34 CKD

Existing therapies have efficacy and safety concerns

Achieves more reliable increases in serum 25D and reductions in plasma PTH than nutritional vitamin D

Lower risk of side effects compared to active 1,25D** products

Additional potential for new indications including stage 5 CKD, institutionalized elderly, osteoporosis & cancer

25-Hydroxyvitamin D3 or Calcifediol

1,25-Dihydroxyvitamin D3 or Calcitriol

7

|

|

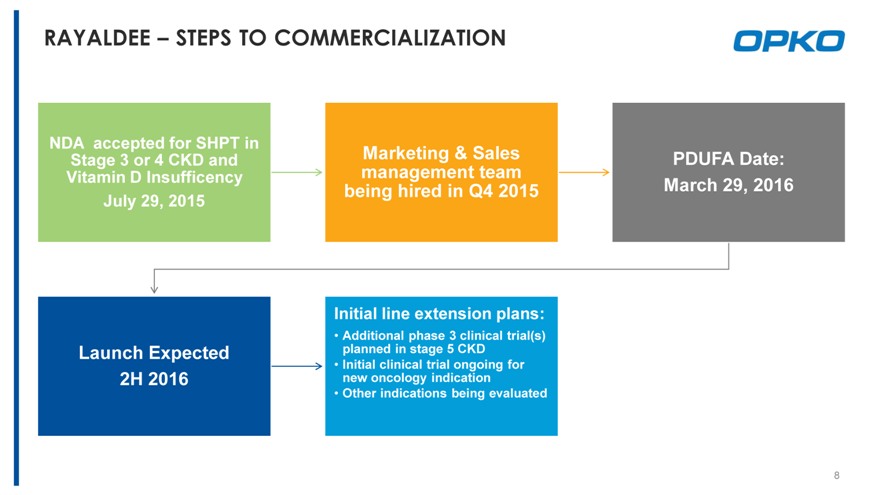

RAYALDEE STEPS TO COMMERCIALIZATION

NDA accepted for SHPT in Marketing & Sales

Stage 3 or 4 CKD and PDUFA Date:

Vitamin D Insufficency management team

being hired in Q4 2015 March 29, 2016

July 29, 2015

Initial line extension plans:

Additional phase 3 clinical trial(s)

Launch Expected planned in stage 5 CKD

Initial clinical trial ongoing for

2H 2016 new oncology indication

Other indications being evaluated

| 8 |

|

|

|

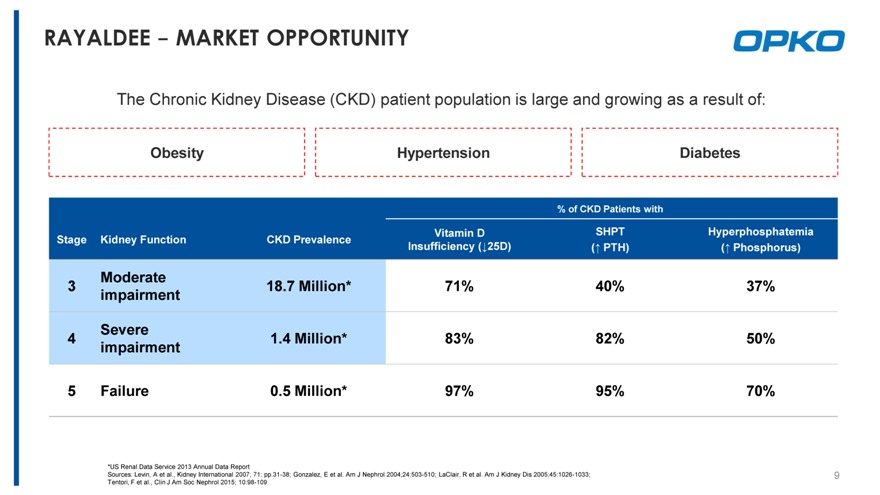

RAYALDEEMARKET OPPORTUNITY

The Chronic Kidney Disease (CKD) patient population is large and growing as a result of:

Obesity Hypertension Diabetes

% of CKD Patients with

Stage Kidney Function CKD Prevalence Vitamin D SHPT Hyperphosphatemia

Insufficiency (?25D) (? PTH) (? Phosphorus)

Moderate

| 3 |

|

18.7 Million* 71% 40% 37% |

impairment

Severe

| 4 |

|

1.4 Million* 83% 82% 50% |

impairment

| 5 |

|

Failure 0.5 Million* 97% 95% 70% |

*US Renal Data Service 2013 Annual Data Report

Sources: Levin, A et al., Kidney International 2007; 71: pp.31-38; Gonzalez, E et al. Am J Nephrol 2004;24:503-510; LaClair, R et al. Am J Kidney Dis 2005;45:1026-1033; Tentori, F et al., Clin J Am Soc Nephrol 2015; 10:98-109

9

|

|

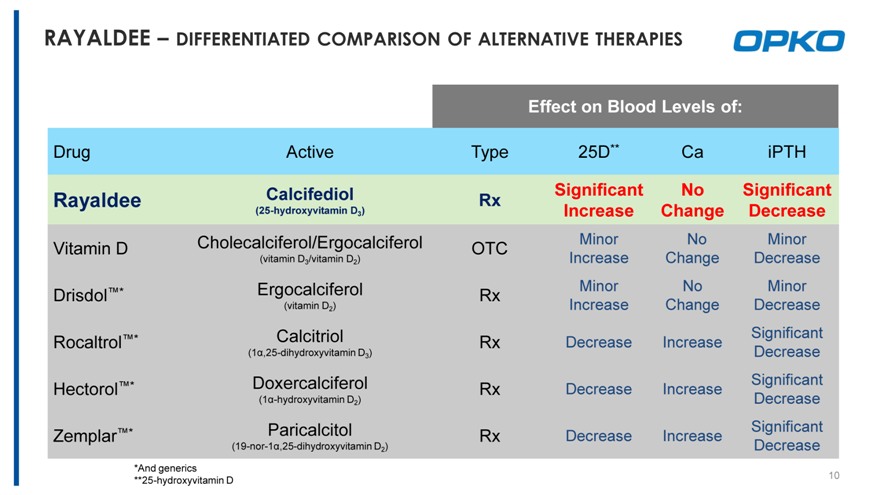

RAYALDEE DIFFERENTIATED COMPARISON OF ALTERNATIVE THERAPIES

Effect on Blood Levels of:

Drug Active Type 25D** Ca iPTH

Rayaldee Calcifediol Rx Significant No Significant

(25-hydroxyvitamin D3 ) Increase Change Decrease

Vitamin D Cholecalciferol/Ergocalciferol OTC Minor No Minor

(vitamin D3 /vitamin D2 ) Increase Change Decrease

Drisdol* Ergocalciferol Rx Minor No Minor

(vitamin D2 ) Increase Change Decrease

Rocaltrol* Calcitriol Rx Decrease Increase Significant

(1á,25-dihydroxyvitamin D3 ) Decrease

Hectorol* Doxercalciferol Rx Decrease Increase Significant

(1á-hydroxyvitamin D2 ) Decrease

Zemplar* Paricalcitol Rx Decrease Increase Significant

(19-nor-1á,25-dihydroxyvitamin D2 ) Decrease

*And generics

**25-hydroxyvitamin D 10

|

|

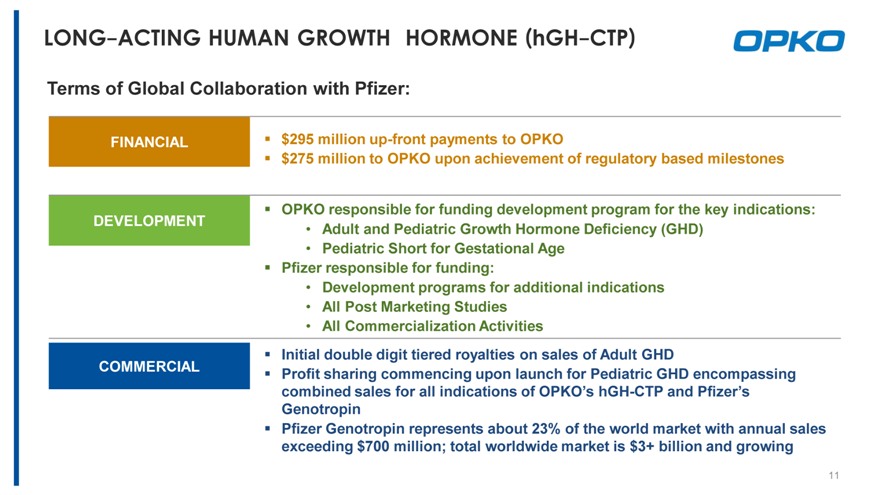

LONG-ACTING HUMAN GROWTH HORMONE (hGH-CTP)

Terms of Global Collaboration with Pfizer:

FINANCIAL $295 million up-front payments to OPKO

$275 million to OPKO upon achievement of regulatory based milestones

OPKO responsible for funding development program for the key indications:

DEVELOPMENT Adult and Pediatric Growth Hormone Deficiency (GHD)

Pediatric Short for Gestational Age

Pfizer responsible for funding:

Development programs for additional indications

All Post Marketing Studies

All Commercialization Activities

Initial double digit tiered royalties on sales of Adult GHD

COMMERCIAL Profit sharing commencing upon launch for Pediatric GHD encompassing

combined sales for all indications of OPKOs hGH-CTP and Pfizers

Genotropin

Pfizer Genotropin represents about 23% of the world market with annual sales

exceeding $700 million; total worldwide market is $3+ billion and growing

11

|

|

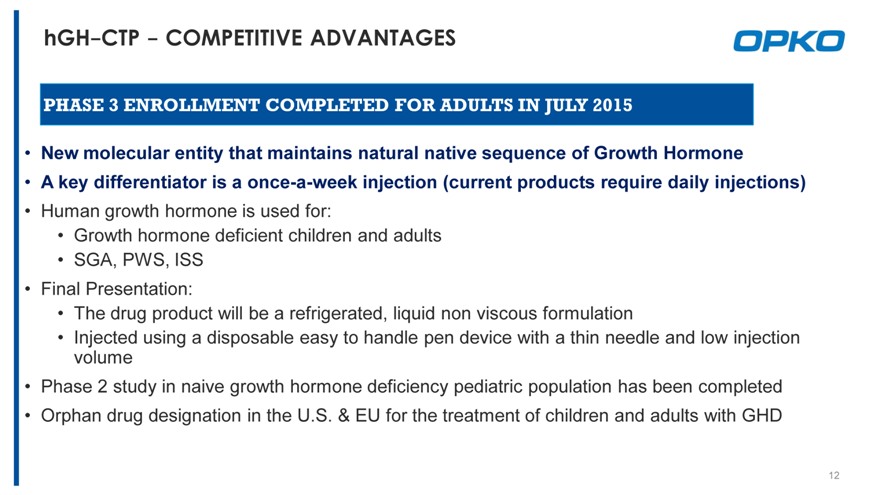

hGH-CTPCOMPETITIVE ADVANTAGES

PHASE 3 ENROLLMENT COMPLETED FOR ADULTS IN JULY 2015

New molecular entity that maintains natural native sequence of Growth Hormone

A key differentiator is a once-a-week injection (current products require daily injections)

Human growth hormone is used for:

Growth hormone deficient children and adults

SGA, PWS, ISS

Final Presentation:

The drug product will be a refrigerated, liquid non viscous formulation

Injected using a disposable easy to handle pen device with a thin needle and low injection volume Phase 2 study in naive growth hormone deficiency pediatric population has been completed Orphan drug designation in the U.S. & EU for the treatment of children and adults with GHD

12

|

|

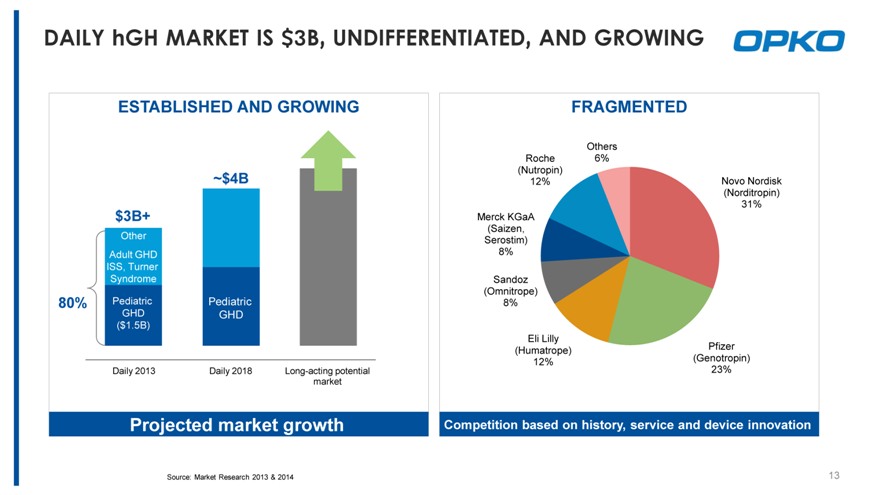

DAILY hGH MARKET IS $3B, UNDIFFERENTIATED, AND GROWING

ESTABLISHED AND GROWING

~$4B

$3B+

Other

Adult GHD

ISS, Turner

Syndrome

80% Pediatric Pediatric

GHD GHD

($1.5B)

Daily 2013 Daily 2018 Long-acting potential

market

Projected market growth

FRAGMENTED

Others

Roche 6%

(Nutropin)

12% Novo Nordisk

(Norditropin)

31%

Merck KGaA

(Saizen,

Serostim)

8%

Sandoz

(Omnitrope)

8%

Eli Lilly

(Humatrope) Pfizer

12% (Genotropin)

23%

Competition based on history, service and device innovation

Source: Market Research 2013 & 2014

13

|

|

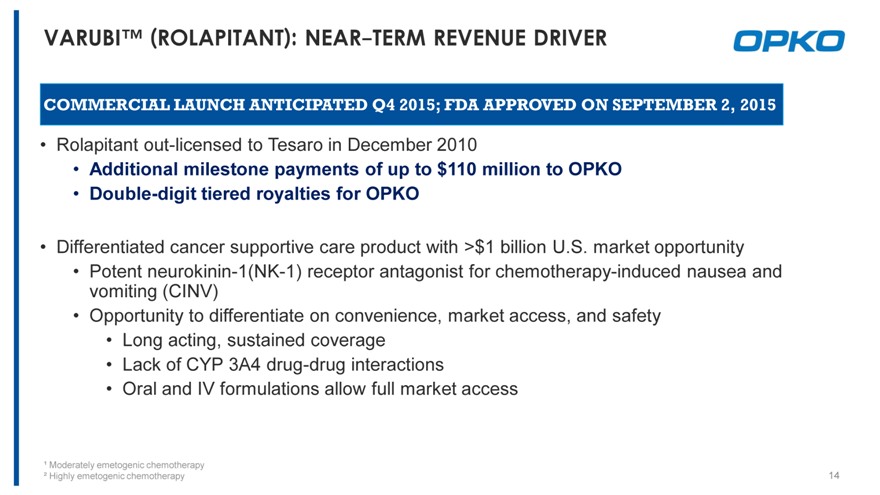

VARUBI (ROLAPITANT): NEAR-TERM REVENUE DRIVER

COMMERCIAL LAUNCH ANTICIPATED Q4 2015; FDA APPROVED ON SEPTEMBER 2, 2015

Rolapitant out-licensed to Tesaro in December 2010

Additional milestone payments of up to $110 million to OPKO

Double-digit tiered royalties for OPKO

Differentiated cancer supportive care product with >$1 billion U.S. market opportunity

Potent neurokinin-1(NK-1) receptor antagonist for chemotherapy-induced nausea and vomiting (CINV)

Opportunity to differentiate on convenience, market access, and safety

Long acting, sustained coverage

Lack of CYP 3A4 drug-drug interactions

Oral and IV formulations allow full market access

¹ Moderately emetogenic chemotherapy

² Highly emetogenic chemotherapy

14

|

|

BIO REFERENCE LABS ACQUISITION: NEAR TERM OPPORTUNITY

LEVERAGE BIO REFERENCES CHANNELS TO ACCELERATE ADOPTION OF OPKOS DIAGNOSTIC PRODUCTS

Bio Reference Labs is the third largest full service reference laboratory in the U.S.

Leverage the national marketing, sales, and distribution resources of Bio Reference Labs to enhance sales of OPKOs diagnostic platforms

~420 sales and marketing personnel

~5,000 people working together to support the needs of clients and patients ~175 BRLI patient service centers located throughout the U.S.

Bio Reference Labs generated $832 million in revenue at 44% gross margins in FY 2014 Has grown at a 20% CAGR over the past 20 years Will serve as a launching pad for the 4Kscore as reimbursement for the 4Kscore continues to be expanded

15

|

|

4KSCORE TEST: MINIMALLY INVASIVE ALTERNATIVE TO PROSTATE BIOPSY

MORE THAN 2 MILLION BIOPSIES PER YEAR WORLDWIDE

4Kscore is the only blood test that accurately identifies risk for aggressive prostate cancer

Reimbursement to be expanded throughout the remainder of 2015 and 2016

Clinical utility is based on three decades of clinical biomarker research and over 20,000 men tested in Europe and the U.S.

Over 1,000 urologists have used the 4Kscore in routine practice

Identifies the actual risk of aggressive prostate cancer for the individual patient with high grade prostate cancer pathology and poor prostate cancer clinical outcomes within 20 years

4055% cost savings to potentially avoid unnecessary MRI and prostate biopsies

16

|

|

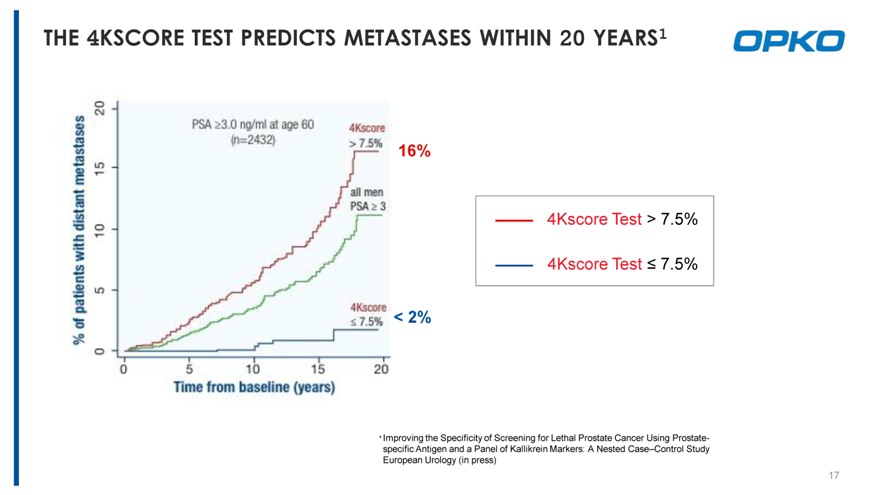

THE 4KSCORE TEST PREDICTS METASTASES WITHIN 20 YEARS1

4Kscore Test > 7.5%

4Kscore Test 7.5%

Improving the Specificity of Screening for Lethal Prostate Cancer Using Prostate- specific Antigen and a Panel of Kallikrein Markers: A Nested CaseControl Study European Urology (in press)

17

|

|

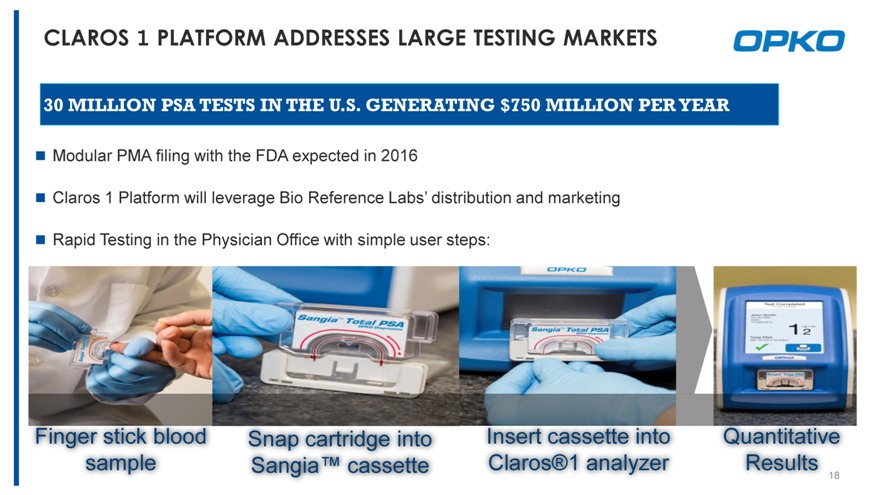

CLAROS 1 PLATFORM ADDRESSES LARGE TESTING MARKETS

30 MILLION PSA TESTS IN THE U.S. GENERATING $750 MILLION PER YEAR

Modular PMA filing with the FDA expected in 2016

Claros 1 Platform will leverage Bio Reference Labs distribution and marketing

Rapid Testing in the Physician Office with simple user steps:

Finger stick blood Snap cartridge into Insert cassette into Quantitative

sample Sangia cassette Claros®1 analyzer Results

18

|

|

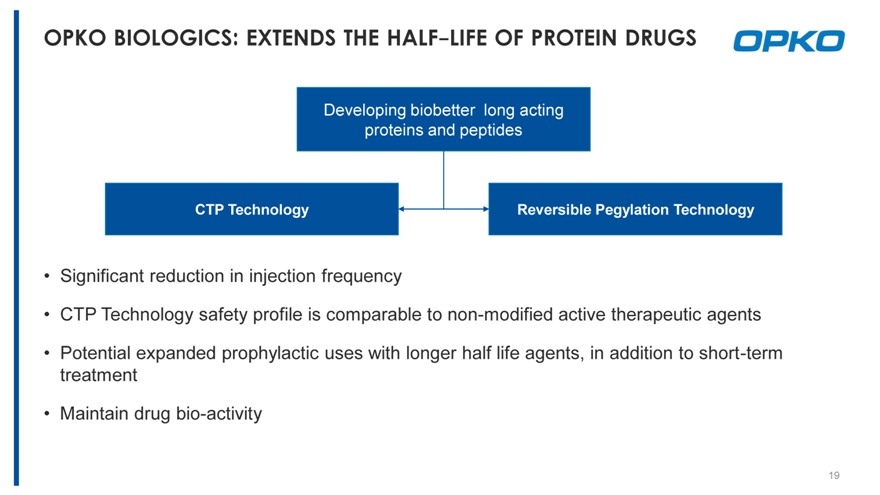

OPKO BIOLOGICS: EXTENDS THE HALF-LIFE OF PROTEIN DRUGS

Developing biobetter long acting

proteins and peptides

CTP Technology Reversible Pegylation Technology

Significant reduction in injection frequency

CTP Technology safety profile is comparable to non-modified active therapeutic agents

Potential expanded prophylactic uses with longer half life agents, in addition to short-term treatment

Maintain drug bio-activity

19

|

|

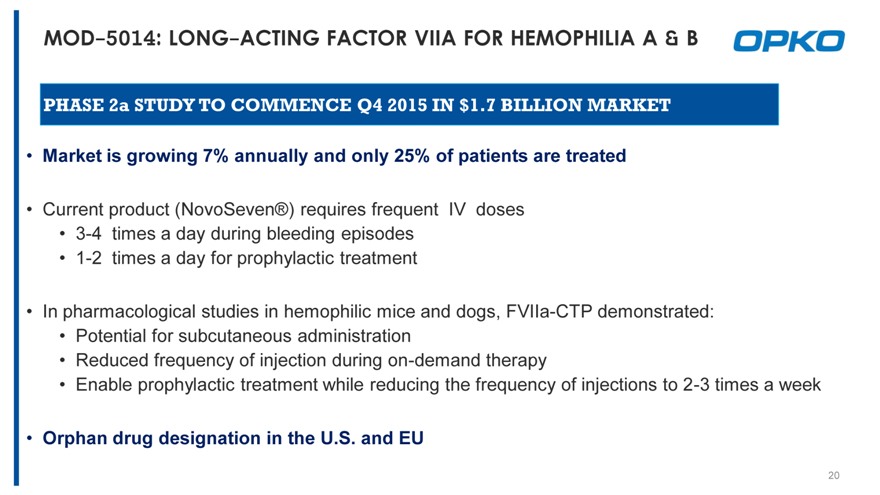

MOD-5014: LONG-ACTING FACTOR VIIA FOR HEMOPHILIA A & B

PHASE 2a STUDY TO COMMENCE Q4 2015 IN $1.7 BILLION MARKET

Market is growing 7% annually and only 25% of patients are treated

Current product (NovoSeven®) requires frequent IV doses

3-4 times a day during bleeding episodes

1-2 times a day for prophylactic treatment

In pharmacological studies in hemophilic mice and dogs, FVIIa-CTP demonstrated:

Potential for subcutaneous administration

Reduced frequency of injection during on-demand therapy

Enable prophylactic treatment while reducing the frequency of injections to 2-3 times a week

Orphan drug designation in the U.S. and EU

20

|

|

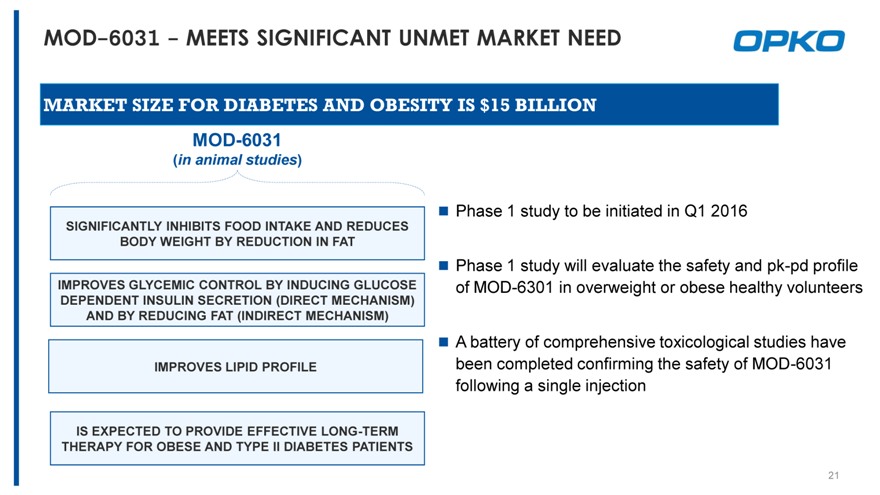

MOD-6031MEETS SIGNIFICANT UNMET MARKET NEED

MARKET SIZE FOR DIABETES AND OBESITY IS $15 BILLION

MOD-6031

(in animal studies)

SIGNIFICANTLY INHIBITS FOOD INTAKE AND REDUCES BODY WEIGHT BY REDUCTION IN FAT

IMPROVES GLYCEMIC CONTROL BY INDUCING GLUCOSE DEPENDENT INSULIN SECRETION (DIRECT MECHANISM) AND BY REDUCING FAT (INDIRECT MECHANISM)

IMPROVES LIPID PROFILE

IS EXPECTED TO PROVIDE EFFECTIVE LONG-TERM THERAPY FOR OBESE AND TYPE II DIABETES PATIENTS

Phase 1 study to be initiated in Q1 2016

Phase 1 study will evaluate the safety and pk-pd profile of MOD-6301 in overweight or obese healthy volunteers

A battery of comprehensive toxicological studies have been completed confirming the safety of MOD-6031 following a single injection

21

|

|

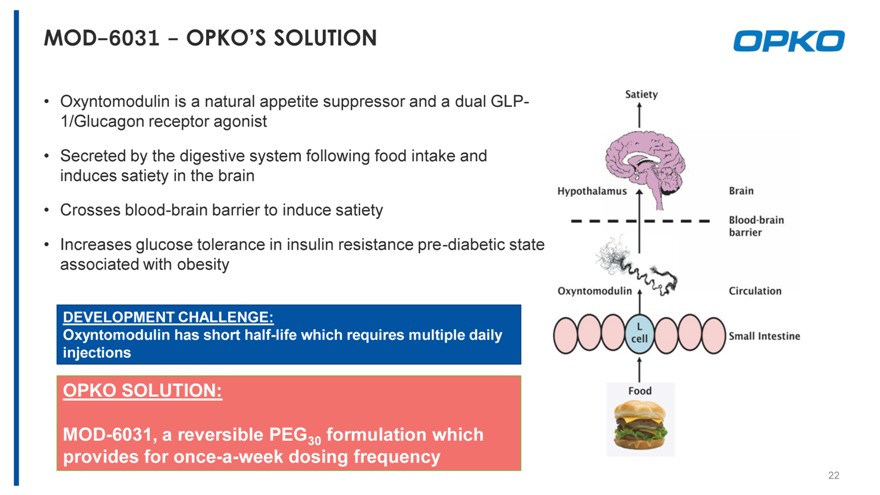

MOD-6031OPKOS SOLUTION

Oxyntomodulin is a natural appetite suppressor and a dual GLP-

1/Glucagon receptor agonist

Secreted by the digestive system following food intake and induces satiety in the brain

Crosses blood-brain barrier to induce satiety

Increases glucose tolerance in insulin resistance pre-diabetic state associated with obesity

DEVELOPMENT CHALLENGE:

Oxyntomodulin has short half-life which requires multiple daily injections

OPKO SOLUTION:

MOD-6031, a reversible PEG30 formulation which provides for once-a-week dosing frequency

22