EX-99.1

Published on June 6, 2018

June 2018 Exhibit 99.1

Forward Looking Statements This presentation contains “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as “expects,” “plans,” “projects,” “will,” “may,” “anticipates,” “believes,” “should,” “intends,” “estimates,” “potential,” and other words of similar meaning, including statements regarding our estimated revenues and financial projections, expected milestones and royalties from the outlicense of our products, our ability to achieve high levels of growth, the potential for our products under development, the potential of the 4Kscore® to influence 89% of biopsy decisions and predict the risk of aggressive prostate cancer, the expected timing of the clinical studies and regulatory approval for our products under development, the outcome of our clinical trials and validation studies and that such outcomes will support marketing approval or commercialization, the expected market penetration and size of the market for our products, including without limitation, Rolapitant, Rayaldee®, hGH-CTP, the 4Kscore, Factor VIIa-CTP, Alpharen, oxyntomodulin, the SARM candidate, and our point-of-care diagnostic products, the potential benefits of our products under development, including whether the 4Kscore will predict the risk of 20 year metastasis free survival and result in 40-55% cost savings, the expected response date from the FDA and approval for the PMA for PSA and submission date for 510k for testosterone and expected launch date for each, that oxyntomodulin will provide superior long-term therapy for obesity and Type II diabetes patients, our ability to successfully commercialize our product candidates such as Rolapitant, the 4Kscore, hGH-CTP, Rayaldee, Alpharen, the SARM, and oxyntomodulin, and whether Rayaldee will take significant market share in stage 3 and 4 CKD patients with SHPT, whether Rayaldee will raise serum total 25-hydroxyvitamin D (25D) more effectively than any over-the-counter (OTC) or prescription (Rx) products currently marketed without the risk of hypercalcemia, our ability to develop Rayaldee for new indications including stage 5 CKD and the timeline for doing so, whether the clinical data and post hoc sensitivity analysis for hGH-CTP will support submission of a Biologics License Application (BLA) and approval for hGH-CTP in adults, whether we will submit a BLA and the timing for doing so, whether we will be required to make any changes to our development plans for hGH-CTP, expectations regarding patent coverage, the expected timing for commencing, enrolling, completing and announcing results for our clinical trials, the timing for release of trial data and seeking and obtaining FDA and European regulatory approvals as well as reimbursement coverage for our products, our ability to obtain a positive coverage determination for the 4Kscore and whether we have enough scientific and clinical data to justify a positive coverage determination, whether Novitas and other payors will reimburse us for the 4Kscore test, and the timing of commercial launch of our product candidates. These forward-looking statements are only predictions and reflect our views as of the date they were made, and we undertake no obligation to update such statements. Such statements are subject to many risks and uncertainties that could cause our activities or actual results to differ materially from the activities and results anticipated in forward looking statements, including integration challenges with Bio-Reference and other acquired businesses, liquidity issues and risks inherent in funding, developing and obtaining regulatory approvals of new, commercially viable and competitive products and treatments, the success of our collaboration with Pfizer, general market factors, competitive product development, product availability, federal and state regulations and legislation, delays associated with development of novel technologies, unexpected difficulties and delays in validating and testing product candidates, the regulatory process for new products and indications, manufacturing issues that may arise, the cost of funding lengthy research programs, the need for and availability of additional capital, the possibility of infringing a third party’s patents or other intellectual property rights, the uncertainty of obtaining patents covering our products and processes and in successfully enforcing them against third parties, and the potential for litigation or government investigations, among other factors, including all of the risks identified under the heading Risk Factors in our Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. June 2018 |

Multinational biopharmaceutical and diagnostics company establishing important positions in large, underserved markets June 2018 |

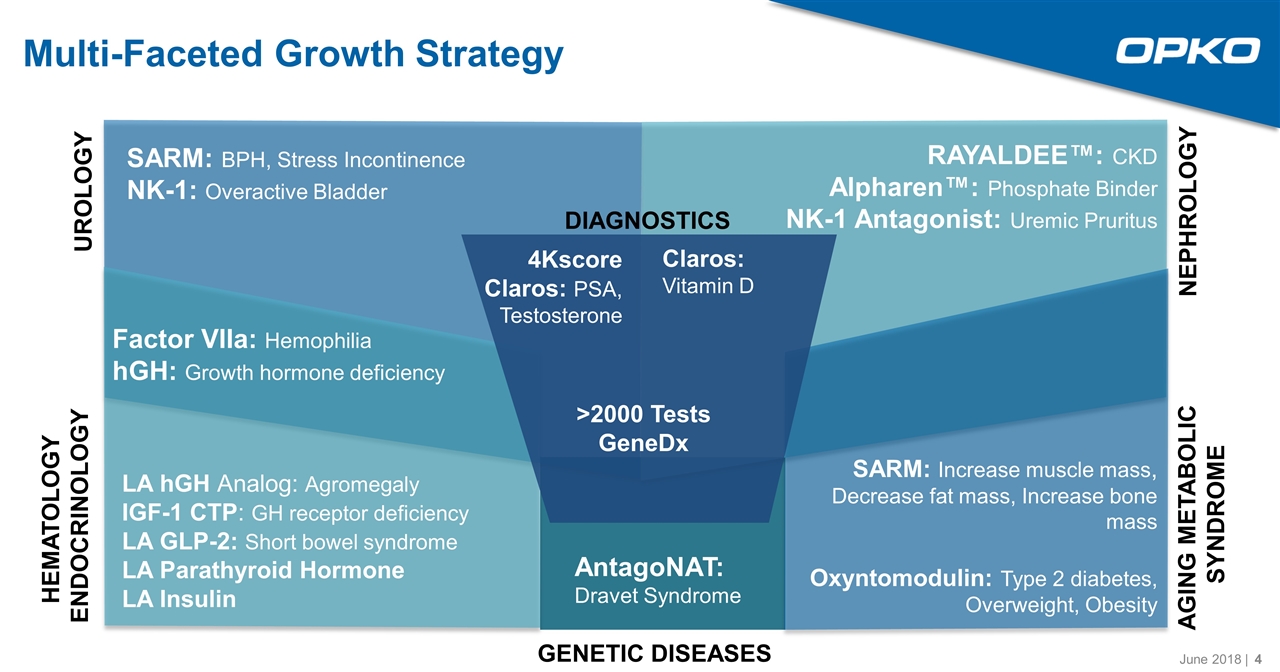

Multi-Faceted Growth Strategy SARM: BPH, Stress Incontinence NK-1: Overactive Bladder UROLOGY Factor VIIa: Hemophilia hGH: Growth hormone deficiency LA hGH Analog: Agromegaly IGF-1 CTP: GH receptor deficiency LA GLP-2: Short bowel syndrome LA Parathyroid Hormone LA Insulin HEMATOLOGY ENDOCRINOLOGY NEPHROLOGY AGING METABOLIC SYNDROME RAYALDEE™: CKD Alpharen™: Phosphate Binder NK-1 Antagonist: Uremic Pruritus SARM: Increase muscle mass, Decrease fat mass, Increase bone mass Oxyntomodulin: Type 2 diabetes, Overweight, Obesity 4Kscore Claros: PSA, Testosterone Claros: Vitamin D >2000 Tests GeneDx DIAGNOSTICS GENETIC DISEASES AntagoNAT: Dravet Syndrome June 2018 |

Investment Highlights Mature Diagnostic Business with ~900MM in revenue & growing Marketed Pharmaceuticals in early life-cycle with multi $B market opportunities in large underserved markets Robust Development Pipeline Multiple late-stage clinical trials addressing indications with large unmet medical needs Strategy & Execution Management team with a track record of success and commitment to opportunistic development June 2018 |

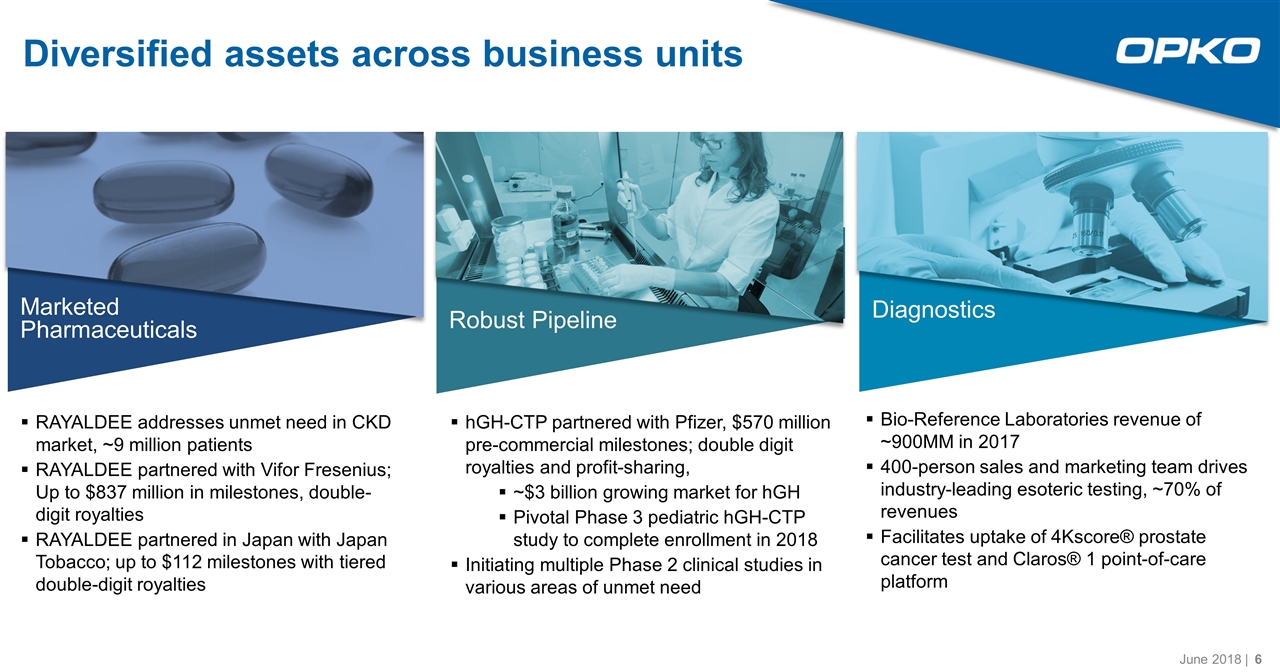

Robust Pipeline Diagnostics Diversified assets across business units RAYALDEE addresses unmet need in CKD market, ~9 million patients RAYALDEE partnered with Vifor Fresenius; Up to $837 million in milestones, double- digit royalties RAYALDEE partnered in Japan with Japan Tobacco; up to $112 milestones with tiered double-digit royalties Marketed Pharmaceuticals hGH-CTP partnered with Pfizer, $570 million pre-commercial milestones; double digit royalties and profit-sharing, ~$3 billion growing market for hGH Pivotal Phase 3 pediatric hGH-CTP study to complete enrollment in 2018 Initiating multiple Phase 2 clinical studies in various areas of unmet need Bio-Reference Laboratories revenue of ~900MM in 2017 400-person sales and marketing team drives industry-leading esoteric testing, ~70% of revenues Facilitates uptake of 4Kscore® prostate cancer test and Claros® 1 point-of-care platform June 2018 |

Robust Pipeline Diagnostics Diversified Assets Early Life Cycle Pharmaceuticals Marketed Pharmaceuticals June 2018 |

Chronic Kidney Disease (CKD) – The Silent Killer 9th Leading cause of death, ahead of breast and prostate cancer Prevalence expected to increase due to obesity, diabetes and hypertension Most patients die from cardiovascular disease, precipitated by secondary hyperparathyroidism (SHPT) SHPT is driven by vitamin D insufficiency (VDI) and characterized by elevated blood levels of parathyroid hormone (PTH) High PTH levels promote calcification (hardening) of vascular and renal tissues, the major cause of CKD mortality New KDIGO Clinical Practice Guidelines recommend against routine use of VDRAs in CKD and highlight the unproven effectiveness of vitamin D supplementation Healthcare providers have no good options to treat SHPT in stage 3-4 CKD except for RAYALDEE RAYALDEE® June 2018 |

Extended-Release (1x daily) oral formulation of 25D3* addresses significant unmet need FDA-approved for SHPT (elevated PTH) in patients with stage 3-4 CKD and VDI Reduces plasma PTH and increases serum 25D with a safety profile similar to placebo Minimal effects on serum calcium or phosphorus (key drivers of vascular calcification) Expected to take significant market share in stage 3-4 CKD patients with SHPT & VDI (~9M patients in US) Potential for new indications including stage 5 CKD, institutionalized elderly, osteoporosis and cancer RAYALDEE® Overview * 25-Hydroxyvitamin D3 or Calcifediol Product Launched November 30, 2016 June 2018 |

RAYALDEE signals changes in treatment of SHPT First and only extended-release prohormone of active form of vitamin D3 Brings 25-hydroxyvitamin D levels up Brings iPTH levels down RAYALDEE® Sends Clear Message June 2018 |

50-Person sales and marketing team launched RAYALDEE on November 30, 2016 Increased field sales force from 35 to 64 reps (October 2017) Commercial insurance under contract for >83% of U.S. covered lives Medicare Part D insurance under contract for >53% of U.S. covered lives Total RAYALDEE prescriptions increased approximately 730% in 1Q18 compared to 1Q17, and 38% compared to 4Q17 1Q18 RAYALDEE revenue of $3.7MM International partnership with Vifor Fresenius; up to $837 MM in milestones, double digit royalties Japanese partnership with Japan Tobacco; up to $112 MM in milestone payments, tiered double-digit royalties Initial line extension plans Phase 2 clinical trials for higher-dose RAYALDEE to treat stage 5 CKD to begin 2H18 Phase 2 clinical trial of NK-1 antagonist to treat pruritus in CKD patients to begin 2H18 RAYALDEE® Commercialization June 2018 |

Robust Pipeline Diagnostics Diversified Assets Broad Development Pipeline Marketed Pharmaceuticals June 2018 |

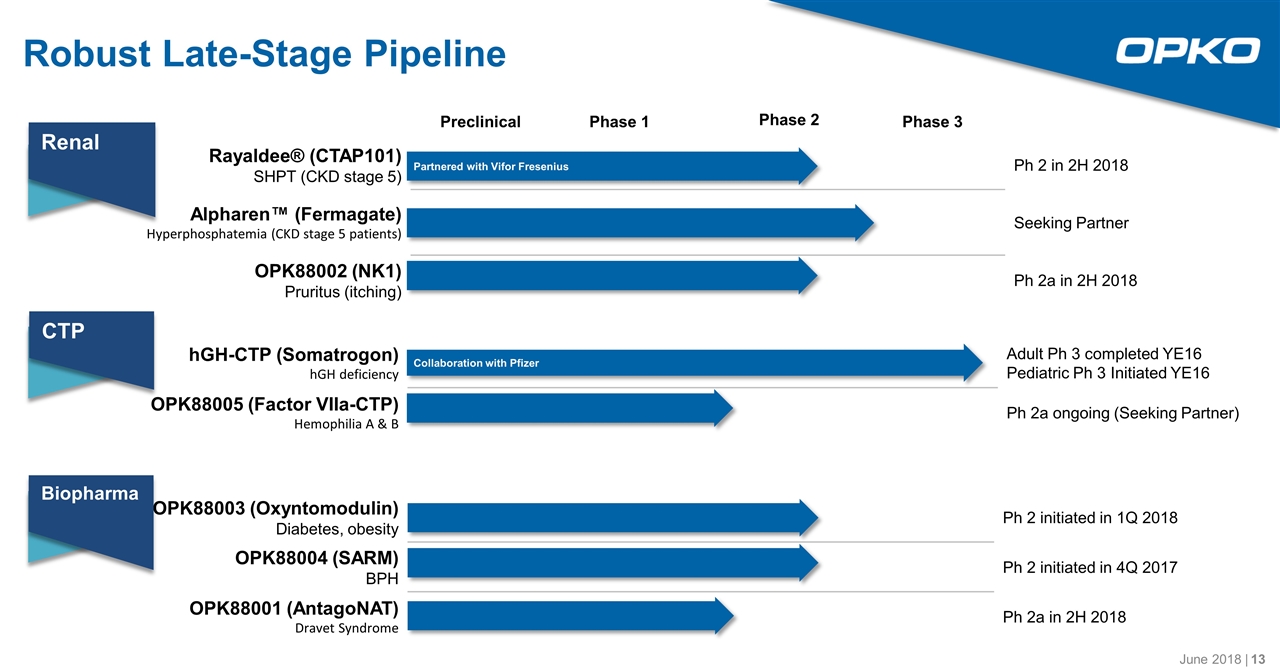

hGH-CTP (Somatrogon) hGH deficiency Adult Ph 3 completed YE16 Pediatric Ph 3 Initiated YE16 OPK88005 (Factor VIIa-CTP) Hemophilia A & B Ph 2a ongoing (Seeking Partner) OPK88003 (Oxyntomodulin) Diabetes, obesity Ph 2 initiated in 1Q 2018 OPK88004 (SARM) BPH Ph 2 initiated in 4Q 2017 OPK88001 (AntagoNAT) Dravet Syndrome Ph 2a in 2H 2018 Robust Late-Stage Pipeline Rayaldee® (CTAP101) SHPT (CKD stage 5) Ph 2 in 2H 2018 Alpharen™ (Fermagate) Hyperphosphatemia (CKD stage 5 patients) Seeking Partner OPK88002 (NK1) Pruritus (itching) Ph 2a in 2H 2018 CTP Biopharma Preclinical Phase 1 Phase 2 Phase 3 Partnered with Vifor Fresenius Collaboration with Pfizer Renal June 2018 |

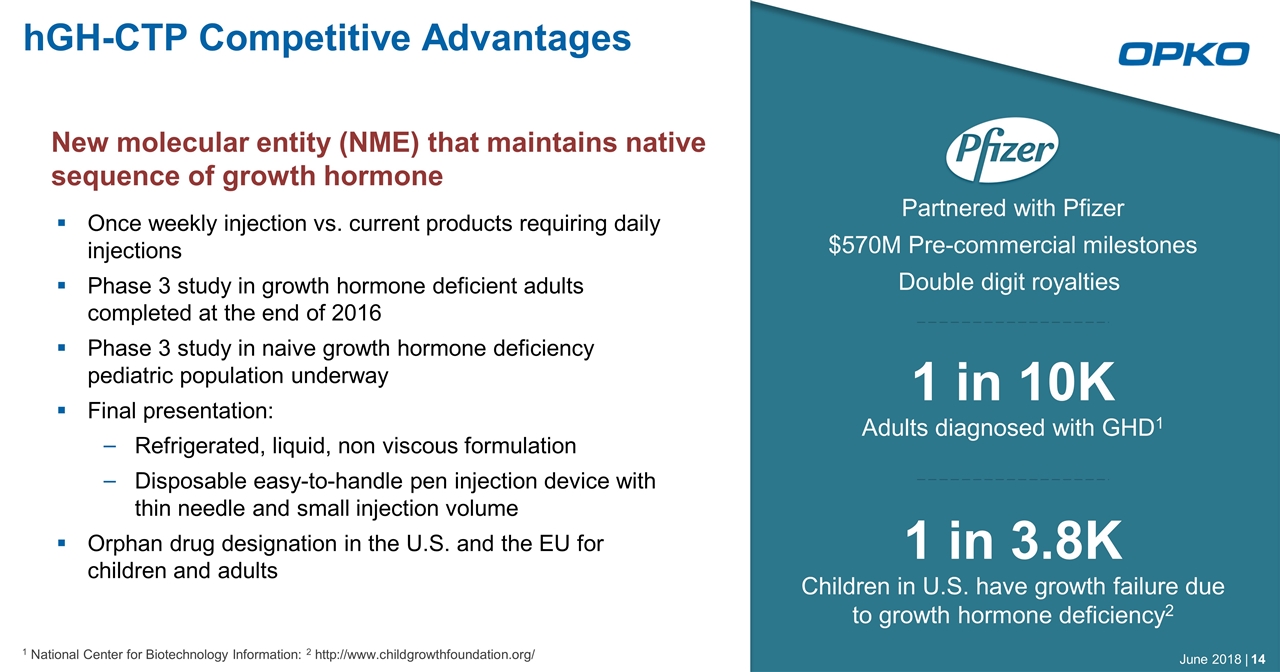

New molecular entity (NME) that maintains native sequence of growth hormone Once weekly injection vs. current products requiring daily injections Phase 3 study in growth hormone deficient adults completed at the end of 2016 Phase 3 study in naive growth hormone deficiency pediatric population underway Final presentation: Refrigerated, liquid, non viscous formulation Disposable easy-to-handle pen injection device with thin needle and small injection volume Orphan drug designation in the U.S. and the EU for children and adults hGH-CTP Competitive Advantages 1 in 10K Adults diagnosed with GHD1 1 in 3.8K Children in U.S. have growth failure due to growth hormone deficiency2 1 National Center for Biotechnology Information: 2 http://www.childgrowthfoundation.org/ Partnered with Pfizer $570M Pre-commercial milestones Double digit royalties June 2018 |

Initiated Phase 3 pediatric hGH-CTP study in December 2016 220 patients, non-inferiority comparison of weekly hGH-CTP to daily growth hormone Global study sites initiated in December 2016 Easy-to-use, disposable, refrigerated pen device Phase 3 adult hGH-CTP In December 2016 reported that primary endpoint of change in trunk fat mass from baseline to 26 weeks did not demonstrate a statistical significance between the hGH-CTP treated group and placebo Completed post hoc outlier analysis in June 2017 to eliminate the influence of outliers on the primary endpoint results Analyses, which excluded outliers, showed a statistically significant difference between hGH-CTP and placebo on the change in trunk fat mass; additional analyses that did not exclude outliers showed mixed results No safety concerns Correspondence and communication with FDA indicated that: There is a path for submission whereby FDA would assess the totality of the data – all relevant efficacy and safety data in adults and pediatric patients The number of patients to be included in the safety database seems sufficient The design of the bioequivalence study for the change from vial to pen formulation is generally acceptable Next Steps Assess regulatory strategy for adult indication based on response from FDA hGH-CTP pediatric registration study in Japan underway 44 patients, comparison of weekly hGH-CTP to daily growth hormone Same pen device, dosage and formulation used in global Phase 3 pediatric study hGH-CTP (Somatrogon) Program Status June 2018 |

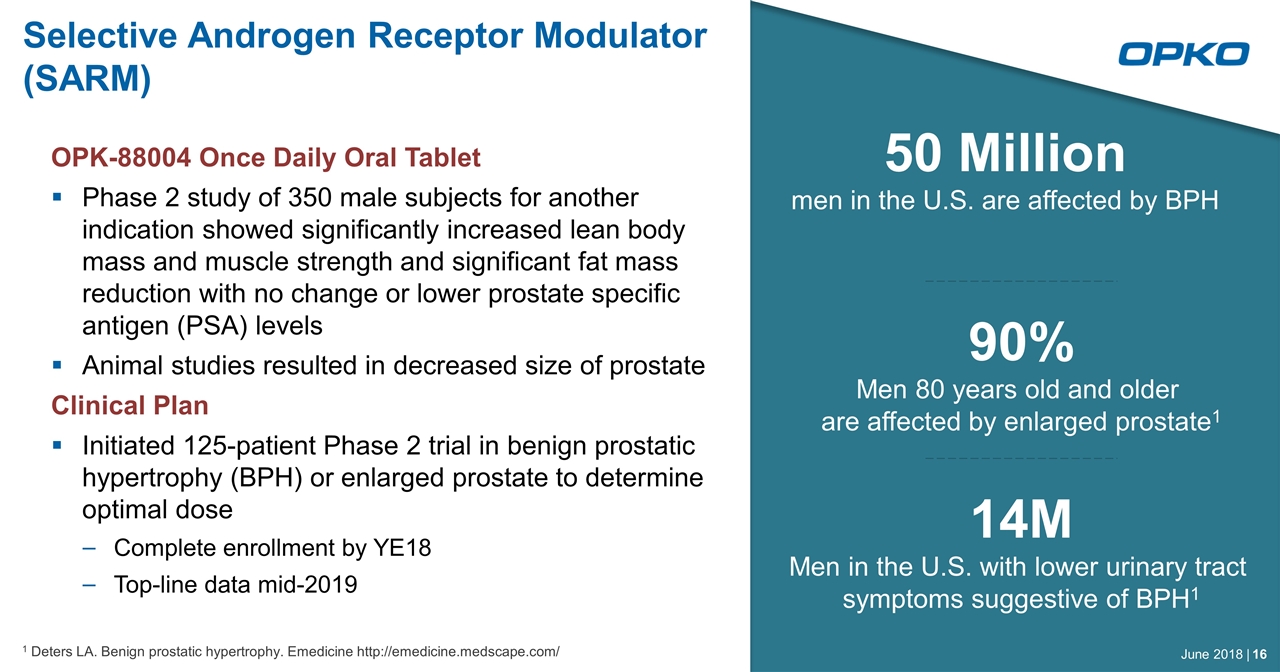

Selective Androgen Receptor Modulator (SARM) 50 Million men in the U.S. are affected by BPH 90% Men 80 years old and older are affected by enlarged prostate1 14M Men in the U.S. with lower urinary tract symptoms suggestive of BPH1 1 Deters LA. Benign prostatic hypertrophy. Emedicine http://emedicine.medscape.com/ OPK-88004 Once Daily Oral Tablet Phase 2 study of 350 male subjects for another indication showed significantly increased lean body mass and muscle strength and significant fat mass reduction with no change or lower prostate specific antigen (PSA) levels Animal studies resulted in decreased size of prostate Clinical Plan Initiated 125-patient Phase 2 trial in benign prostatic hypertrophy (BPH) or enlarged prostate to determine optimal dose Complete enrollment by YE18 Top-line data mid-2019 June 2018 |

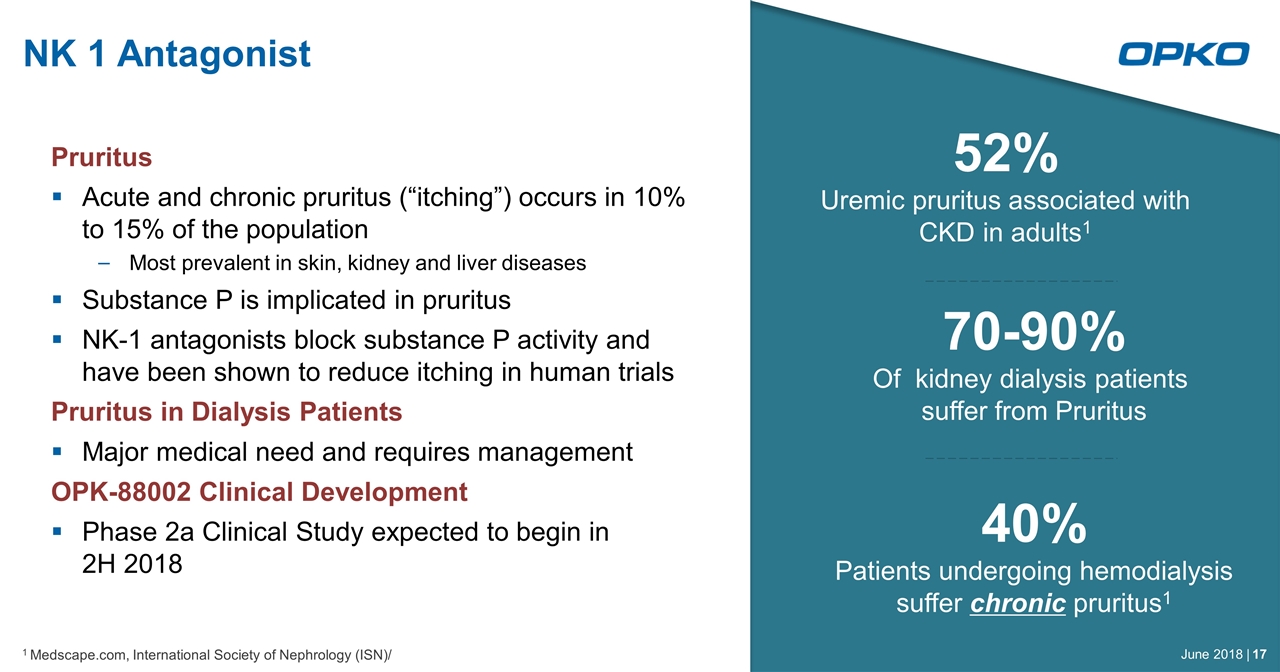

Pruritus Acute and chronic pruritus (“itching”) occurs in 10% to 15% of the population Most prevalent in skin, kidney and liver diseases Substance P is implicated in pruritus NK-1 antagonists block substance P activity and have been shown to reduce itching in human trials Pruritus in Dialysis Patients Major medical need and requires management OPK-88002 Clinical Development Phase 2a Clinical Study expected to begin in 2H 2018 NK 1 Antagonist 52% Uremic pruritus associated with CKD in adults1 40% Patients undergoing hemodialysis suffer chronic pruritus1 70-90% Of kidney dialysis patients suffer from Pruritus 1 Medscape.com, International Society of Nephrology (ISN)/ June 2018 |

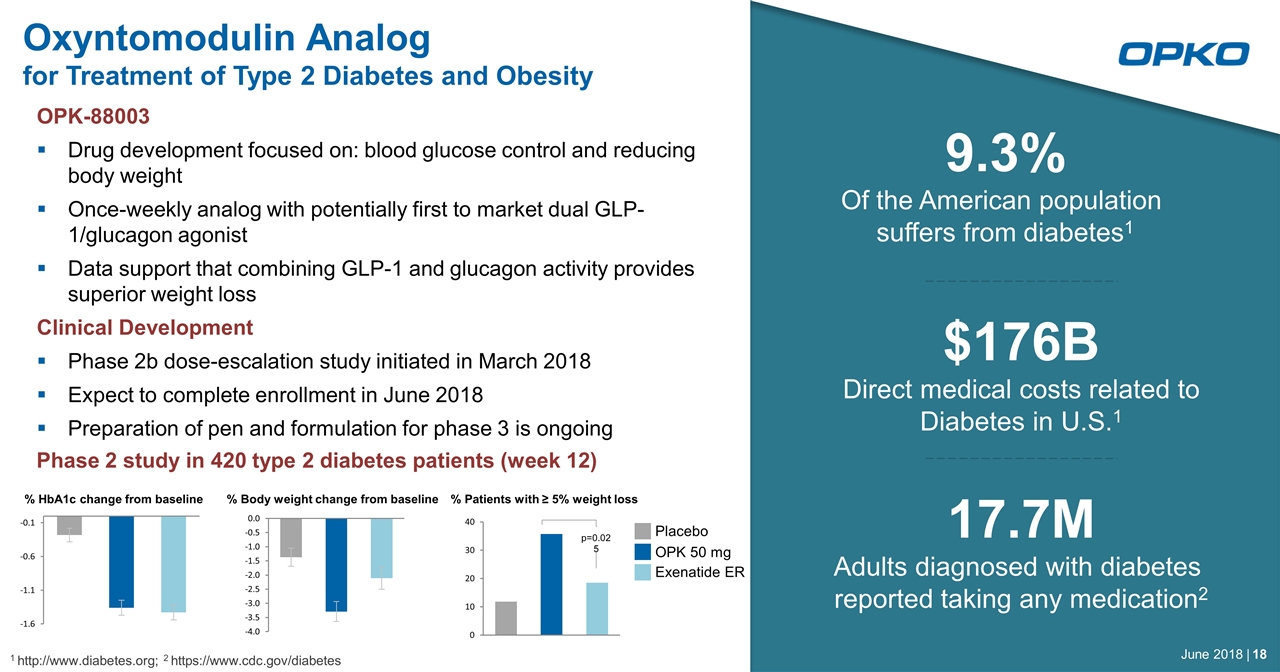

Oxyntomodulin Analog for Treatment of Type 2 Diabetes and Obesity Phase 2 study in 420 type 2 diabetes patients (week 12) % HbA1c change from baseline % Body weight change from baseline % Patients with ≥ 5% weight loss p=0.025 Placebo OPK 50 mg Exenatide ER OPK-88003 Drug development focused on: blood glucose control and reducing body weight Once-weekly analog with potentially first to market dual GLP-1/glucagon agonist Data support that combining GLP-1 and glucagon activity provides superior weight loss Clinical Development Phase 2b dose-escalation study initiated in March 2018 Expect to complete enrollment in June 2018 Preparation of pen and formulation for phase 3 is ongoing 9.3% Of the American population suffers from diabetes1 $176B Direct medical costs related to Diabetes in U.S.1 17.7M Adults diagnosed with diabetes reported taking any medication2 1 http://www.diabetes.org; 2 https://www.cdc.gov/diabetes June 2018 |

Robust Pipeline Diagnostics Diversified Assets Core $900 MM Business And Growing Marketed Pharmaceuticals June 2018 |

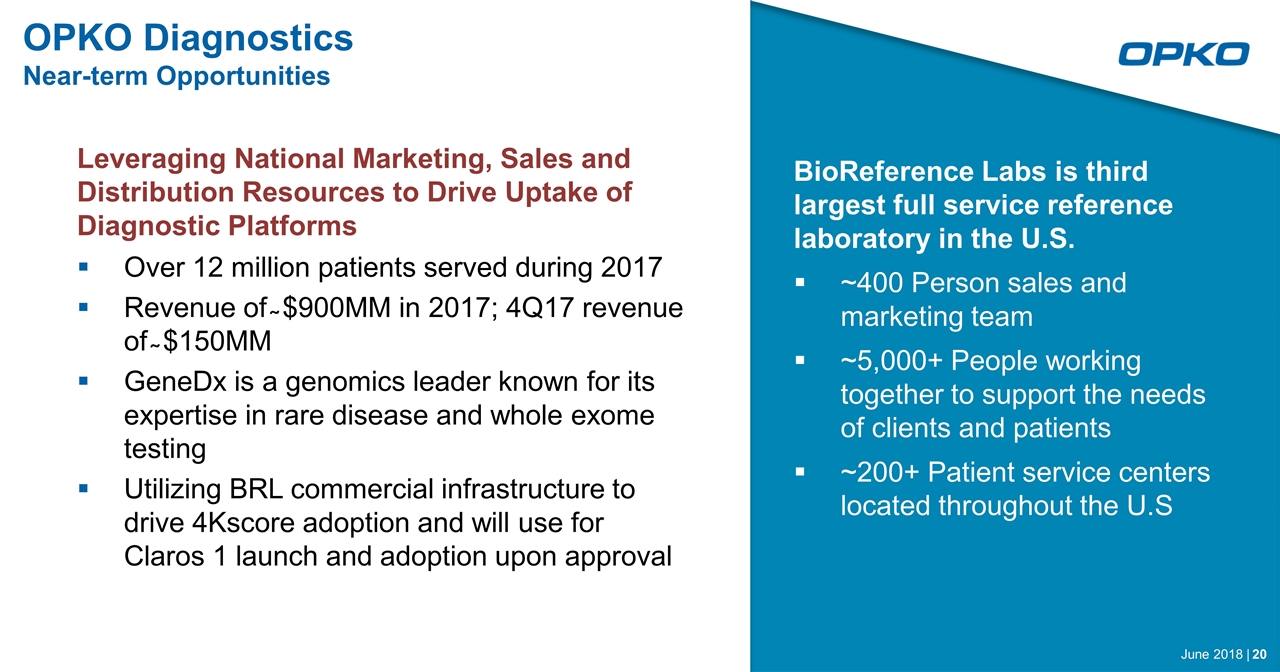

Leveraging National Marketing, Sales and Distribution Resources to Drive Uptake of Diagnostic Platforms Over 12 million patients served during 2017 Revenue of ̴ $900MM in 2017; 4Q17 revenue of ̴ $150MM GeneDx is a genomics leader known for its expertise in rare disease and whole exome testing Utilizing BRL commercial infrastructure to drive 4Kscore adoption and will use for Claros 1 launch and adoption upon approval BioReference Labs is third largest full service reference laboratory in the U.S. ~400 Person sales and marketing team ~5,000+ People working together to support the needs of clients and patients ~200+ Patient service centers located throughout the U.S OPKO Diagnostics Near-term Opportunities June 2018 |

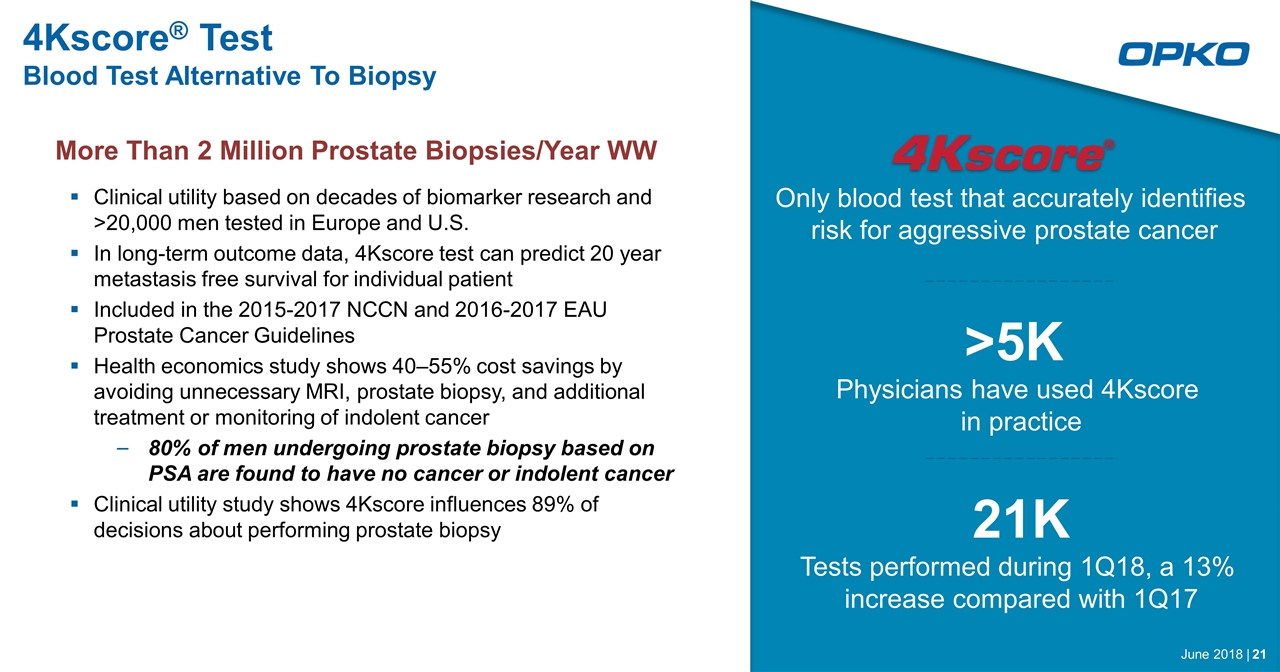

More Than 2 Million Prostate Biopsies/Year WW Clinical utility based on decades of biomarker research and >20,000 men tested in Europe and U.S. In long-term outcome data, 4Kscore test can predict 20 year metastasis free survival for individual patient Included in the 2015-2017 NCCN and 2016-2017 EAU Prostate Cancer Guidelines Health economics study shows 40–55% cost savings by avoiding unnecessary MRI, prostate biopsy, and additional treatment or monitoring of indolent cancer 80% of men undergoing prostate biopsy based on PSA are found to have no cancer or indolent cancer Clinical utility study shows 4Kscore influences 89% of decisions about performing prostate biopsy 4Kscore® Test Blood Test Alternative To Biopsy Only blood test that accurately identifies risk for aggressive prostate cancer >5K Physicians have used 4Kscore in practice 21K Tests performed during 1Q18, a 13% increase compared with 1Q17 June 2018 |

Category I CPT published and effective January 1, 2017; CMS national rate for 2018 increased to $760 vs $600 in 2017 Novitas Solutions (Medicare Administrative Contractor for OPKO Elmwood Park, NJ facility) Novitas issued a draft non-coverage determination in May 2018 subject to a public comment period ending July 5, 2018 Novitas has been and continues to pay for 4Kscore Medicare submissions pending finalization of the draft non-coverage decision. OPKO is taking a multiple pronged approach to address the concerns raised in the Novitas draft LCD Data from study at VA hospitals confirming the 4Kscore’s ability to accurately predict aggressive prostate cancer presented Demonstrated equally effective and vital clinical test for African American men, who have the highest rates of prostate cancer mortality Radical prostatectomy study demonstrated 4Kscore can effectively differentiate biopsy Gleason 6 cancer from those likely to harbor adverse pathology June 2018 | 4Kscore Clinical and Commercial Update

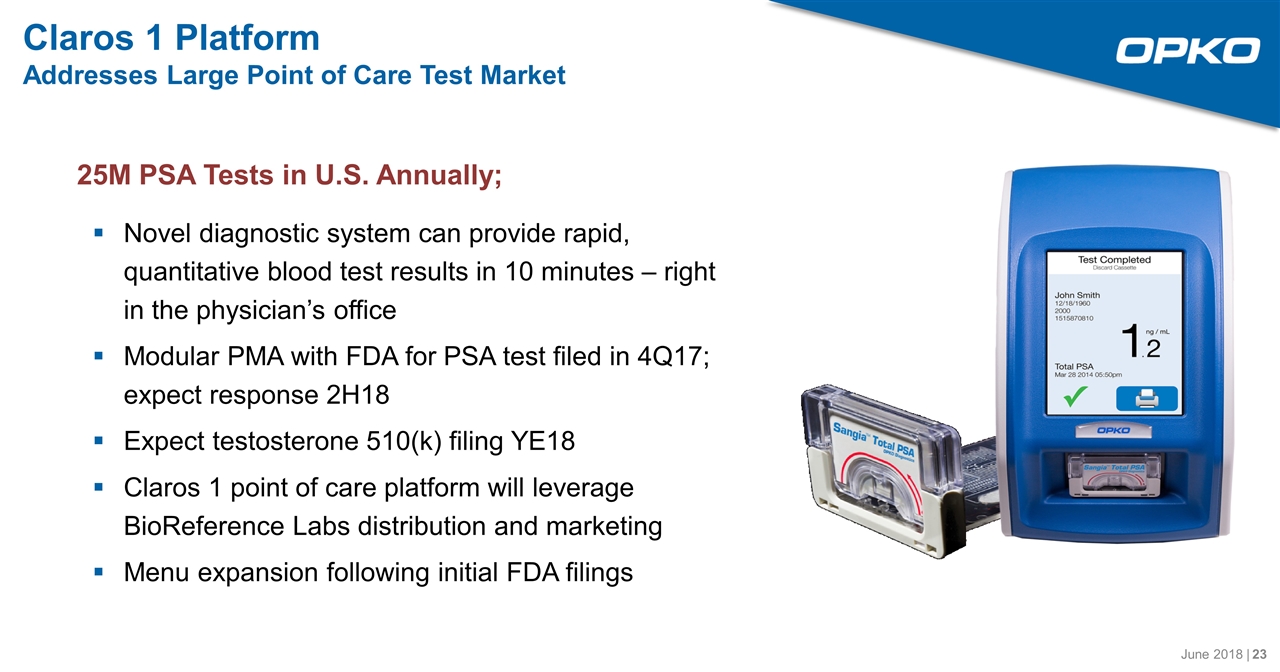

25M PSA Tests in U.S. Annually; Novel diagnostic system can provide rapid, quantitative blood test results in 10 minutes – right in the physician’s office Modular PMA with FDA for PSA test filed in 4Q17; expect response 2H18 Expect testosterone 510(k) filing YE18 Claros 1 point of care platform will leverage BioReference Labs distribution and marketing Menu expansion following initial FDA filings Claros 1 Platform Addresses Large Point of Care Test Market June 2018 |

Select Financial Information March 31, 2018 Cash, cash equivalents & marketable securities: $99.9 million Net investments: $297.5 million Current portion of line of credit and notes payable: $11.9 million Senior notes: $31.8 million $55 million convertible note issued February 2018 Common shares outstanding: 559.47 million Consolidated revenues for the three months ended March 31, 2018 were $254.9 million compared with $266.4 million for the comparable period of 2017 Revenue from services were $211.3 million for the three months ended March 31, 2018 compared with $228.6 million for the comparable 2017 period While not directly comparable, this represents a marked improvement from the most recently completed quarter ended December 31, 2017 Balance Sheet Capital Structure Revenue June 2018 |

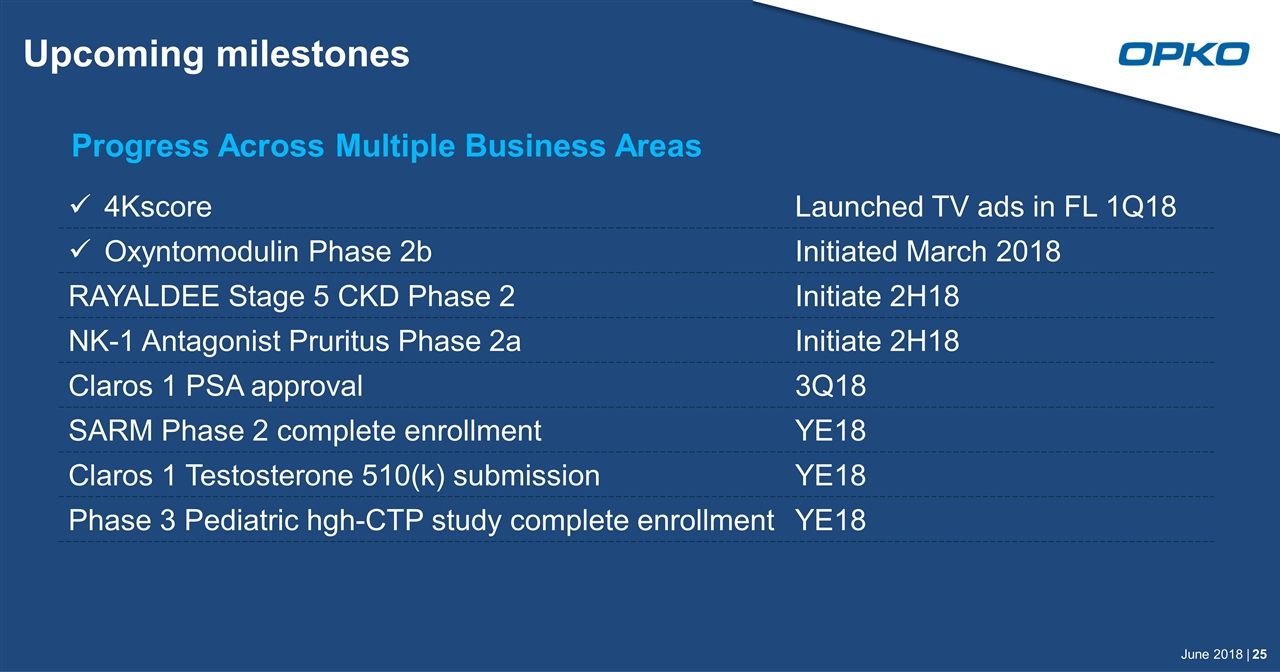

Upcoming milestones Progress Across Multiple Business Areas 4Kscore Launched TV ads in FL 1Q18 Oxyntomodulin Phase 2b Initiated March 2018 RAYALDEE Stage 5 CKD Phase 2 Initiate 2H18 NK-1 Antagonist Pruritus Phase 2a Initiate 2H18 Claros 1 PSA approval 3Q18 SARM Phase 2 complete enrollment YE18 Claros 1 Testosterone 510(k) submission YE18 Phase 3 Pediatric hgh-CTP study complete enrollment YE18 June 2018 |

Thank You